If there’s one thing you can safely rely on in the shifting sands of the cosmos, it’s that every time someone mentions a “strong buy signal”, the universe shifts uncomfortably and checks its wallet. The Ethereum (ETH) CrossX Indicator has started blinking furiously, possibly trying to warn us of imminent fortune or merely suffering from a rare blockchain-induced rash. Either way, analysts are now confidently predicting a leap towards $4,000, because, as we all know, round numbers are just so much cooler than decimals. 🚀

Epic Whales Amass ETH Like There’s No Tomorrow (Which, In Crypto, Is Always Possible)

Armed with far too much on-chain data and probably slightly too little sleep, the intrepid sleuths at Lookonchain have witnessed a massive feeding frenzy. Institutions, otherwise known as ‘the whales with nice suits’, have started hoarding Ethereum at a pace suggesting their summer homes are at risk of being outbid by meme coin billionaires.

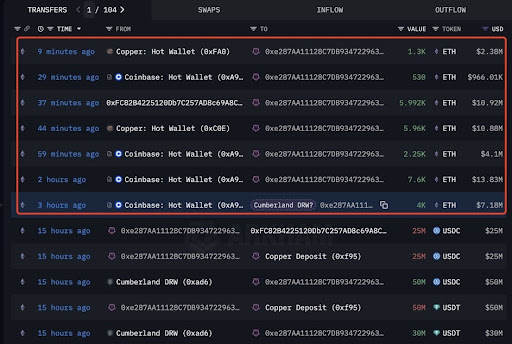

One particular wallet—rumored to belong to Cumberland DRW, or possibly a sentient AI obsessed with Ethereum—scooped up 27,632 ETH (that’s roughly $50.24 million, or five good Caribbean islands) in a mere three hours. Most of this crypto was withdrawn from Coinbase, Copper and Binance, presumably after Coinbase tried to talk them into signing up for their newsletter.

For those keeping count: 7,600 ETH from Coinbase ($13.83M), 5,992 ETH from Copper and Binance ($10.92M), and 5,960 ETH from Copper again ($10.88M). All these majestic sums were funneled into the same wallet: 0ex287AA111…—a name so secretive that even the wallet itself isn’t quite sure who it is.

Coordinated accumulation? Absolutely. Standard trading? Not unless your definition of “standard” involves casually yanking millions off exchanges like you’re buying milk at the corner shop. The theory: large-scale withdrawals mean less ETH for desperate sellers, more for placid hoarders, and historically, this is the sort of thing that happens right before prices decide to cosplay as rockets. 🛰️

Ezy Bitcoin on X (the app formerly known as Twitter, possibly renamed by Douglas Adams in his sleep) has confirmed the CrossX Indicator’s latest wild flash of optimism. It’s offering hope, expectation, and possibly a few headaches for people who enjoy the quiet life. Demand is up, supply is thin, and something volatile seems to be preparing for takeoff. Please keep your arms and legs inside the vehicle at all times.

CrossX Points North: Or, How I Learned to Stop Worrying and Love the Upside

The CrossX Indicator, which sounds suspiciously like something you’d find plugged into Zaphod Beeblebrox’s brain, now says: “Buy”. The last six months have been oddly quiet—clearly, too quiet. Typically, this silence is the prelude to either a price surge or someone tripping over the blockchain’s power cord.

CrossX claims to predict trend reversals using volume, price action, and patterns so mysterious that not even Marvin the Paranoid Android could decipher them. Historically, these mystical buy signals have been followed by rallies—ETH shooting to new highs and investors congratulating themselves on their genius (briefly, before checking the charts again every ten seconds).

Right now, ETH is dusting itself off and hinting at another bullish divergence (think of it as déjà vu but with more graphs). If the past, which is famously never predictive of the future except when it is, repeats, then $3,000 could just be the appetizer, and $4,200 might be dessert. Digi-puddings for everyone! 🍮

CoinMarketCap currently lists ETH at $1,803—a 43.1% annual drop, which in crypto language is officially classified as “Monday.” But, should ETH muster up the courage for a $4,200 move, that’s a 132.95% surge, putting it alarmingly close to its all-time high. If this happens, expect celebratory memes, an Ethereum-branded towel for your next interplanetary hitchhiking, and one very smug indicator.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- MrBeast Becomes the Youngest Self-Made Billionaire in History

- Quarantine Zone: The Last Check Beginner’s Guide

- How to use a Modifier in Wuthering Waves

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Tainted Grail The Fall of Avalon: Best Beginner Build Guide

- INJ PREDICTION. INJ cryptocurrency

2025-05-01 00:49