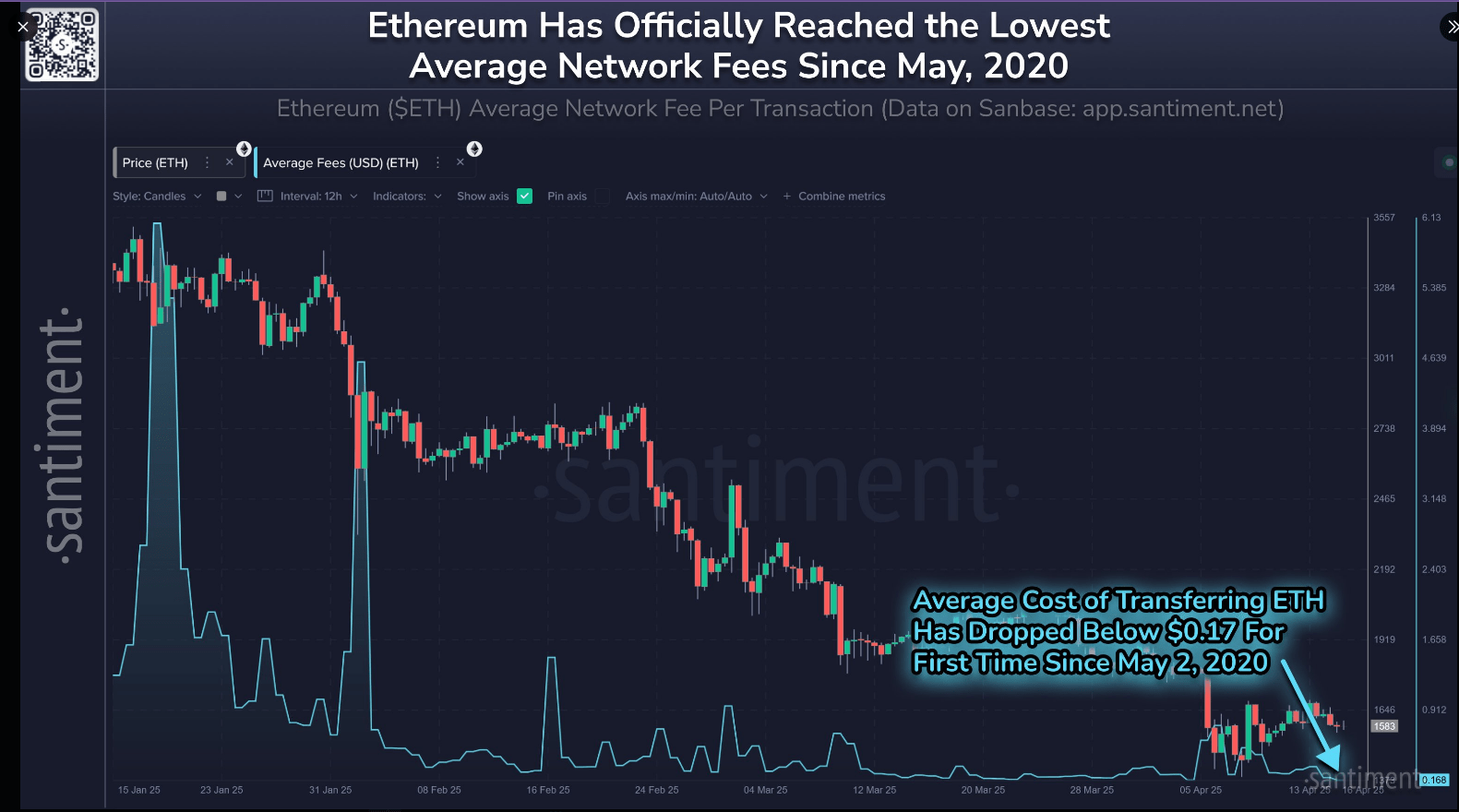

Transaction fees for Ethereum have reached their lowest levels in half a decade. This decrease is occurring due to users reducing activity on the network because of economic uncertainties, as indicated by data from Santiment, a platform that analyzes blockchain activity.

Ethereum Transaction Costs Plummet To Just 17 Cents

Currently, it costs around $0.168 to process a transaction on Ethereum. This significant drop aligns with less activity taking place, as there are fewer individuals transferring Ether or utilizing smart contracts on the blockchain. Brian Quinlivan, marketing director at Santiment, elaborated on this trend in a blog post dated April 17th.

Market Uncertainty Keeps Traders On Sidelines

In the words of Quinlivan, it’s common to see low network fees precede price increases. Yet, a lot of traders appear to be holding off on resuming usual trading activities, preferring to wait until global economic uncertainties are addressed.

UPDATE: The cost to process Ethereum transactions has fallen to a five-year low, sitting at only $0.168 per transaction. This is the lowest daily fee for transferring ETH since May 2nd, 2020, as explained in our latest analysis.

— Santiment (@santimentfeed) April 16, 2025

The uncertainty persists following market concerns that arose on April 2 when President Trump declared extensive tariffs. Both conventional markets and the cryptocurrency sector experienced a setback, with the majority of their assets falling below their initial values established before the announcement.

Pectra Upgrade Set For Launch On May 7

In spite of the ongoing market turmoil, the progress in Ethereum development remains unabated. The much-anticipated launch of Pectra is now officially set for May 7, following some schedule adjustments due to technical issues and an unidentified intruder disrupting testnet operations.

In the initial phase of Pectra, we can expect several improvements in the system, including:

1. Boosting layer-2 blob capacity from three to six.

2. Decreasing transaction fees.

3. Relieving network congestion issues.

4. Providing an option for users to pay fees using stablecoins such as USDC and DAI.

5. Increasing the maximum staking limit from 32 ETH to a significantly higher 2,048 ETH.

In late 2025 or early 2026, we’re looking forward to launching a subsequent phase that introduces advanced data structures for enhanced storage effectiveness. This upgrade will also establish a mechanism enabling nodes to authenticate transaction data without having to save the entire database.

Long-Term Holders Begin Selling Positions

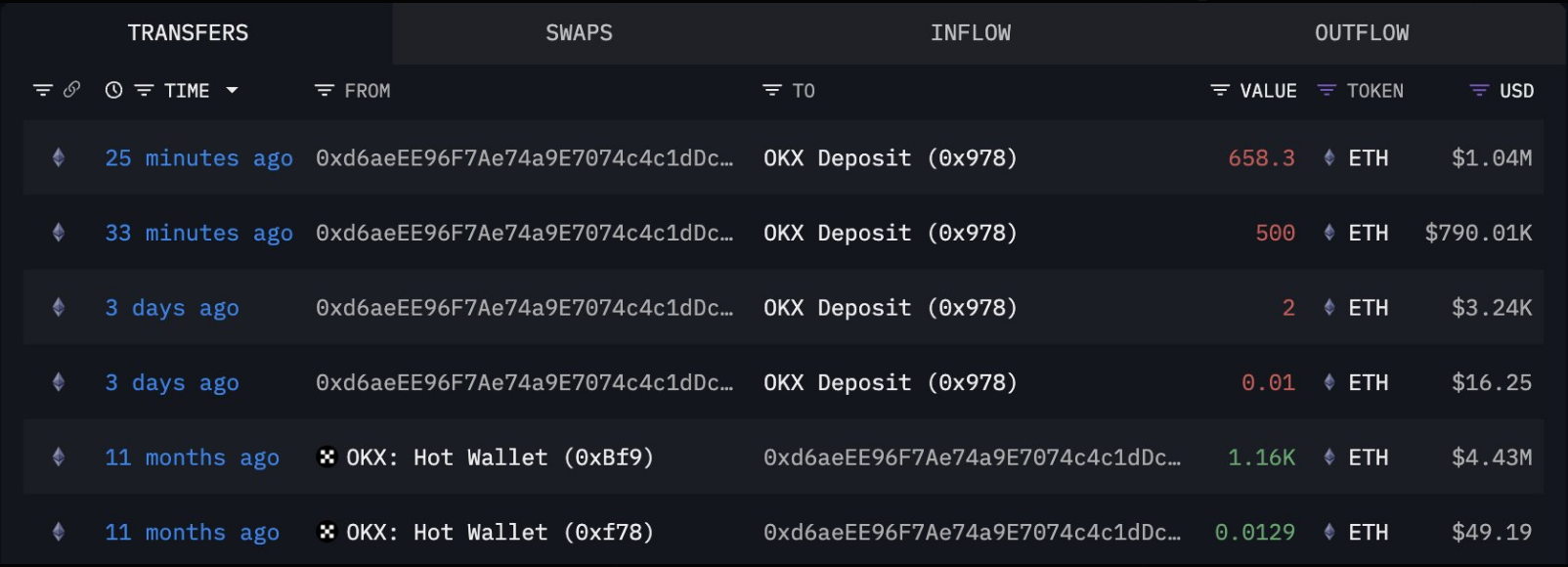

Currently, data from Lookonchain indicates that long-term Ethereum owners are offloading their investments, a trend that continues despite past market fluctuations. This selling activity is taking place at prices ranging between $1,500 and $1,700.

After keeping Ethereum (ETH) for 11 months, this individual decided to cash out completely, selling off the entire 1,160 ETH ($1.83 million) at a net loss of approximately $2.6 million (-58.6%).

Approximately eleven months back, he took out 1,160 ETH valued at approximately 4.43 million dollars from OKX when the price was around 3,816 dollars. Recently, about half an hour ago, he deposited the same 1,160 ETH back into OKX, but this time when the price was at $1,580, resulting in a loss of roughly 2.6 million dollars or 58.6% of its initial value.

— Lookonchain (@lookonchain) April 16, 2025

Market observers are receiving conflicting indications from the trading activity, with some interpreting it as a possible indication of an upcoming downturn, while others see it as potentially leading to market equilibrium or even stabilization.

At present, this sale occurs during a notable moment, as network usage is at its lowest in years, yet significant technological advancements are imminent. According to Quinlivan’s evaluation, the confluence of decreased retail interest and continuous development might lead to “an unexpected resurgence with minimal obstacles.

The cost of Ethereum has dropped over 11% in the past fortnight, according to data from CoinMarketCap, and it’s currently being exchanged for around $1,600. However, its price has stayed constant during the previous day.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-04-17 23:20