Good morning, crypto detectives! Grab your overpriced artisanal coffee because here’s what people pretending to understand markets are buzzing about today. Spoiler: Bitcoin’s eyeing $90K like it’s a Black Friday sale.

Apparently the world’s liquidity is flooding like your inbox after a breakup, which usually means those ‘risky’ assets like crypto get their moment in the sun—or, y’know, a frenzied caffeine high.

Is Bitcoin About to Ride China’s Money Supply Wave or Just Wipe Out?

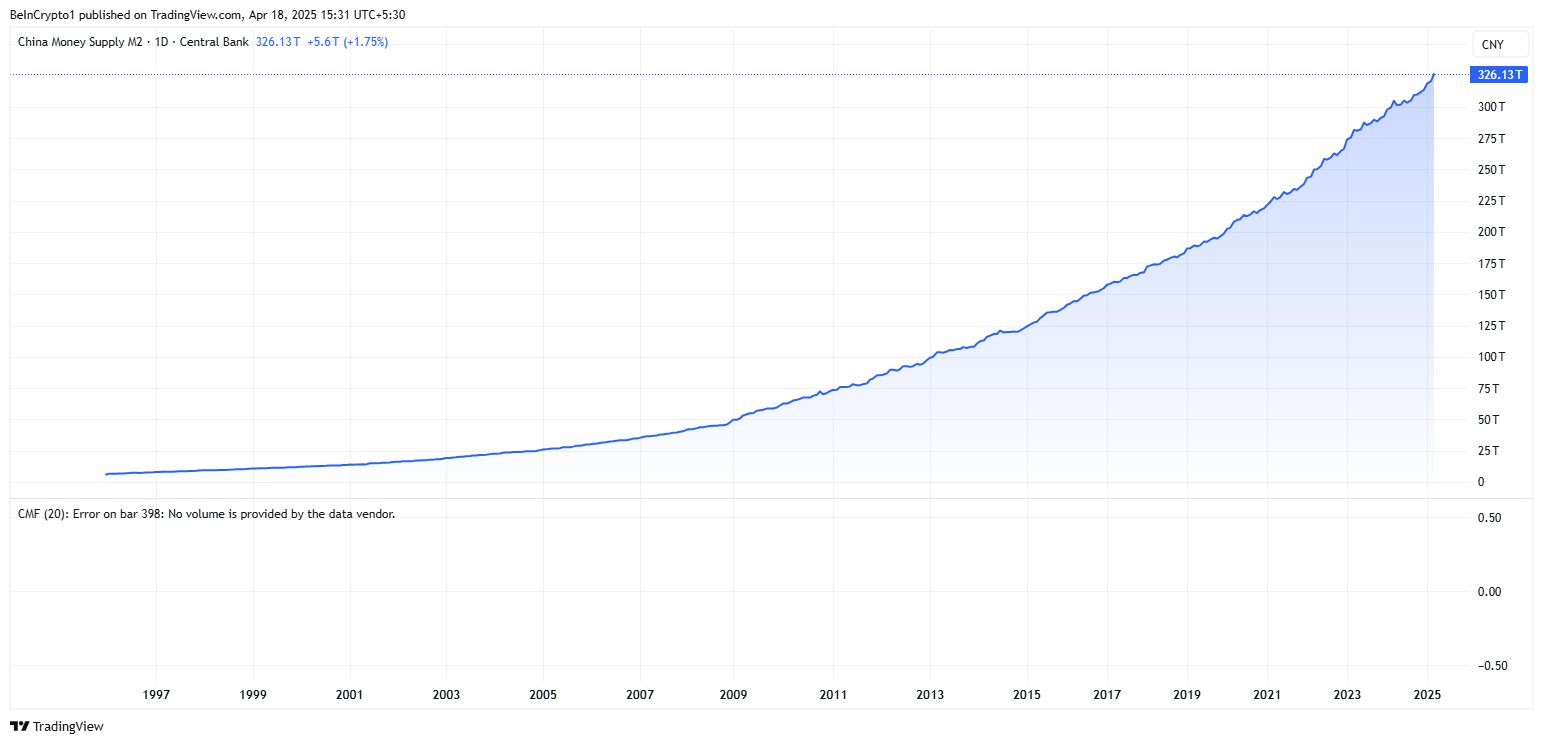

So, China’s M2 money supply has ballooned to a mind-numbing $326.13 trillion. For perspective, that’s more zeros than your grandma’s “just one more cookie” promise.

M2 rising means there’s more cash floating around looking for a dance partner—usually riskier things like Bitcoin, altcoins, or even that sketchy startup your mate won’t stop hyping.

“China’s printing money like it’s going out of style. Risk assets? Buckle up, we’re about to go parabolic,” says Kong Trading. Translation: chaos or opportunity—your pick. 🍿

Turns out, global M2 isn’t just copying China’s homework—it’s setting its own record. Imagine a school where everyone’s just making it rain cash nonstop.

Market brain Enmanuel Cardozo D’Armas threw his two satoshis in, saying Bitcoin might flirt with $90K soon if China keeps this money party going.

“If China’s M2 keeps inflating, Bitcoin’s $85K right now could soon look like $90K. And no, it’s not just wishful thinking—there’s historic receipts,” Enmanuel told BeInCrypto.

This lines up with yesterday’s crystal-ball gazing from Blockhead Research’s Valentin Fournier, who’s also bullish on Bitcoin hitting $90K because, well, everyone loves a good round number.

Side note: China could hit even more record levels in M2 by the end of 2025, which might mean more folks tossing money at crypto because, shocker, positive vibes are contagious.

But hold your horses before buying that Lambo sticker: $90K is a big “if” with the Fed acting like the strict headmaster refusing to cut rates anytime soon, and Trump’s tariffs still playing like a bad rerun.

“A May or June Fed rate cut could fuel this rocket, but if trade drama or regulation creep back, it’s more likely a soap opera than a sprint,” warns Enmanuel.

Also, China’s reportedly selling off seized crypto to patch its finances—because nothing says “economic strategy” like dumping coins to the highest bidder.

So while China’s money bonanza might give Bitcoin a shove, don’t forget other things lurking in the macroeconomic shadows ready to rain on this parade.

Charts: Because We Love Proof (or Pretty Pictures)

Look at this and imagine Bitcoin chasing after China’s cash flow like it owes it money.

Legend has it altcoins wait until liquidity bursts to party hard. TechDev says “It’s time.” Translation: buy now or cry later.

“Altcoins don’t sprint until liquidity breaks out. This is the starting pistol,” quipped crypto analyst TechDev. 🏁

Market Tea: Crypto Stocks Pre-Game

| Company | Close on April 17 | Pre-Market Mood |

| Strategy (MSTR) | $317.20 | $316.25 (-0.30%) Not exactly a rave party |

| Coinbase Global (COIN) | $175.03 | $175.02 (-0.009%) So steady it’s boring |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.51%) Slightly dramatic exit |

| MARA Holdings (MARA) | $12.66 | $12.68 (+0.16%) Barely waving hello |

| Riot Platforms (RIOT) | $6.46 | $6.46 (+0.009%) Practically frozen |

| Core Scientific (CORZ) | $6.63 | $6.65 (+0.29%) Slight pep in its step |

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-04-18 15:23