Picture, if you will, a dashing fellow in a cravat—TechDev by name—who’s been peering into his crystal ball of crypto with the rapt attention of a bloodhound on the scent. This chap, a strategist of no mean repute, boldly announces to his 520,200 minions on the mystical realm of X, that altcoins are gearing up for their moment of glory. One might say the stage is set for a right old show.

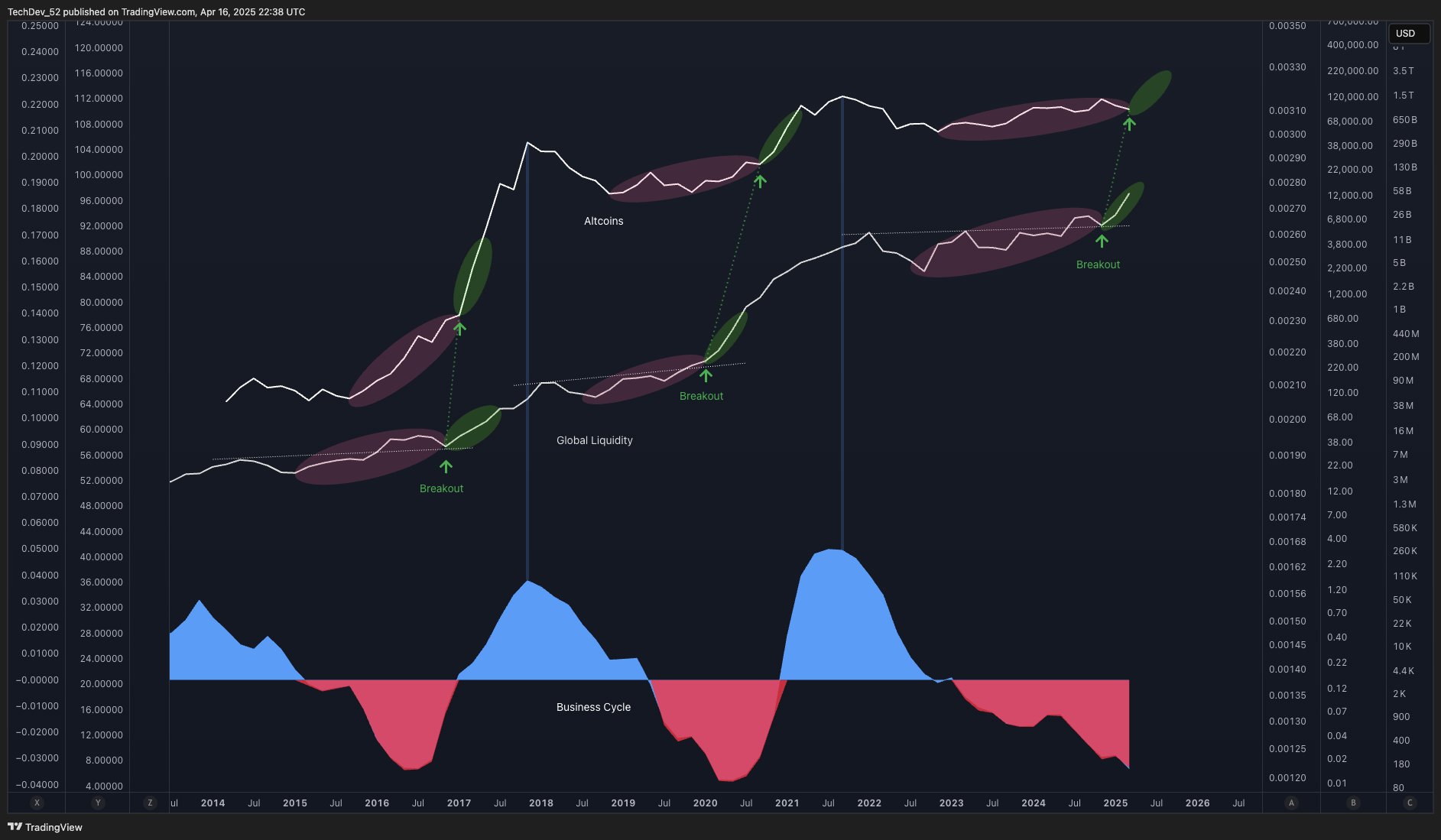

According to our roguish analyst, two grand events in the economic carnival—the surge in global liquidity and the business cycle hitting its nadir—are flashing bullish signals like a cabbie’s rooftop lantern on a foggy London night.

For the uninitiated, global liquidity is just a fancy term for all the money swimming around the world’s financial pond, presumably in tiny floaties. The business cycle, meanwhile, is the economic equivalent of a pendulum, swinging with all the predictability of Aunt Agatha’s temper.

TechDev doffs his hat and declares:

“Altcoins don’t run until liquidity breaks out. It’s time.” 🕰️💸

Our savvy friend’s charts suggest that in years gone by—namely 2016 and 2020—altcoins started doing their victory dance just as the business cycle hit bottom and the money floodgates burst open. Sort of like your uncle Grandpa when he finally breaks loose from a genteel tea party.

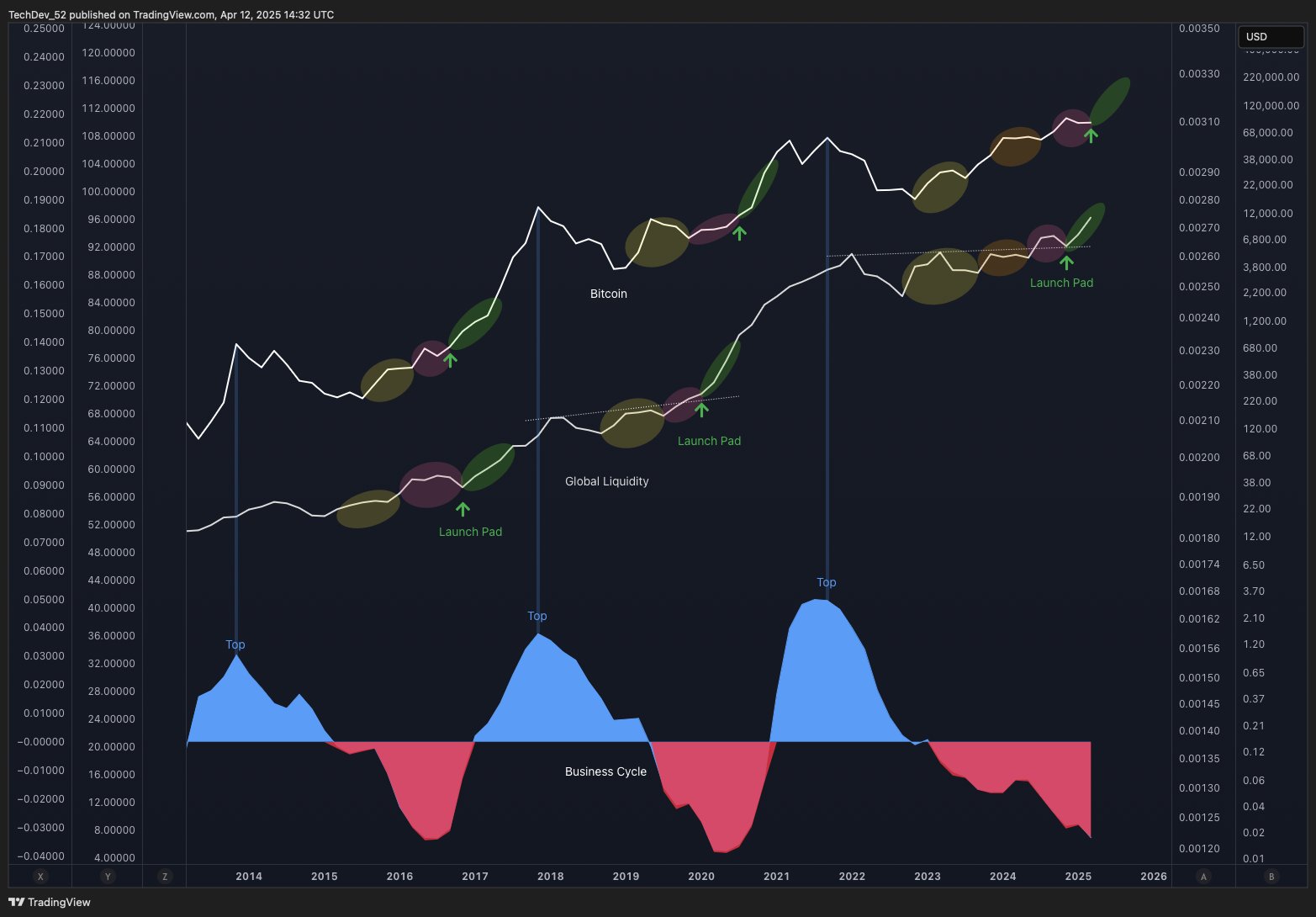

As for the reigning monarch of crypto, Bitcoin (oh, BTC, you capricious sovereign), TechDev pronounces that even His Majesty will find himself swept up in this whirlwind of bullishness.

“Are you ready?” (He asks, eyes gleaming with all the subtlety of a cat about to pounce.) 🐱👤

Zooming the telescope towards BTC, our intrepid analyst foresees the crypto’s price doing a rather splendid jig after breaking free from a “cup-and-handle” formation—a pattern so bullish it makes one want to break out the champagne and the monocle.

“After all the rigorous analysis, will be amusing if it ends up this simple…” 🍾📈

By his reckoning, dear reader, Bitcoin might quite merrily waltz up to a staggering $500,000 by the year 2026. Meanwhile, at the time of scribbling these words, it’s lounging at a modest $85,165—barely out of its dressing gown.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-04-21 03:03