So, guess what? Digital asset investment products just had a really tough week, losing a whopping $240 million! Why? Well, let’s just say global economic jitters are giving everyone a bad case of the heebie-jeebies. But wait, there’s a twist! Blockchain equities decided to flaunt their charm and snagged $8 million in inflows, proving that not all hope is lost in this crypto soap opera. 🙃

Crypto Fund Outflows Hit $240M, but Blockchain Equities Draw Fresh Inflows

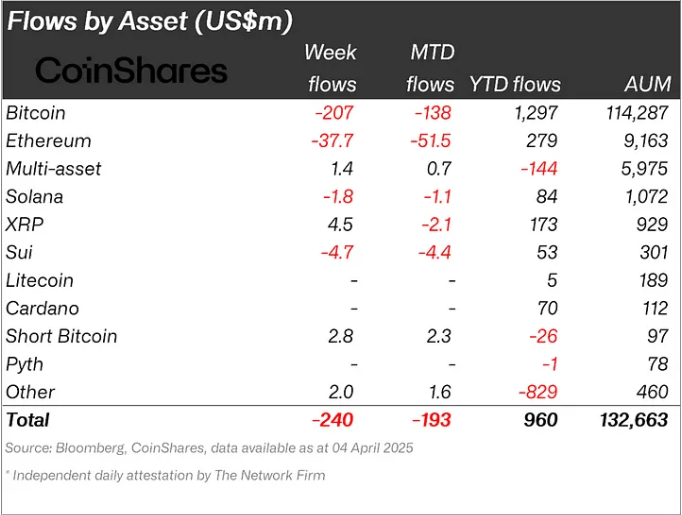

Last week felt like a scene straight out of a bad horror movie, with digital asset funds watching $240 million fizzle away. And get this—$207 million of that came specifically from Bitcoin products. According to Coinshares’ digital assets weekly report, it seems the grim reaper of economic uncertainty has arrived, thanks to pesky U.S. trade tariffs throwing a wrench in the global growth machine.

But hold your horses! Amidst the chaos, total assets under management (AUM) managed to rise ever so slightly to $132.6 billion. Yes, you heard that right! A tiny silver lining in a storm of losses compared to traditional equities, which are currently in a steeper decline than your aunt’s diet on Thanksgiving.

Meanwhile, Ethereum decided to join the outflow party, losing $37.7 million. Solana and Sui tried to keep up, shedding $1.8 million and $4.7 million respectively. But look out world: Toncoin, like the kid in gym class who always gets picked last, managed a modest $1.1 million inflow, reminding us that there’s always one overachiever in every group. 🌟

Now, let’s talk geography, shall we? The U.S. and Germany took the lead in the outflow race, losing $210 million and $17.7 million respectively. Meanwhile, the Canadians were sipping their Tim Hortons and adding $4.8 million to digital assets like true rebels during this market madness.

In the midst of all this, there’s a silver lining! Blockchain equities saw $8 million in inflows for two consecutive weeks. Looks like some investors are sensing a long-term opportunity amidst the chaos. Or maybe they just have a really strong affinity for techy things—who can say? 🤷♀️

While the markets continue to be shaken like a cocktail at a bad bar, digital assets seem to be hanging in there, keeping their cool and maintaining investor interest despite all the outflows. Cheers to that!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Which Is the Best Version of Final Fantasy IX in 2025? Switch, PC, PS5, Xbox, Mobile and More Compared

2025-04-08 08:57