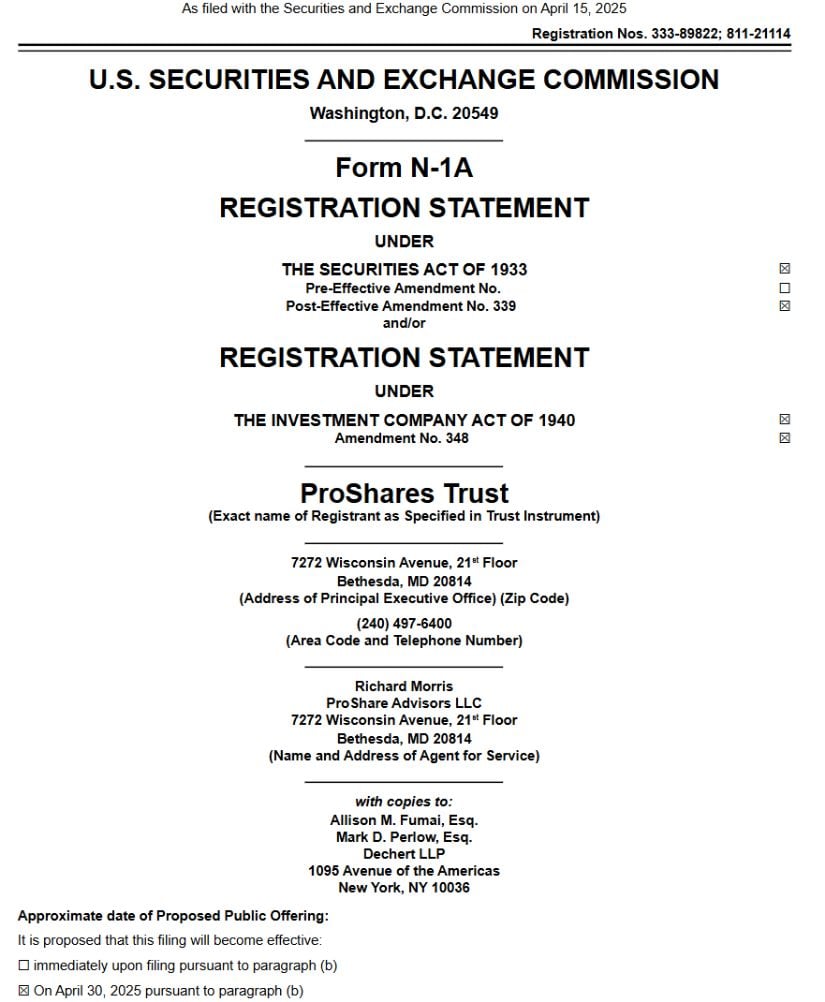

Pray, dearest reader, be apprised that certain novel contrivances, destined to make their debut upon the 30th day of April in the year of our Lord 2025, promise the gentlefolk an opportunity to profit from the vagaries of the XRP valuation, and all this without the bother of direct possession—not unlike enjoying the music without the trouble of owning a fiddle.

A Most Remarkable Advance: ProShares and Their Platforms of Exchange

The worthy ProShares, it appears, shall soon present three manners of ETFs—the Ultra XRP, UltraShort XRP, and Short XRP—each differing in their ambition and vigour, designed to tickle the fancy and strategies of investors various.

Such approval is indeed a landmark herald in the grand saga of XRP, especially following the much-anticipated denouement of Ripple’s somewhat interminable legal wrangling with the SEC, which was no small matter. By introducing these leveraged contrivances, ProShares positions itself at the vanguard, capturing a swell of interest from both the eager commoners and the august lords of finance alike.

“This approval doth usher XRP nearer to the grand masquerade of mainstream finance, revealing a new corridor for enthusiasts to imbibe the cryptocurrency,” proclaimed Mr. Brad Garlinghouse, chief of Ripple, with the air of a man who has seen the ballroom doors finally open to crypto’s genteel assembly.

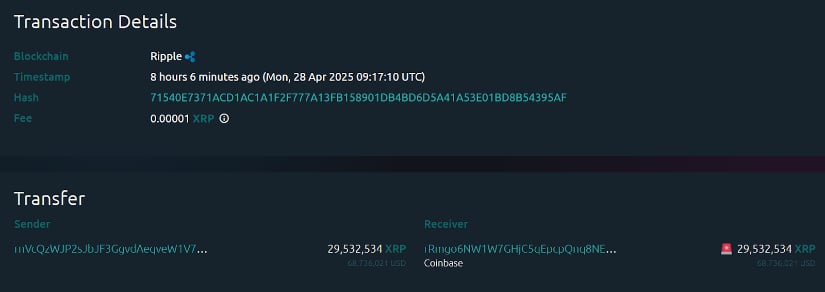

Whales, Wallets, and Wonders: The Tale of 69 Million XRP

Amidst this bustling theatre, XRP surged nobly to a monthly zenith of $2.35, accompanied by a dispatch of 69 million coins, no less, from the coffers of a most sizeable whale, as observed by the watchful eye of Whale Alert. This transfer, valued near £68.7 million, has sent tongues wagging and keen minds conjecturing: is it a cunning act of securing profit, or merely a gambit in the larger game?

Analysts do quarrel over the matter; some declare it the gentle shifting of sentiment, others suspect the mere tactical recasting before the next tempest. Regardless, this grand transaction has fanned the flames of debate among the crowd, perhaps more lively than the average town gossip.

Ripple’s March Forward: Forecasts and Fancy Calculations

The wider market, recovering as if from a genteel faint, hath lent its strength to XRP, which danced upwards by seven percent and attained increased volume in trade, thereby greatly bolstering investor confidence. The venerable analyst Ali Martinez did intimate that XRP doth stand upon the cusp of a breakout, eyeing prizes that lie between $2.70 and $2.90—a figure certain to tempt even the most prudent suitors.

The ascent promises much, particularly with the imminent debut of ProShares’ ETFs for futures. Truly, such instruments open windows aplenty for the public to better glimpse XRP’s expanding domain. Miss Monica Long, President of Ripple, in a spirited chat, opined that these developments allow XRP to entrench itself more firmly within the grand ballroom of finance.

The Grand Assembly: Institutional Fancies and Prospective Hopes

The SEC’s tender blessing of these futures ETFs hath been hailed as a boon indeed, much like a royal endorsement. They are likely to magnetize the attentions of the institutional aristocracy, a procession hastened somewhat by prior efforts to weave cryptocurrencies into the fabric of established finance. Ripple’s friendships with eminent institutions such as Bank of America further polish its credentials.

Yet, this journey is but half completed. All await with bated breath the SEC’s judgment on spot ETFs, where confederates like Grayscale stand ready to unveil their offerings at the signal. Such regulatory caprice keeps the market on edge, eager for a beacon of certainty.

As the tides of momentum swell, XRP strides into a new era of institutional recognition. One CME Group analyst, suitably impressed, hailed the addition of futures as “a testament to XRP’s growing influence in this digital realm.”

The Horizon Beckons: Predictions and Prudence

Looking forward, the road of XRP shall be dictated by many a factor—the triumph, or otherwise, of ProShares’ ETFs launch shaping the temper of investors, and gifting refined instruments to the practiced and the bold. Yet, let none dismiss the inherent perils of such leveraged endeavours; as often as not, the siren’s call conceals sharp reefs beneath.

The tale of XRP continues, a narrative of price and adoption still very much unfolding. Whether it shall maintain its bullish carriage seems to hinge upon fresh dispatches from regulators, the fickle whims of market sentiment, and the steady march of institutional embrace.

In sum, the recent rally, coupled with ProShares’ approvals and the leviathan whale’s movements, augur a promising future for this curious token. Nevertheless, the prudent investor would do well to tread carefully—for the regulatory landscape remains as capricious as a debutante’s affections.

Read More

2025-04-28 22:21