Hyperliquid (HYPE), that cheeky fellow of the crypto parlour, has been raking in a tidy sum — a whopping $42.53 million in fees over the past month, no less. Jolly good show! Yet, alas, our dear momentum indicators are behaving like a damp squib at the garden party: the RSI and BBTrend, those ever-watchful chaps, are decidedly losing their vim and vigour.

Twice has HYPE attempted to scale the daunting £19.26 barricade—and twice it has found itself politely turned away, left nursing a bruised ego and a faltering short-term trend. Now, it teeters at a crossroads: will it flounce gracelessly below support or spring forth with the zeal of a terrier on parade towards $25?

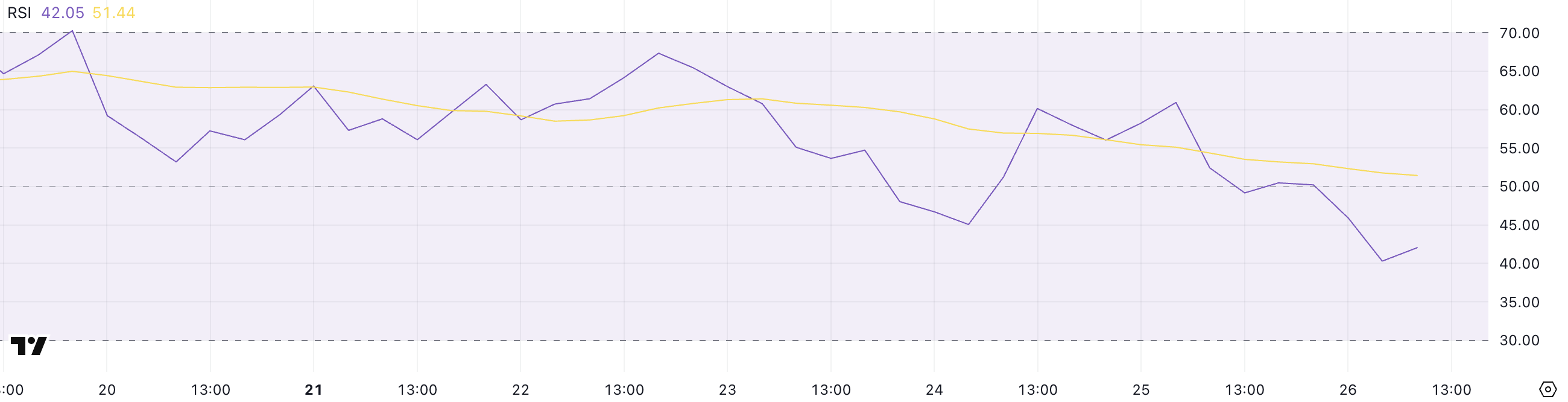

Hyperliquid’s RSI: From Peppy to “Oh Dear” at 42

The Relative Strength Index, or RSI, that clever little number that gauges price spirit, has taken a tumble faster than Aunt Agatha from a ladder, dropping from a sprightly 60.93 yesterday to a decidedly lacklustre 42 today.

Once soaring above the lofty overbought realm, HYPE now nods towards the neutral aisles, casting a wary glance at the slightly oversold shelves. Traders, ever the cautious sorts, sip their teas a little slower these days.

The RSI, for the uninitiated, is the dandy indicator standing sentry over the pace and magnitude of price jiggles. It flits between 0 and 100: above 70, one’s in the overcooked territory; below 30, in the “poorly sorted” zone.

At 42, our dear token lounges in the neutral lounge, sipping a gin and tonic, but visibly leaning toward the couch cushions labelled Weakness.

Should the RSI nose-dive further, prepare for more bearish theatrics. Should it pull a quick rebound, HYPE might just pirouette back into the spotlight before the curtain of loss drops.

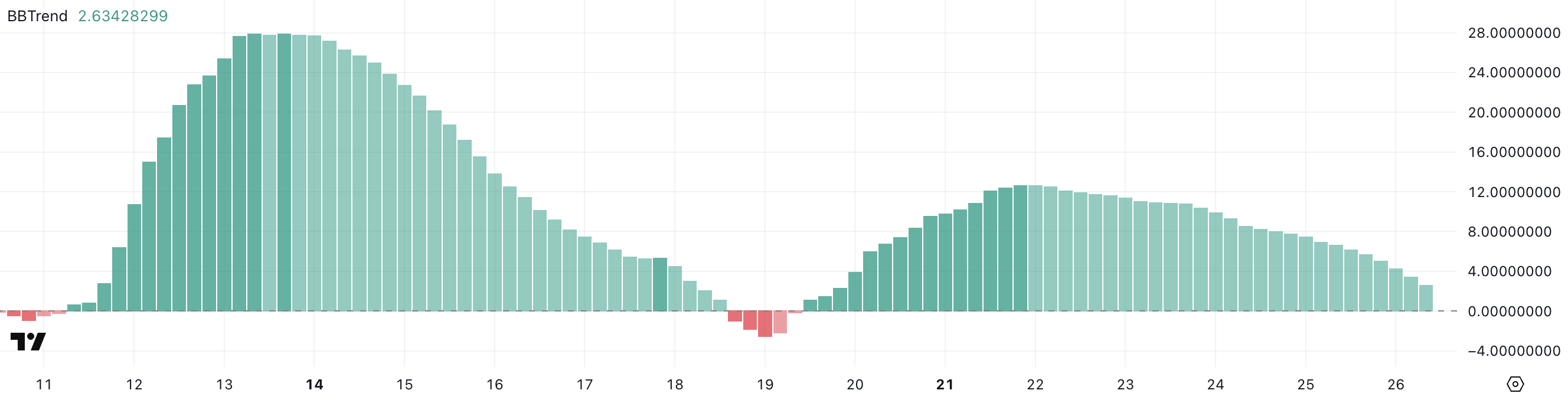

BBTrend Takes a Nose-Dive: Consolidation or Just a Hangover?

Our pal Hyperliquid’s BBTrend, which measures how furiously Bollinger Bands are flapping about, has nosedived from a robust 12.68 down to a meek 2.63 in just five days. That’s a fall steeper than Jeeves’s disdainful sigh.

Such a slump typically signals a halt in the bullish fandango—possibly a consolidation phase or, heaven forbid, the prelude to a dreary correction waltz.

Think of BBTrend as the bouncer of the ballroom: high values mean everyone’s jitterbugging wildly; low values mean folks are politely shuffling side to side, hoping for the music to pick up.

At 2.63, HYPE’s trend strength resembles a lethargic dormouse, dozing along unless an energetic tune arrives.

The Great Question: Will HYPE Flop Below $16 or Showtime Past $25?

After two embarrassments at the $19.26 resistance ball, poor HYPE looks like it might be limping toward a “death cross” soirée—a grim affair that could see it tumble to $16.82 support or, worse, below $14.66 where it might find itself in the deep, dark cellar of $12.42 and $9.32.

But let’s not jump to conclusions, old bean! Should the bullish party crash once more, HYPE could rally like a proper sport, challenging $19.26 again.

A victorious breakout there might just clear the path to $21, then, fingers crossed, a triumphant charge to $25.87—the first time since that febrile February 21 bash when HYPE danced above $25.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lottery apologizes after thousands mistakenly told they won millions

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-26 21:06