There’s renewed attention for Ripple‘s native token due to an increase in token burns, a possible upcoming exchange-traded fund (ETF), and advancements in the ongoing XRP legal case.

Legal Pause Ignites XRP Settlement Chatter

In a significant development this week, the SEC vs. Ripple legal battle took another step forward as the U.S. Court of Appeals for the Second Circuit granted a mutual request to put the appeals process on hold. As per attorney James Filan’s update, this move extends Ripple’s response deadline to the SEC’s dispute concerning programmatic XRP sales, potentially creating space for a potential settlement negotiations.

According to Jerome Powell, Chair of the Federal Reserve, both the Senate and House are developing a regulatory structure for stablecoins, marking a significant turning point for assets like RLUSD. [Amelie speaks through platform X]

Lawyer Fred Rispoli, who supports cryptocurrency, pointed out the tight timing of the decision, expressing his thought, “Wow, that’s cutting it really fine! I can only imagine if Ripple’s Chief Legal Officer Stuart Alderoty had said the brief was prepared, finalized, and ready for submission today if this hadn’t happened!

As a researcher, I’m focusing my attention on Judge Analisa Torres, who is poised to make a decision in this case. According to Alderoty, there seems to be a preliminary understanding that Ripple would pay just $50 million out of the initial $125 million penalty, with the remaining $75 million being refunded. Moreover, negotiations are ongoing between Ripple and the SEC to potentially lift an earlier injunction that previously restricted the company’s institutional XRP sales.

As a researcher, I find myself in agreement with legal analysts such as Bill Morgan and Fred Rispoli who posit that Ripple may seek a modification of the court’s order to mitigate the fine imposed and remove restrictions that have impeded XRP’s expansion within the U.S. crypto market.

Approving a resolution might open the path towards the launch of a much-awaited Ripple XRP Exchange-Traded Fund (ETF), thereby reducing overall regulatory scrutiny on Ripple’s cryptocurrency operations.

ETF Momentum Builds: Analysts See XRP as Next in Line

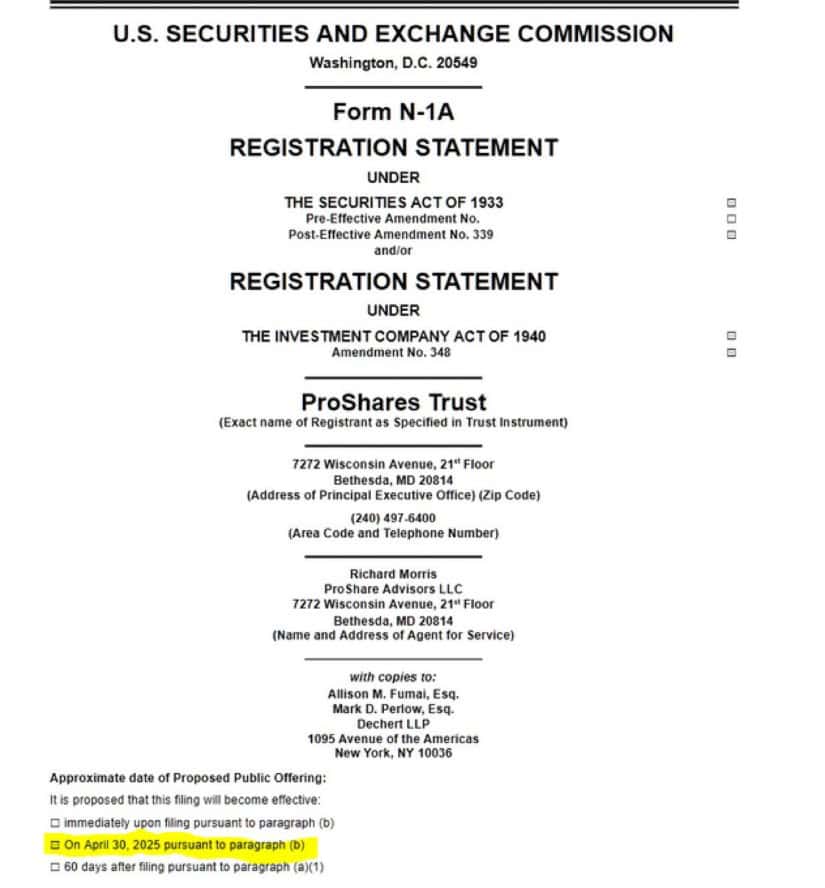

Building more excitement among investors is the increasing belief that a XRP spot Exchange-Traded Fund (ETF) might gain approval. Nate Geraci, president of the ETF Store, expressed high confidence in this happening, saying, “I genuinely can’t imagine the SEC not approving a spot XRP ETF.

As an analyst, I’m observing a noteworthy change in the Securities and Exchange Commission (SEC)’s approach under the leadership of Paul Atkins, who is recognized as a crypto advocate. Unlike the enforcement-focused strategy of Gary Gensler, the SEC under Atkins seems to be adopting a more accommodating stance. This shift is evident in the halting or dismissal of several legal actions, including significant decisions related to the Ripple case.

On Polymarket’s blockchain-based prediction platform, there’s an estimated 77% likelihood that XRP will receive ETF approval by the end of this year. The introduction of a 2x leveraged XRP ETF (symbol: XXRP) by Teucrium and the recognition of numerous spot ETF applications by the SEC are indicators of a more favorable regulatory environment. Key applicants include established players such as Grayscale, Bitwise, and WisdomTree, with experts predicting that heavyweights like BlackRock and Fidelity may also enter this space.

Given approval, an Exchange Traded Fund (ETF) centered on XRP would offer investors a chance to track XRP’s price movement without the need for self-management of the asset—a move that might bring in vast institutional investments totaling up to $8 billion within its initial year, according to JPMorgan analysts.

XRP Burn Rate Doubles—But Impact Remains Modest

As a researcher, I’ve observed an extraordinary surge in the burning of XRP tokens at the network level. In a single day, approximately 4,600 XRP were destroyed – double the average seen this month. This significant increase indicates increased activity on the Ripple ledger. However, analysts are suggesting that the immediate effect on the XRP price might be limited.

In simpler terms, within the Ripple system, there’s an automatic process that eliminates tiny portions of XRP with every transaction. This gradual decrease in the overall XRP supply is a built-in feature. However, the recent increase in burning isn’t indicative of a long-term pattern but rather a temporary surge due to increased usage.

Nevertheless, certain investors view this occurrence as a sign that the Ripple exchange system is becoming more valuable and demanded, especially as legal certainty becomes more established.

XRP Price Hovers Near Key Technical Level

As a crypto investor, I’m observing that after a decline from the $2.25 resistance zone, XRP seems to be in a tight consolidation phase. Currently, the price is close to the $2.08 mark, and it’s trading below the 100-hour simple moving average. There’s a significant bearish trend line emerging near $2.13, and analysts are cautioning about a possible breakdown if XRP can’t maintain the critical $2.00 support level.

If the price moves close to or below the specified threshold, it could potentially drop to around $1.92 or even $1.84. Conversely, if there’s a breakout above $2.20, it might result in another test of the $2.35 – $2.50 price range. At present, the value of Ripple currency hovers between optimistic expectations and economic pressures.

What’s Next for Ripple and XRP?

As the Ripple lawsuit nears its conclusion, the anticipated XRP price trend over the next few months will largely hinge on three key influences: the court’s final decision, SEC’s stance on ETF proposals, and overall investor sentiment within the market. A positive resolution in any of these aspects could potentially reshape the Ripple market dynamics considerably.

Brad Garlinghouse, CEO of Ripple, has consistently pushed for clear regulations and widespread acceptance of Ripple’s XRP. With growing institutional interest and U.S. regulators becoming more welcoming to crypto developments, there’s a strong possibility that XRP could soon regain its place among the leading digital currencies.

Looking ahead, we’re keeping a close watch on three key areas: approaching the $2.00 mark, upcoming verdicts from the SEC regarding Ripple, and the anticipated debut of the first Exchange Traded Fund (ETF) directly linked to Ripple.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Which Is the Best Version of Final Fantasy IX in 2025? Switch, PC, PS5, Xbox, Mobile and More Compared

2025-04-17 18:23