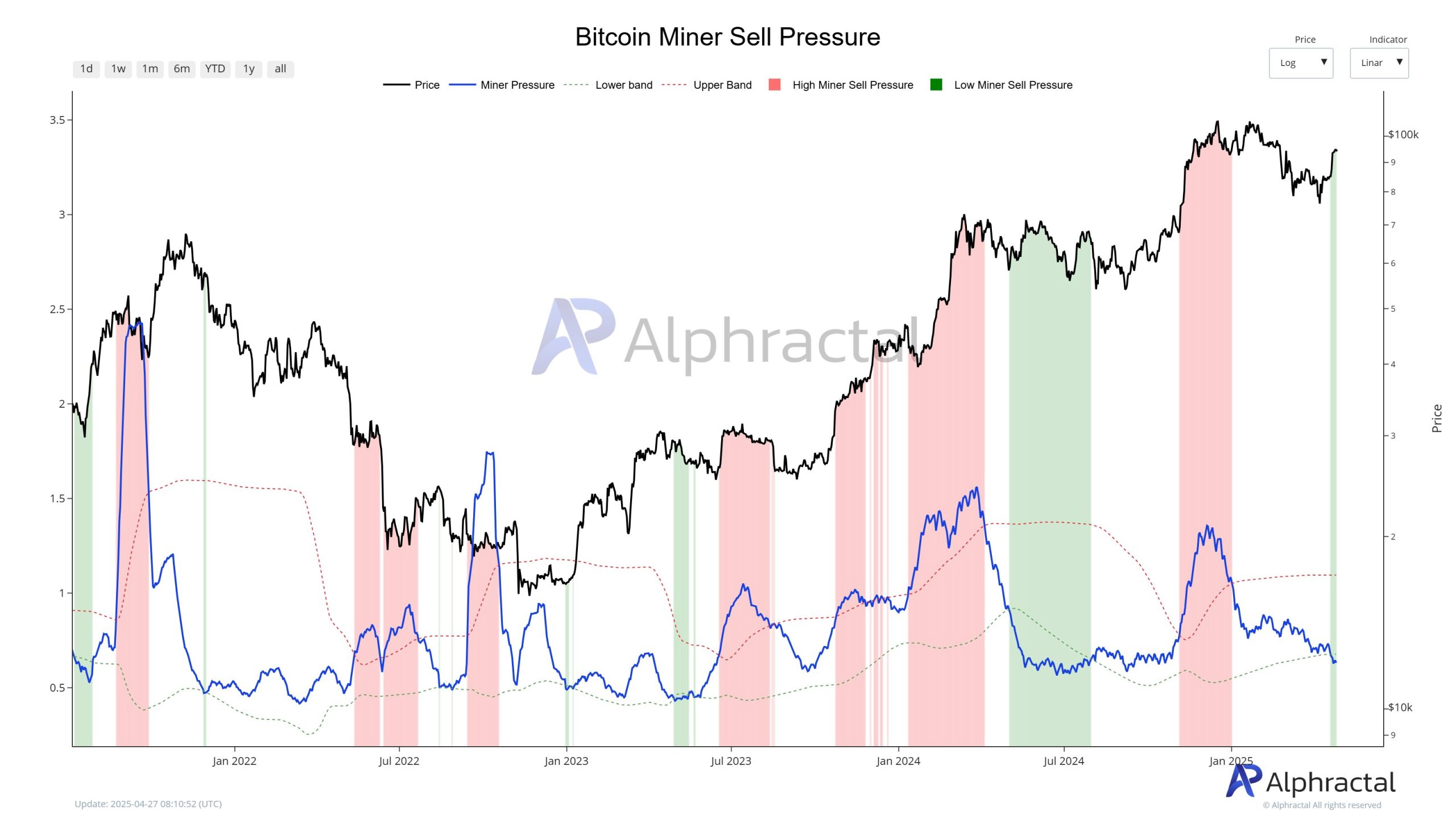

So, apparently, when Bitcoin miners decide to play it cool and barely sell their stash, we shouldn’t get our hopes up for a financial fireworks show. Instead, history suggests we’re more likely in for a tedious game of price freeze tag or the kind of slide that’s as exciting as watching paint dry. Sure, there were a few rebels who broke the mold back in 2012, 2013, 2016, and that wild July 2021 — but mostly, low selling pressure means less drama and more yawns. 🥱

April’s Bitcoin Mining Rollercoaster: Hold On Tight

In April 2025, Bitcoin’s hash rate decided to show off by hitting an all-time high. Then, like a gymnast who misses the dismount, it dipped slightly before trying to bounce back — sounding suspiciously like April 2021’s stunt. A bit of déjà vu for those keeping score at home. If you think April 14th is just another day for awkward Zoom calls, think again: it’s been a popular date for Bitcoin’s little peak parties in 2021 and 2023.

Now, don’t get too comfortable. Alpharactal (the name alone sounds like a financial wizard) is waving a cautious flag. The recent hash rate antics raise the big question: is Bitcoin about to take another nosedive into the year-ago doldrums? Spoiler: it’s complicated.

Here’s the skinny: many miners apparently cashed out early in 2025 while prices were decent, playing it smart by protecting their bottom line. But, watch out — if mining gets tougher or less profitable, these guys might panic sell all over again, turning the market mood from mellow to “oh no.”

What to Stare At If You Want to Feel Like You Know What’s Going On

Alpharactal (again, the financial fortune teller) advises keeping a close eye on:

- Bitcoin price gymnastics

- The ever-elusive hash rate trends

- Mining difficulty updates (think: Bitcoin’s version of gym class)

- How publicly traded mining companies are holding up or losing their marbles

In plain English: miners selling a lot has historically been like a weather warning for financial thunderstorms. If they keep quiet, the seas stay calm— at least until some unpredictable market tsunami crashes the party.

Bottom Line: Miners Are Chilling, But Don’t Break Out The Champagne Yet

Right now, the miner-sell slow dance is more “meh” than “woohoo” for Bitcoin. History has a sense of humor, though, and often these tranquil spells are the calm before a bumpy ride rather than an all-out rocket launch. 🚀😬

So, if you’re the type who likes to gamble on digital gold, keep your eyes peeled. April’s curtain call might be over, but the Bitcoin drama is probably just warming up.

Source

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-04-27 20:36