Even as the crypto markets attempt to present a cheerful countenance this week, it appears that institutional investors are, shall we say, less than convinced. Indeed, Bitcoin spot ETFs have suffered yet another round of outflows, marking a sixth consecutive day of capital flight from these esteemed funds. 🙄

Despite the market’s rather optimistic, short-lived rebound, these persistent withdrawals suggest a certain degree of caution among our institutional brethren. The outflows, like a leaky faucet, paint a picture of investors seeking the supposed safety of other ventures or, perhaps, merely observing the volatility with a detached amusement. 🤔

Bitcoin ETFs Continue Their Losing Streak (How Dreadfully Unfortunate!)

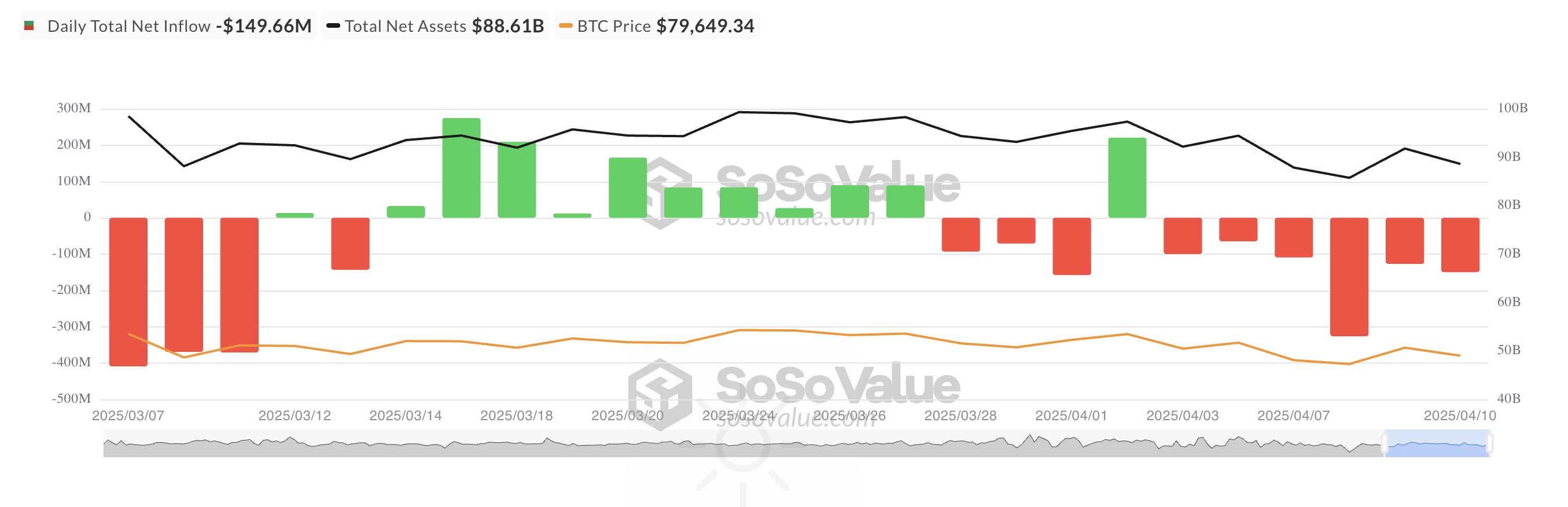

On Thursday, net outflows from BTC ETFs amounted to a considerable $149.66 million, a sum reflecting a 17% increase from Wednesday’s mere $127.12 million. One might almost suspect a trend. 😒

This unfortunate milestone marks the sixth consecutive day of withdrawals from spot Bitcoin ETF funds, thereby highlighting the growing caution and, dare we say, weakening sentiment among those institutional BTC investors.

According to the ever-reliable SosoValue, Grayscale Bitcoin Mini Trust ETF $BTC experienced the highest net inflow on that particular day, totaling a modest $9.87 million, thus bringing the fund’s historical net inflow to a respectable $1.15 billion. A glimmer of hope, perhaps?

On the other hand, Fidelity’s ETF FBTC, not to be outdone in the game of financial see-saw, witnessed the highest net outflow on Wednesday, totaling a rather alarming $74.67 million. As of this writing, its total historical net inflow stands at a somewhat less alarming $11.40 billion. 😅

Derivatives Market Remain Optimistic (Against All Odds!)

Meanwhile, BTC futures open interest has suffered a modest blow, aligning itself rather neatly with the broader market dip. At the time of writing, it stands at $51.73 billion, having fallen by 7% over the past day. This occurs amidst a general decline in cryptocurrency market activity, during which BTC’s value has dipped by a paltry 2%.

A drop in open interest during a price decline suggests that traders are closing out positions with a certain alacrity, rather than venturing into new ones. This indicates a possible “bottoming phase” or, at the very least, a period of reduced volatility. How very…predictable.

But the narrative does not conclude here, dear readers.

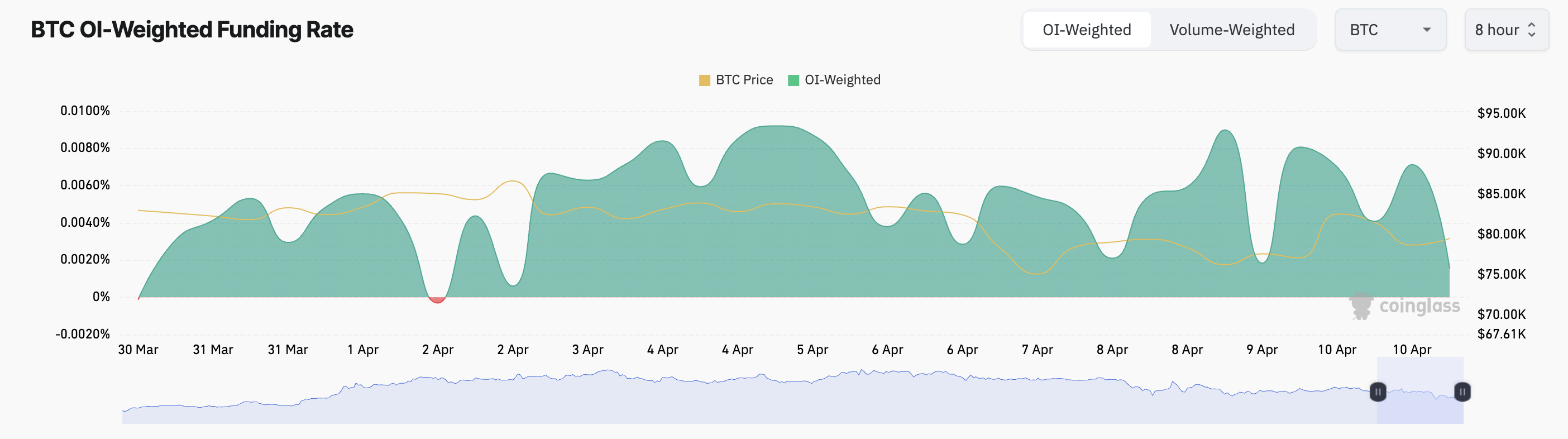

Funding rates remain stubbornly positive, and call options are, to an almost alarming degree, in high demand. Both factors are considered, by some, to be bullish signals. 🤔

At the time of writing, BTC’s funding rate stands at a respectable 0.0015%. The funding rate, as you may or may not know, is a recurring payment exchanged between long and short traders in perpetual futures markets to ensure that contract prices remain aligned with the spot market. A positive funding rate such as this indicates that long traders are paying short traders, signaling a dominance of bullish sentiment. 🧐

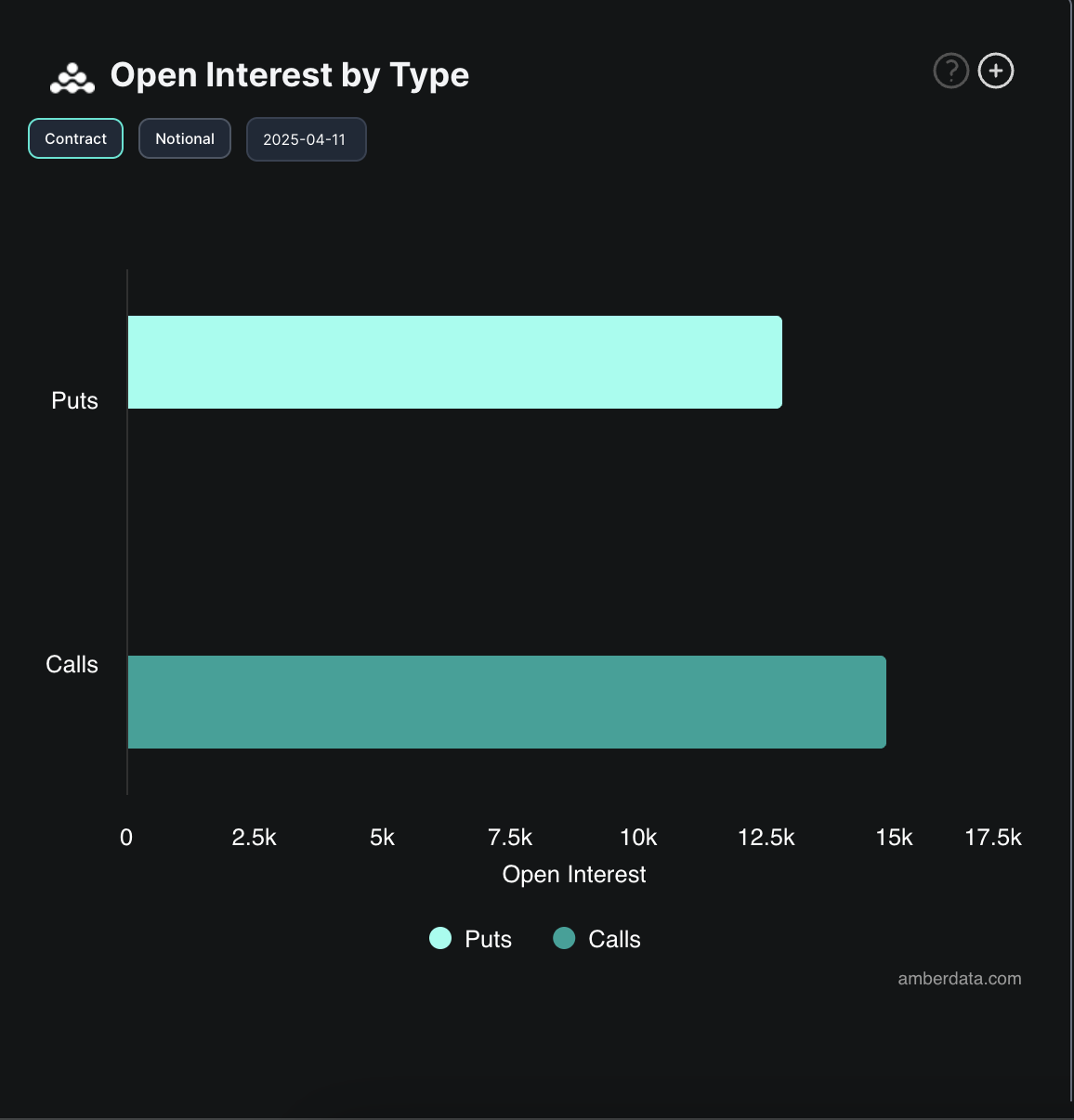

In the options market, there is a decidedly high demand for calls over puts, further reinforcing the impression of a bullish bias towards BTC. One might almost believe in its potential, were one so inclined. 😉

The divergence between ETF flows and derivatives activity this week suggests that, while traditional institutions may be scaling back their exposure with a certain haste, retail and leveraged traders continue to wager, with perhaps a touch too much enthusiasm, on a rebound. Time, as always, will tell who is the wiser. 😇

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-04-11 10:36