In the grand theater of global economics, where the United States and China perform their latest pas de deux of tariffs and tantrums, both traditional assets and the enigmatic cryptocurrency Bitcoin have chosen to waltz sideways, as if choreographed by a particularly indecisive maestro.

BTC Takes a Nap While U.S.-China Trade Tensions Snooze

After President Donald Trump, in a move one might charitably describe as “doubling down on dumb,” imposed a 104% tariff on China, the communist state retaliated with an 84% levy on U.S. imports. Yet, Bitcoin, ever the aloof diva, barely batted an eyelash. 🎭

A Snapshot of Market Metrics

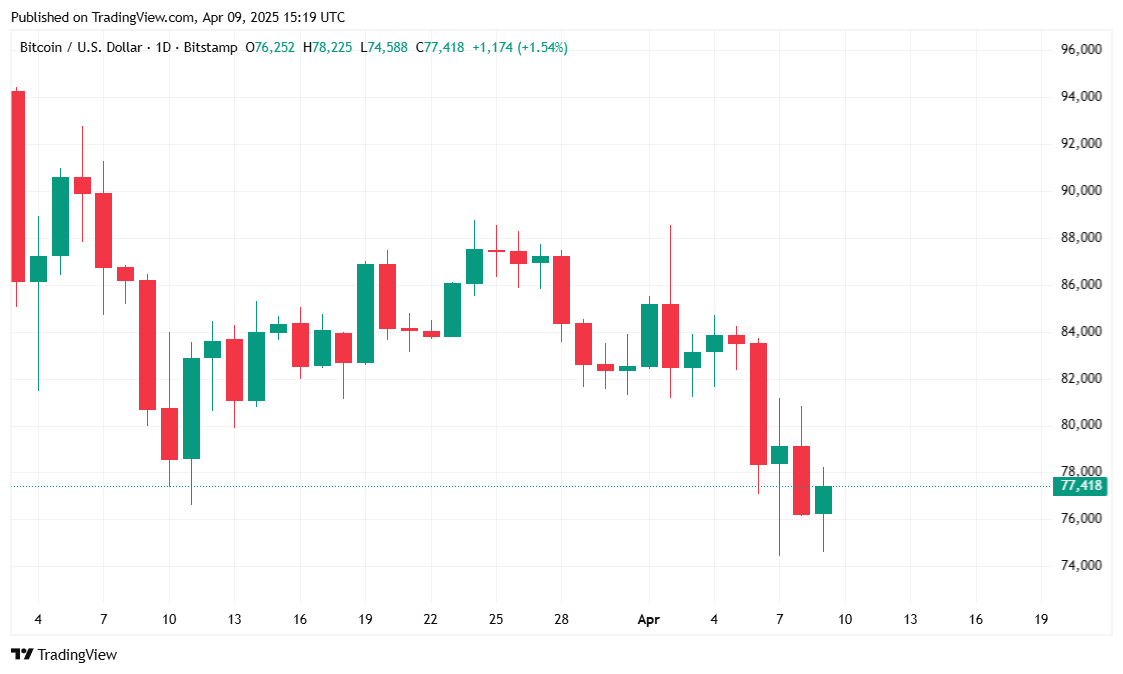

The digital asset currently languishes at $77,411.52, a 1.37% drop over the past 24 hours, extending its weekly losses to a rather unimpressive 10.47%, according to Coinmarketcap. Prices oscillated between $74,589.67 and $78,486.21, as if Bitcoin were a pendulum in a clock that no one bothered to wind. ⏳

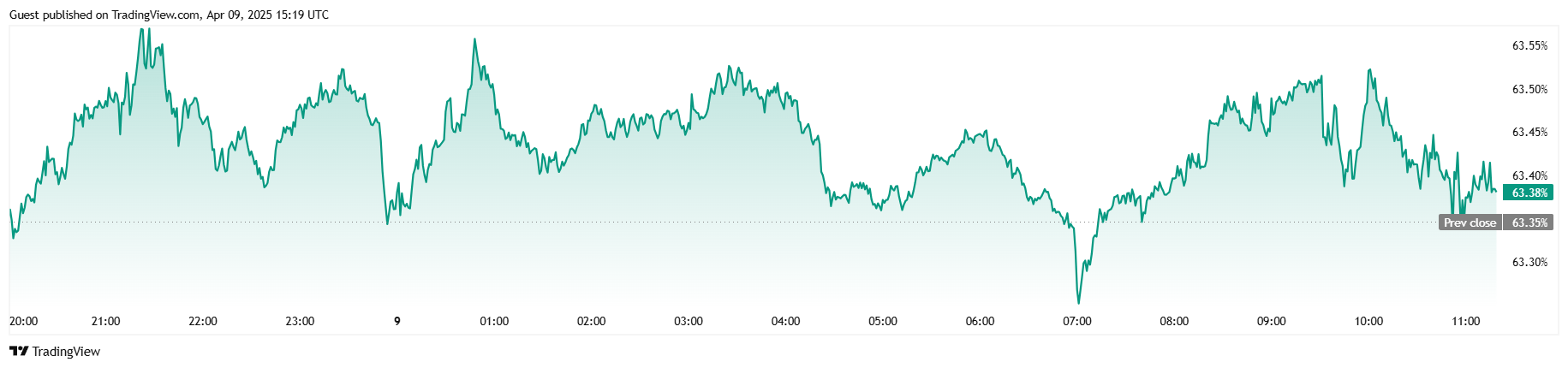

Despite the modest price decline, trading volume surged by 22.90% to $62.60 billion, as if traders were frantically rearranging deck chairs on the Titanic. Bitcoin’s market capitalization dipped by 1.19% to $1.53 trillion, while its dominance inched up 0.01% to 63.35%, a statistic as thrilling as watching paint dry. 🎨

In the derivatives market, Bitcoin futures open interest rose 1.64% to $51.44 billion, suggesting that traders are still gambling, albeit with the enthusiasm of someone playing solitaire. Liquidation data from Coinglass shows $2.43 million in total liquidations, with $1.80 million from long positions, as if the bulls were caught in a particularly awkward game of musical chairs. 🪑

When Markets Whisper ‘Tank,’ Bitcoin Yawns ‘How Low?’

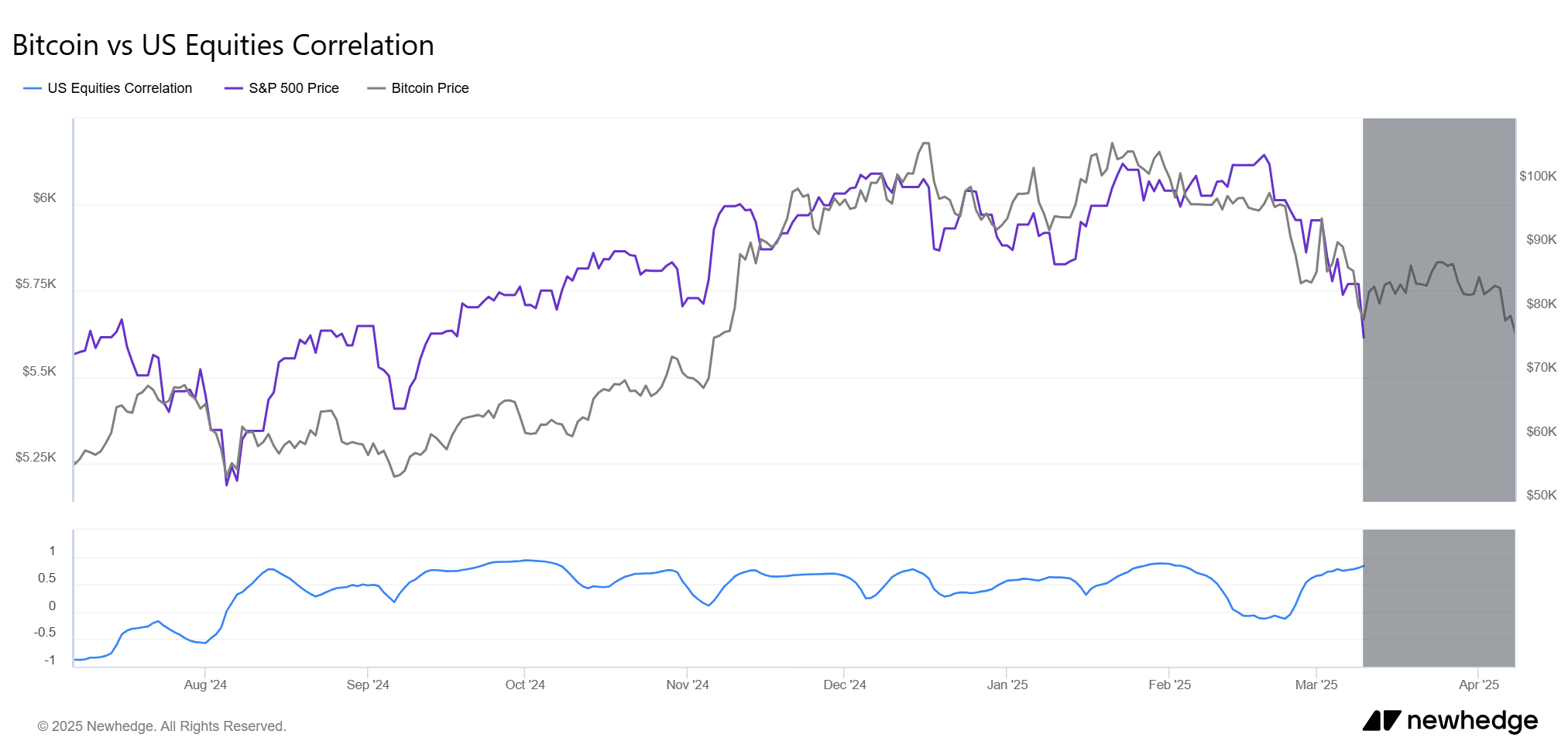

Despite China’s trade spat with the U.S., the S&P 500 is up slightly by 0.88%, the Dow has barely budged, increasing by 0.48%, and the Nasdaq had a decent uptick of 1.89%. Meanwhile, crypto markets continue to bleed, down 2.21% over 24 hours to a market capitalization of $2.46 trillion. Bitcoin’s sideways movement mirrors traditional markets, as if it were a moody teenager copying its parents’ fashion choices. 👗

Given this relationship, Bitcoin will likely continue to mimic traditional assets, at least in the near term, as if it were a parrot with a penchant for financial jargon. 🦜

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- How to Cheat in PEAK

- Death Stranding 2 Review – Tied Up

2025-04-09 19:28