Picture this: in the grand circus of blockchain, the Ethereum ringmasters announced the Pectra Upgrade—finally. Or so they claimed, brandishing a stack of proposals like a used magician’s deck, while investors everywhere searched the air for the white rabbit of profit. 🐇

If you’re the sort who sniffs out volatility like an old Moscow bloodhound after a meaty bone, these cryptic headlines might just spice up your otherwise stablecoin existence.

Ethereum’s Pectra Upgrade: As Expected, Except When It’s Not

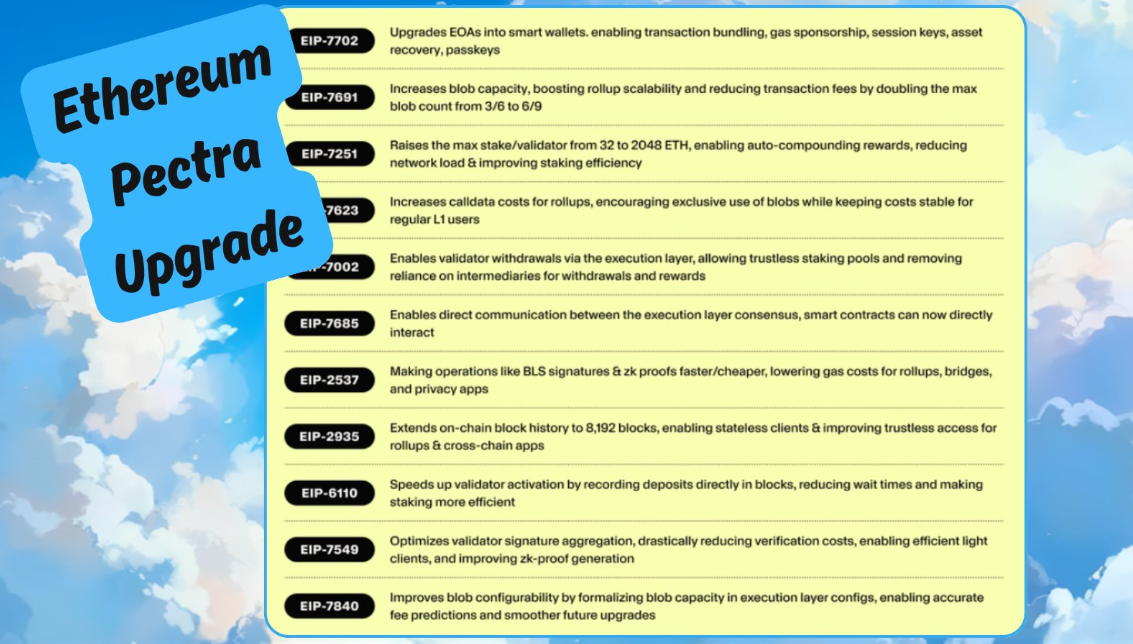

Coming to a blockchain near you on May 7—or whenever Chaos wills it—the Ethereum Pectra Upgrade arrives, featuring a courageous collection of 11 EIPs.

Raising the staking cap from 32 ETH to 2048 ETH, EIP-7251 offers whales more room to splash their fins, while the little guppies watch from the shallows. User-friendly wallets and easier recovery also appear, allegedly so simple your grandmother could use them—if she weren’t still hiding her rubles under the mattress.

“Ethereum is having its biggest upgrade this month,” declared hodl, barely audible above the sound of developers arguing on X (Twitter).

All intended, at least in theory, to boost staking, grease the dApp gears, and, with luck, float ETH’s price on a fluffy cumulative cloud. If only exchanges didn’t slam the doors shut when upgrades roll out, trapping your assets like an ill-timed train from Kiev.

Should Pectra glide through like a ballerina, expect bulls to dance. If, however, things break…well, the price chart may need medical attention. And let us not forget the historic delays—testnets, bugs, developers sobbing quietly—all part of Ethereum’s ongoing theatrical production. Bravo, maestro. 👏

Sonic Summit: Fantom Tries to Be Heard Above the Crowd

On May 6, Fantom’s Sonic Summit kicks off in Vienna, where visionaries gather for three days to convince everyone that Fantom—sorry, Sonic—isn’t just another poltergeist haunting the crypto attic.

The program? Lightning-fast transactions! Scalable dApps! Networking, partnerships, you name it—plus the ever-present hope that a S token announcement might send traders into a temporary delirium (before gravity reasserts itself).

“Got your ticket for Summit yet?” Sonic Labs asked, clearly unaware of blockchain developers’ social anxiety.

Will the summit electrify the price? Possible. Will everyone leave with one more branded hoodie but no life-changing alpha? Almost certain. Institutional suits may float around, pretending to be interested until their WiFi cuts out.

Polkadot App Release: One App to Rule Them All, Or Just Another Widget?

If you enjoy doing everything in one place, Polkadot is planning an app that promises staking, shopping, and saving—because apparently, nobody can open more than one tab in a browser any more.

The intent: lure retail users and pump DOT. Staking could dry up token supply, maybe even support the price, if only briefly—if, and it’s a monumental “if”, it isn’t as buggy as a Moscow tram on a hot day.

Of course, there’s always the risk of security gone rogue. If the app flops, Polkadot may discover that even interoperability has limits, and Cosmos will chuckle quietly in the corner.

Hyperliquid’s Fee Circus: Stakers, Prepare for Discount, Maybe Disappointment

Hyperliquid’s new fee system and staking tiers launched May 5: trade more, stake more, pay less—the crypto equivalent of “buy twelve, get the thirteenth free.”

“…the new Hyperliquid fee system is now live,” Steven.hl pronounced, as if blessing a ship at the harbor.

The hope: staking incentives will pump HYPE, draw traders, and reduce supply. The reality: HYPE promptly dropped 1.42% anyway, and the only thing surging was traders’ skepticism.

Revenue might spike—if traders can figure out the fee tiers without a degree in economic theory. Watch this space, and maybe keep your wallet close, just in case.

FOMC Meeting: The Oracle on the Hill Prepares to Speak

On May 8, Jerome Powell and the FOMC descend from their mountain fortress to, once again, play chess with interest rates. Will they hike, will they pause, or will they throw the market into existential dread?

Should rates rise, expect Bitcoin sellers to emerge from the shadows. Should rates drop (oh, the dreams), brace for rallying bulls and fevered Twitter threads. The oracle’s word will echo across every chat group, in true Soviet fashion.

“Fed Press Conference…will they end quantitative tightening?” pondered Ozzy, as markets held their collective breath.

Certain prophets predict a $250,000 Bitcoin—give or take a zero. Others are less optimistic, blaming the MOVE Index and international instability. Either way, everyone’s glued to the screen, popcorn in hand.

Berachain’s Boyco Unlock: Release the Kraken! 🐙

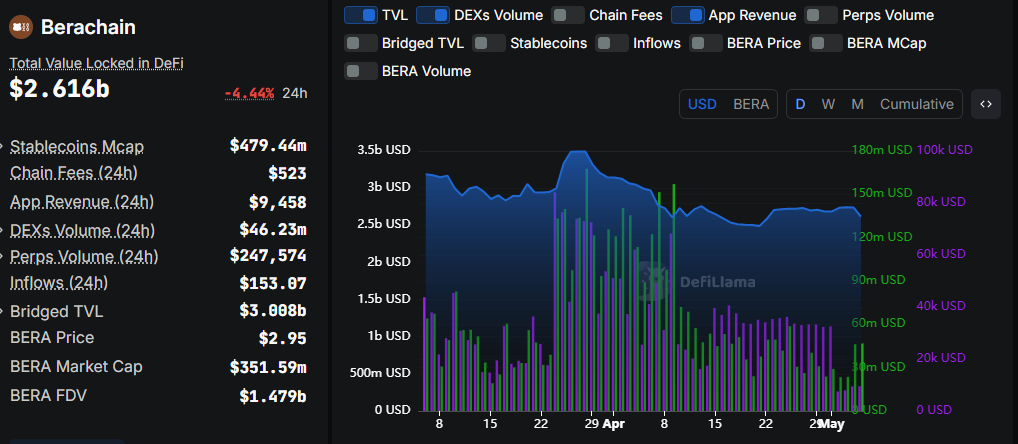

The Boyco vaults on Berachain unlock May 6, liberating $2.7 billion in TVL—enough liquidity to float several yachts or a modest Russian revolution.

Expect volatility, with whales farming tokens faster than you can say “exit liquidity.” Early investors might dump, the market might tremble, and the BERA price may finally discover gravity’s pull—although some optimists still hope for a rebound above $5. Is it hope, or delirium? Only the charts will tell.

“There’s over $2 billion waiting… BERA is dumping fast,” Langerius shared, sounding both impressed and alarmed.

Berachain: the worst-performing chain of the month, yet some believe this is the battered hero’s redemption arc. Place your bets, comrades.

“I strongly believe BERA has hit the bottom…” came the hopeful cry, like a gambler raising his last glass.

Coinbase Earnings: The Annual Seance

Finally, Coinbase holds its earnings call—a séance for analysts and traders to interpret the financial entrails. Will revenue surge, signaling health, or will regulatory ghosts spook the stock?

Everyone will divine stats: trading volumes, user growth, Web3 expansion. Good news could bring speculative buying; disappointing numbers will have traders hurling sandwiches at their screens. Naturally, this all creates the kind of delicious chaos that crypto traders secretly love.

Coinbase’s results ripple out to BNB holders, who trade in spiritual sync. Wild optimism or grim resignation? Check the markets, and pass the aspirin.

“FOMC and Coinbase earnings. Volatile week in the crypto market,” noted CrypNuevo—a true master of understatement.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- League of Legends: Anyone’s Legend Triumphs Over Bilibili Gaming in an Epic LPL 2025 Playoff Showdown!

- League of Legends: T1’s Lackluster Performance in LCK 2025 Against Hanwha Life Esports

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Lucky Offense Tier List & Reroll Guide

2025-05-05 11:54