- Pompliano, the Bitcoin wizard, claims BTC could leave gold in the dust. 🪙💨

- Tariff chaos and BTC’s grumpy mood might let gold shine a bit longer. 🌟

Gold, the old reliable, has been strutting its stuff in 2025, leaving Bitcoin [BTC] in the dust as investors flock to it like seagulls to a chip. 🕊️🍟

Meanwhile, BTC, the rebellious teenager, has been mimicking U.S. equities like a parrot on a sugar rush. 🦜🍭 But recently, it’s taken a 10% nosedive, while gold has soared over 25% this year. 📉📈

In a recent CNBC interview, Anthony Pompliano, the BTC enthusiast and founder of Professional Capital Investments, declared that BTC could outshine gold in the long run. He quipped,

“Gold always leads these rallies. When gold runs, about 100 days or so later, Bitcoin always catches up and runs much harder.” 🏃♂️💨

BTC vs. gold

Indeed, BTC (the yellow flash) has a knack for cozying up to gold (the cyan classic) after a bit of a tiff, as Pompliano pointed out. 💛💙

According to the chart, BTC and gold had a lovers’ quarrel in early November and February but made up in December and January. 💔❤️

Even so, gold has been the belle of the ball, outperforming BTC by 37% in 2025, according to the BTC/gold ratio. 🎉 Although the indicator has retreated to a crucial trendline support, it’s anyone’s guess if BTC can claw its way back. 🐾

In the past few days, BTC has been lounging between $83K and $85K, while U.S. equities have been doing their best impression of a sinking ship. 🚢💥

Reacting to BTC’s resilience, Bloomberg ETF analyst Eric Balchunas mused,

“$MSTR up 7% YTD while $QQQ is down 10% is not something I would have predicted. I’m also surprised BTC is at $85k after all this; both good signs imo, shows toughness and counters that it’s just a high beta version of tech.” 🤔💪

He added that Michael Saylor and ETFs have been gobbling up BTC like it’s the last slice of pizza, giving it a stronger base than in past cycles. 🍕📈

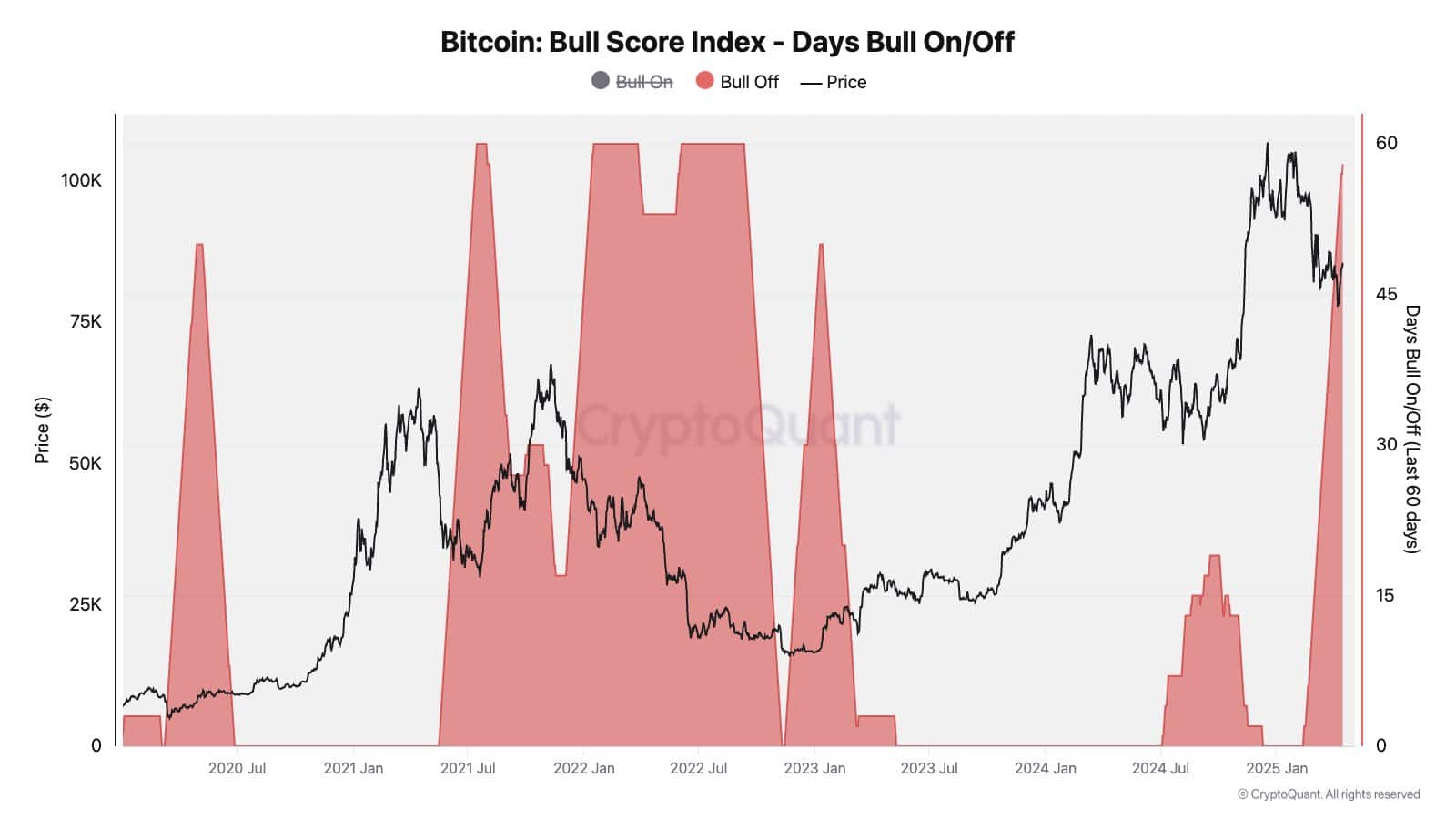

That said, overall demand and bullish conditions for BTC have been as elusive as a unicorn in a haystack. 🦄 According to CryptoQuant’s Bitcoin Bull Score Index, it’s been a ‘Bull Off’ season for the past 60 days. 🐂❌

This mirrored the weak conditions seen during the 2022 crypto winter, marked by negative price action. ❄️📉

The overall market sentiment has been ‘fear’ since February, and a decisive rebound could only be determined by an end to the ongoing tariff uncertainty. 😱

In the meantime, the uncertainty might just tip the scales in gold’s favor, letting it extend its winning streak against BTC. 🏆

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- How to watch the South Park Donald Trump PSA free online

2025-04-16 20:14