In a world where money often seems to disappear faster than socks in a laundry, Bitcoin ETFs swaggered in on Friday with a cool $380 million strut, while Ether ETFs decided to join the party with a hefty $104 million. Talk about a financial fiesta—these are their best dance moves in months. 🕺💰

Bitcoin ETFs Rack Up $380 Million, Ether Shows Off Its Biggest Inflow Since February

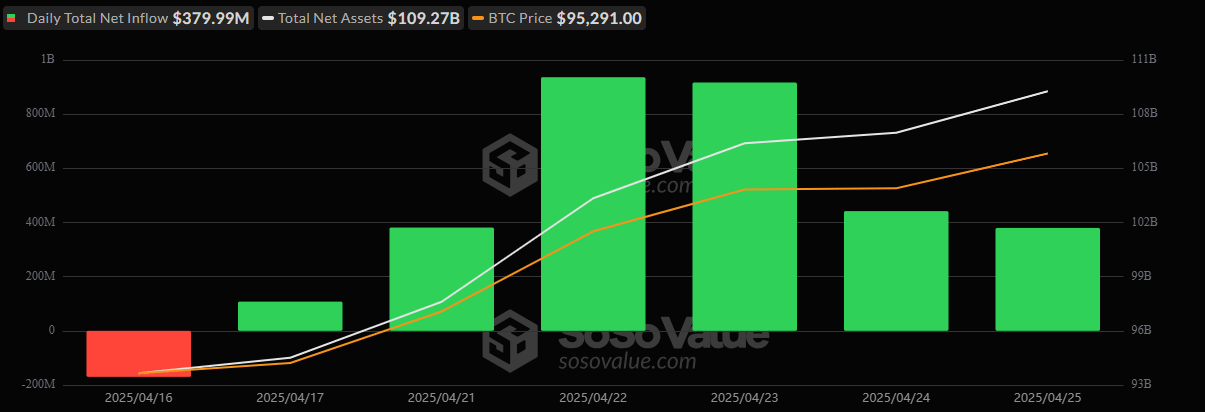

Despite what your grandma says about “putting money under the mattress,” crypto investors kept their hats on and their wallets open. On Friday, April 25, bitcoin and ether ETFs wrapped the week like they were auditioning for a Vegas magic show—poof! $379.99 million appeared out of thin air (or maybe thin wallets) in bitcoin ETFs alone.

Leading this parade of green was Blackrock’s IBIT with a hefty $240.15 million inflow, because why be modest? Fidelity’s FBTC was right behind, pulling $108.04 million like it just found a winning lottery ticket. Grayscale’s BTC chipped in $19.87 million, while Ark 21Shares’ ARKB and Vaneck’s HODL tossed in $11.39 million and $8.08 million respectively—essentially pocket change for these financial giants. The only party pooper was Grayscale’s GBTC, which quietly slipped out with a $7.53 million departure. Someone’s on a diet.

Trading action was as lively as a tavern on a Saturday night, with $3.31 billion changing hands and total assets climbing to a teasing $109.27 billion. Records? Almost. Just nudge it a bit more, folks.

Ether ETFs, not wanting to be outclassed, flexed their muscles with a cool $104.16 million in net inflows. Blackrock’s ETHA was the star of this show, hauling in $54.43 million, while Fidelity’s FETH picked up $35.94 million like change from a couch. Grayscale’s ETH tagged along with a modest $10.20 million.

Bitwise’s ETHW and Invesco’s QETH added some cheeky $1.80 million contributions each, like the energetic nephews at a family reunion. Impressively, none of the nine active ether ETFs did the financial moonwalk out the door—no outflows detected. Trading for these digital nuggets hit $311.70 million, and net assets rose to a stately $6.14 billion.

With these two cryptic cryptos firing on all cylinders, it seems the market bulls are back, wearing their spurs and ready to charge. 🐂💥

Read More

2025-04-28 21:57