Ah, the mighty Bitcoin, that mercurial beast of the digital realm, has surged past the sacred threshold of $105,000 today. And what might have spurred this majestic leap, you ask? A “miraculous” truce between the US and China—because, why not? The price touched a high of $105,705, sending traders into a frenzy, as if they had just discovered fire.

Alas, like all things in life, the joy was fleeting. A slight pullback followed, but not to worry, dear reader—bullish pressure remains in full force, and this might just be the calm before the next storm of profits. Or, you know, losses. Who can say?

BTC Surges to $105,000, Thanks to US-China Love Affair

On Monday, those great titans of the global economy, the US and China, announced a monumental 90-day tariff relief deal. Naturally, the entire world reacted as if they had been handed the keys to prosperity. As part of this trade pact, the US promised to lower tariffs on Chinese imports from an eyebrow-raising 145% to a more palatable 30%. Meanwhile, China, in a fit of generosity, promised to reduce tariffs on US goods from 125% to a mere 10%. The markets, predictably, went wild.

This news sent Bitcoin’s price soaring past the coveted $105,000 mark for the first time in what felt like an eternity. The digital coin reached a brief peak at $105,705, before performing its classic trick of dipping back down—such is the life of a volatile cryptocurrency.

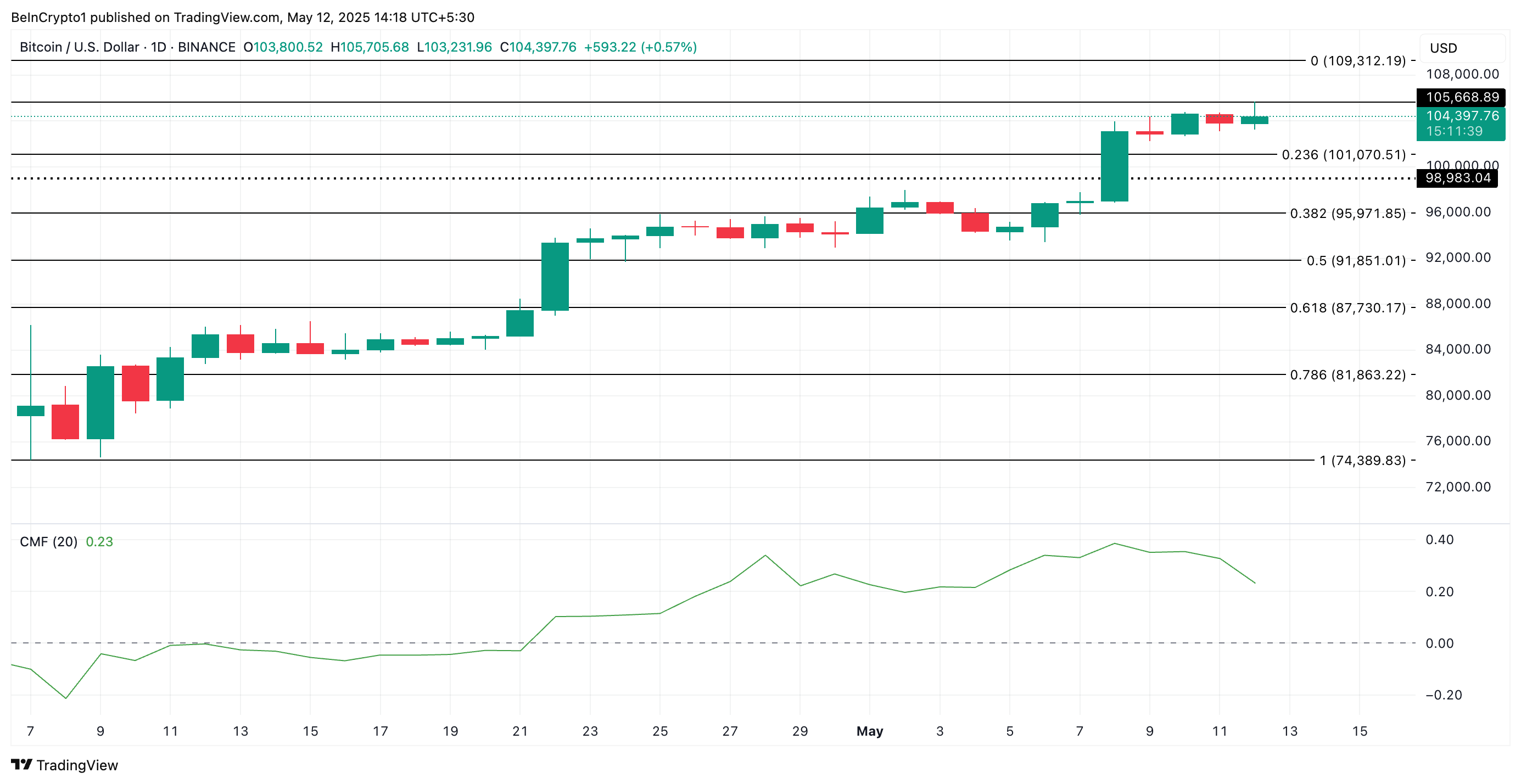

As of this moment, BTC is resting at a modest $104,397, but fear not. On-chain indicators suggest that the bullish sentiment is still very much alive, like a stubborn plant refusing to die. The market is alive with optimism, despite the occasional dip.

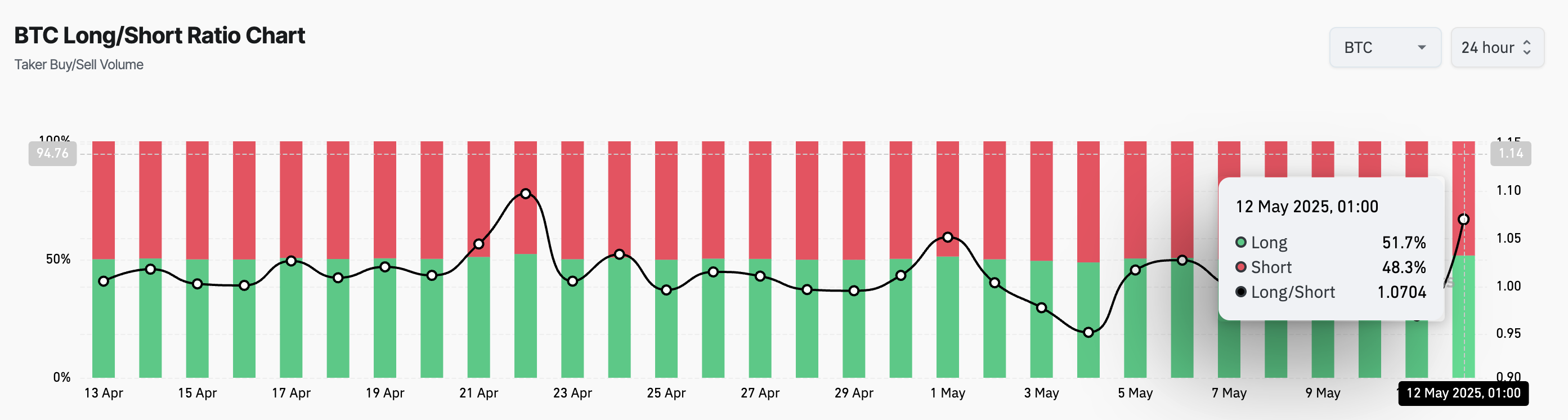

Take, for instance, the Long/Short Ratio. This handy metric, currently at 1.07, reveals that more traders are betting on Bitcoin’s rise than its fall. When this ratio is greater than one, it’s like a herd of traders all chanting “to the moon” in unison. And yes, we all know how that story goes—mostly upward, with a few cliff dives for dramatic effect.

To elaborate, when the Long/Short Ratio exceeds one, it suggests traders are overwhelmingly bullish—i.e., betting that Bitcoin will rise. Quite the sight, I assure you. A ratio under one, however, would have us all scrambling for our emergency parachutes.

This suggests the market sentiment is, indeed, very optimistic about Bitcoin’s future. The futures traders are betting on more gains, like gamblers at a high-stakes poker table—always thinking the next hand is their winning one.

But wait—there’s more! The options market is also playing along with this bullish charade. Call options are in demand, indicating that traders are increasingly betting that Bitcoin will soar even higher. Yes, folks, the optimism knows no bounds.

When calls outnumber puts, it’s a clear sign that traders are, indeed, putting their money where their mouths are. If this continues, we might just see Bitcoin break through its psychological barriers like a hero in an action movie—without the explosions (unfortunately).

Bitcoin Faces a Serious Test

But, as with any story of triumph, there are shadows lurking. The surge in bullish activity has sparked hope, but it also faces some challenges. If Bitcoin’s buying pressure holds, we might just see it reclaim the $105,000 mark. Should the support at $105,668 remain firm, a climb toward its all-time high of $109,312 might be on the horizon. Let’s all hold our collective breath.

However, dear reader, the daily chart reveals something worrisome—a bearish divergence in the Chaikin Money Flow (CMF). It seems the buying pressure is starting to wane. In other words, while Bitcoin’s price is climbing, the CMF is dropping, which is a bit like having a car that’s speeding up while the fuel tank is slowly emptying. Not ideal.

If this bearish trend persists, Bitcoin’s price might take a nosedive to $101,070. Oh, the drama! Will it rise like a phoenix, or will it plummet like a stone? Stay tuned for the next chapter of this thrilling saga!

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-05-12 13:46