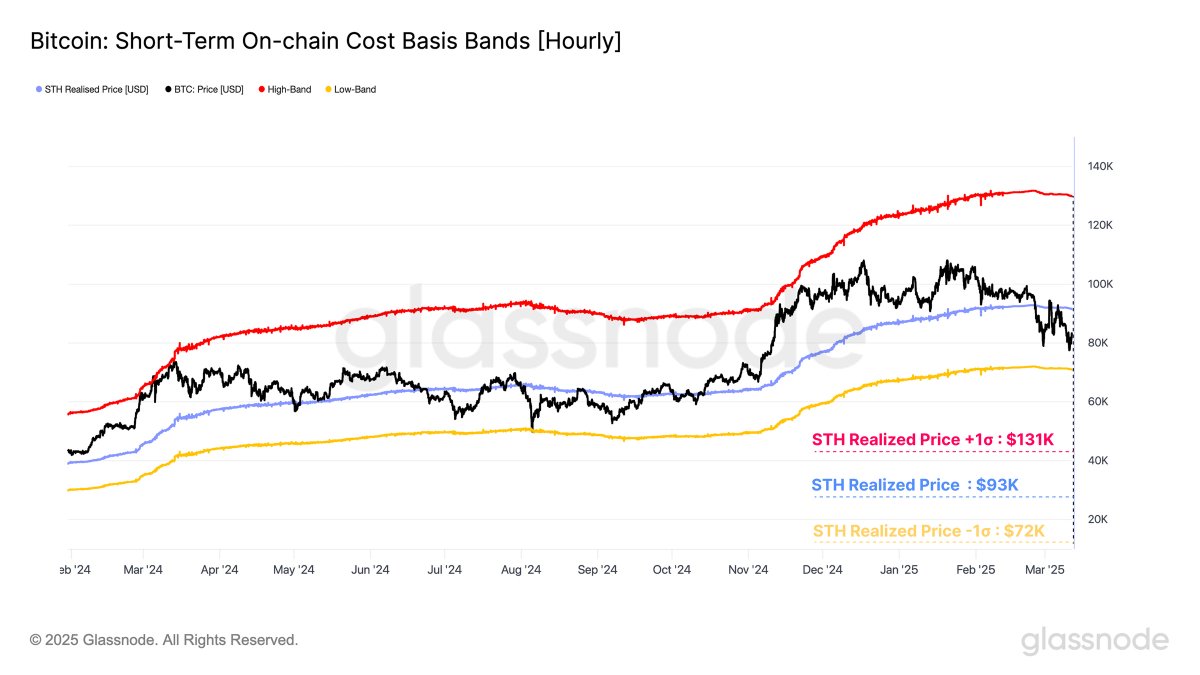

Well now, friends, it appears that our dear Bitcoin may find itself about as nervous as a long-tailed cat in a room full of rocking chairs—if that one mighty support level around $72,000 decides to buckle. According to them learned folks at Glassnode, some short-term coin owners (those who scooped ‘em up in the last 155 days) might just stampede for the exits faster than you can say “crypto calamity.” 😵💫

They reckon if that price takes a swan dive below $72,000—based on a fancy notion called the realized price metric—then all those nervous Nellies could send this flagship coin tumbling like a raft in the rapids.

In case you’re wonderin’, realized price is basically what folks actually paid for their coins, not just what they’re worth this very moment. A mighty fine yardstick, I’d say, for measuring hopes and dreams.

“Short-term holder realized price rests at $93,000, with some kind of wiggle room from $131,000 down to $72,000. The price seems to be waddling about in that range, nearly tickling the lower edge. Should we dip below $72,000, we might see even more folks jump ship faster than a skittish frog.” 🐸

Speaking of nerve-wracking, Glassnode also points out that Bitcoin has gotten mighty cozy under these moving averages: the 111 DMA at $93,000 and the 200 DMA at $87,000, and it even paid a not-so-polite visit to the 365 DMA around $76,000. Historical patterns show these markers have the same effect as your grandma’s front porch: strong support until someone takes a sledgehammer to it. A breach might just holler a big ol’ warning that the market’s feelin’ more jittery than a firework in the henhouse.

“Crossing below these key daily moving averages might unleash a deeper shift in sentiment—like a sudden chill down a gambler’s spine.” 😬

Meanwhile, there’s talk of a drop clear down to $65,000, which some folks might welcome as a bargain more tempting than a second slice of pie. This figure hails from the true market mean metric—fancy talk for a cost basis formula that tries to figure out what all coins are truly worth based on the prices folks coughed up on secondary markets.

Glassnode also sprinkles in another notion called the active realized price, sittin’ at $71,000. This number ignores the coins that are likely lost or couched away, leaving us with a new critical line in the sand. Cross that, and the price might flail around like a fish at a hoedown, though it may coax long-term buyers out of the woodwork.

“True Market Mean at $65,000 and Active Realized Price at $71,000 remain vital support thresholds—just above a zone as liquid as an Arizona creek in summer. Slipping into this region might stir up heavy volatility and lure in those patient investors.” 💸

Why, as we speak, Bitcoin’s meandering around the $78,888 mark, up a modest 1.8% over the last day—proving, if nothing else, it sure likes to keep us on our toes. 😏

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-04-10 21:23