So, there was a bit of a kerfuffle in the financial markets on Monday. The U.S. stock market took a nosedive, but don’t worry, cryptocurrencies just sat there like that cool kid who doesn’t get involved in playground drama. Meanwhile, the Commander-in-Chief, Donald Trump, took his latest public spat with Federal Reserve Chairman Jerome Powell to a whole new level. The Guardian and some other news outlets, because why not, reported on this little tiff.

It’s like a bad soap opera, where the main stars—the President and the Fed Chair—are throwing verbal haymakers at each other, and yet somehow, the cryptocurrency market is just chilling in its hammock, unbothered.

Stock Markets? More Like Stock Meltdown

On April 21, the American stock indices decided to have a meltdown, probably just for fun. The S&P 500 dropped 2.3%, the Nasdaq took a 2.4% nosedive, and the Dow Jones? Oh, it went full drama queen, losing almost 1,000 points. If you don’t believe me, check Google Finance. It’s all there.

BREAKING: Trump calls Jerome Powell a “major loser” and demands interest rates be slashed “NOW!”

— Morning Brew (@MorningBrew) April 21, 2025

Trump’s Call for Rate Cuts: The Reality Show Edition

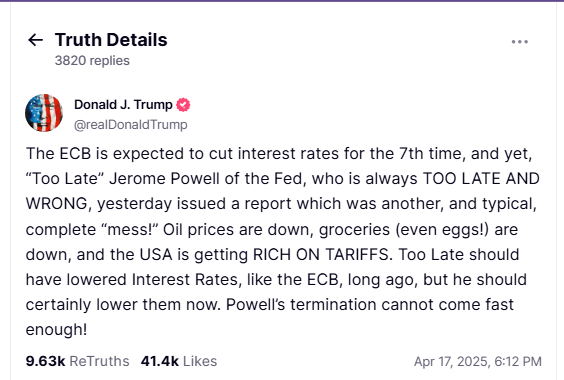

Apparently, Trump woke up on the 21st and decided it was the perfect day to rant about interest rates. Using his platform on Truth Social, he posted, and I quote, “Preemptive Cuts in Interest Rates are being called for by many.” Clearly, everyone has an opinion on interest rates these days.

The President, ever the economist, went on to explain that rates should be lowered because, according to him, “Energy Costs are way down, food prices are substantially lower, and most other ‘things’ are trending down.” I don’t know about you, but it’s nice to know that the President has his finger on the pulse of “things.”

Trump has been fairly vocal about Powell, calling him “Too late and wrong” for not cutting interest rates. So, 4.5% rates? That’s a no-go. Apparently, Powell is not the man for the job.

Things got even juicier when Powell warned that Trump’s tariffs might cause something called “stagflation” (which, if you’re like me, sounds like a really bad stomach ailment). This caused Trump to demand Powell’s removal, declaring that his “termination cannot come fast enough.” Yikes.

Dollar Takes a Dive, Bitcoin Shrugs

In the middle of all this drama, the U.S. Dollar Index (DXY)—which tracks how the dollar is doing compared to other currencies—decided to drop below 98 on April 21, hitting a three-year low. Because why not add to the chaos?

Let’s not forget that the dollar has lost over 10% of its value since the start of 2025. Oh, the joys of modern economics.

Now, if you’re wondering what’s happening in the world of cryptocurrency, let me tell you, Bitcoin is just sitting there all zen-like. The cryptocurrency market cap is holding steady at $2.74 trillion, despite the stock market’s existential crisis.

Bitcoin’s price hit a four-week high of $88,428, which, if you’re keeping score, is doing just fine. Who needs traditional markets when you’ve got Bitcoin?

Why is the price of bitcoin flat? Should Trump fire Jerome Powell? Will the US lose its reserve currency status?

I answer your questions. Or don’t. Either way, I’m Anthony Pompliano. Deal with it.

— Anthony Pompliano (@APompliano) April 18, 2025

Meanwhile, Anthony Pompliano, who’s basically the crypto version of your friend who thinks they know everything, warned against Trump trying to play puppet master with the Fed. In a video, Pompliano said that firing Powell just because of policy disagreements was a “bad idea” and could lead to “perilous waters.” Because, of course, it would.

Market experts, those wise sages who predict the future from their ivory towers, believe that the Fed will stand firm at its next meeting on May 7. And guess what? There’s only a 13% chance they’ll actually cut interest rates. So much for all that drama.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-04-22 21:07