Hold onto your hats, folks! Bitcoin ETFs just made a staggering $3.06 billion in net inflows, and ether ETFs didn’t just watch from the sidelines – they pulled in $157.09 million. It’s like crypto’s party of the century, and everyone’s invited!

Bitcoin ETFs: A Record-Breaking Week With $3 Billion Inflows. Ether ETFs Are in the Mix, Too!

Well, well, well, what do we have here? Crypto ETFs are back at it, and boy, did they make waves last week. As bitcoin and ether buzzed with energy, ETF inflows surged like an unexpected viral TikTok dance.

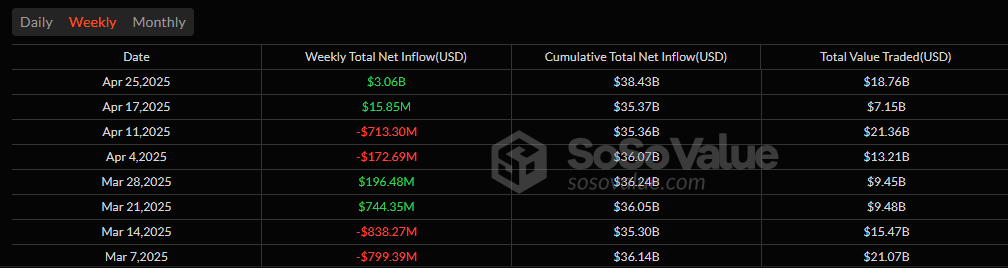

Bitcoin ETFs saw a jaw-dropping $3.06 billion in net inflows between April 21 and April 25, making it their second-best week ever (yep, second, but hey, that’s still pretty amazing). The most exciting day? Tuesday, April 22, when a massive $936.43 million in fresh cash poured in. Not a single day saw any outflows, and you know what they say: if it ain’t broke, don’t fix it!

Leading the charge was Blackrock’s IBIT, pulling in an eye-popping $1.45 billion. That’s not a typo. Ark 21shares’ ARKB wasn’t far behind, bagging $621.13 million, while Fidelity’s FBTC scraped up a respectable $573.84 million. Bitwise’s BITB brought in $116.72 million, Grayscale’s Mini Bitcoin Trust added $103.35 million, and Grayscale’s GBTC chipped in $94.13 million. Some of these numbers sound like the GDP of small countries. Can you imagine?

On the smaller side, but still impressive, VanEck’s HODL grabbed $31.55 million, Invesco’s BTCO saw $25.74 million, and Valkyrie’s BRRR (Yes, they named it that) hauled in $23.82 million. Franklin’s EZBC tossed in $20.71 million, which is basically pocket change when compared to the first wave of big numbers, but hey, it all counts.

Meanwhile, ether ETFs decided to join the fun after a series of disappointing weeks. They snatched up $157.09 million in net inflows. The winner of the ether ETF race was Fidelity’s FETH with $68.59 million, followed closely by Blackrock’s ETHA with $64.18 million. Grayscale’s Mini Ether Trust also added a solid $34.87 million to the pile. Other smaller contributions came from Bitwise’s ETHW ($12.95 million) and 21shares’ CETH ($4.14 million). But hold your horses—Grayscale’s ETHE did experience a small hiccup, seeing $32.02 million in outflows. Oops, better luck next time!

As of now, bitcoin ETFs are sitting pretty at over $109 billion in assets, while ether ETFs have reclaimed the $6 billion milestone. In other words, 2025 is shaping up to be one heck of a year for crypto ETFs. We’re talking about momentum like you’ve never seen—unless, of course, you’ve seen a rocket launch.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade Update 1.011.002 Adds New Boss Fight, Outfits, Photo Mode Improvements

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- League of Legends: Anyone’s Legend Triumphs Over Bilibili Gaming in an Epic LPL 2025 Playoff Showdown!

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Lucky Offense Tier List & Reroll Guide

- An Important HDR Setting Is Hidden On Nintendo Switch 2 – Here’s How To Find It

2025-04-28 18:58