So, crypto… remember when it was all cowboy hats and tumbleweeds? Yeah, the “Wild West” of investing is officially hanging up its boots. In this week’s edition of Crypto for Advisors, Dovile Silenskyte from WisdomTree breaks down how crypto has gone from a “maybe, maybe not” investment to a full-fledged portfolio heavyweight. Spoiler: It’s no longer just for the daredevils.

But wait—Kim Klemballa from CoinDesk Indices also chimes in with some serious talk about digital asset benchmarks and trends in our “Ask an Expert” section. If you’re wondering if Bitcoin is still king, or if some new kid on the block is going to knock it off the throne, keep reading. You might be in for a surprise!

– Sarah Morton

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

The Evolution of Crypto Products — From Speculative Bets to Strategic Assets

Here’s the deal: Crypto has matured. It’s not the wild rollercoaster ride it used to be, but more like a smooth, strategic asset you can actually trust. If you thought crypto was just another flash-in-the-pan trend, guess what? It’s here to stay— and big institutional investors are onboard. No longer just for the crypto bros and Silicon Valley dreamers, this is the real deal.

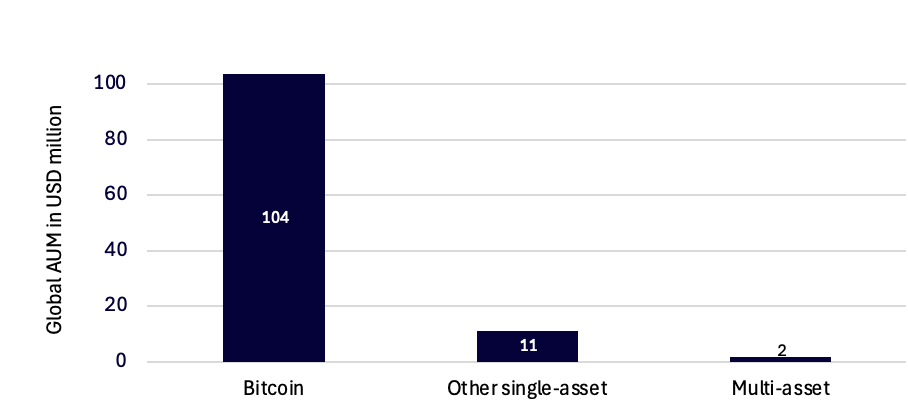

Figure 1: Global assets under management (AUM) in physical crypto ETPs

In fact, by the end of Q1 2025, more than $100 billion was invested in physical bitcoin exchange-traded products (ETPs). Yep, that’s billion with a “B.” And this isn’t just some reckless gamble anymore. We’re talking institutional investors, like sovereign wealth funds and pension schemes, all jumping on the crypto bandwagon. Seems like it’s not just a “fad,” huh?

After over 15 years of ups and downs and half a billion users later, crypto has solidified itself as a serious asset. Bitcoin? It’s now viewed as a scarce, decentralized macro asset, showing up as a core holding in diversified portfolios. Who knew?

But here’s the catch — crypto allocations are still under-diversified. Yep, you heard me.

Most crypto portfolios are still way too concentrated in Bitcoin. Like, remember that time you put all your eggs in one basket and then tried to pretend it was a good idea? Yeah, same energy. Diversification is crucial, people! If you wouldn’t put all your stock in one tech company, why treat crypto any differently? 🤔

Remember, diversification isn’t about avoiding risk. It’s about being smart— and not leaving money on the table. With crypto, you’ve got to embrace the chaos (sorry, not sorry) and capture every opportunity across a multi-chain world.

And it’s not just Bitcoin anymore. Ethereum, Solana, Cardano, Polkadot— they’re all part of a rapidly growing ecosystem. Whether you’re into decentralized finance (DeFi), non-fungible tokens (NFTs), or just want to stay ahead of the curve, there’s a whole world of crypto out there waiting for you to explore. 🚀

The case for crypto indices

Now, let’s get real: most people don’t have the time, energy, or technical know-how to keep up with crypto markets 24/7. No worries though, because that’s where crypto indices come in. Think of them like your personal tour guide through the wild, wild west of digital assets.

Just like you’d use the S&P 500 to get a broad sense of stock market performance, crypto indices let you access the market without losing your sanity (or sleep). No more guessing or picking tokens— just straight-up exposure to the crypto landscape. Ahhh, the sweet smell of simplicity.

– Dovile Silenskyte, Director of Digital Assets Research, WisdomTree

Ask an Expert

Q. Why is diversification important in crypto?

A. You’re dealing with over 20,000 cryptocurrencies— and Bitcoin still rules about 65% of the market cap. Diversification helps institutions manage volatility and seize broader opportunities. You can track this with crypto indices or go for exchange-traded funds (ETFs) and separately managed accounts (SMAs), which give you access to multiple cryptos in one go. Less stress, more rewards!

Q. What trends are you seeing in digital assets?

A. The big players are finally getting in. A survey of over 350 institutional investors showed 87% plan to increase their crypto investments in 2025. And guess what? They’re not just going for Bitcoin. Nope, they’re diversifying into things like digital asset companies, stablecoins, and more. It’s like crypto’s going mainstream. 📈

Q. Does a broad-based benchmark exist in crypto?

A. You bet! We launched the CoinDesk 20 Index in 2024, which tracks the performance of top digital assets. It’s got liquidity, diversification, and tons of trading volume—$14.5 billion, to be exact. This index is available globally and gives you the tools to keep up with the ever-changing crypto scene.

– Kim Klemballa, Head of Marketing, CoinDesk Indices

Read More

- Unleash Your Heroes’ True Potential: Best Stadium Builds for Every Overwatch 2 Hero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lucky Offense Tier List & Reroll Guide

- Elder Scrolls Oblivion: Best Mage Build

- Elder Scrolls Oblivion: Best Spellsword Build

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- Best Crosshair Codes for Fragpunk

- SWORN Tier List – Best Weapons & Spells

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Elder Scrolls Oblivion: Best Rogue Build

2025-04-24 18:46