The Hedera Foundation, in a move as audacious as a cat chasing a laser pointer, has partnered with Zoopto in a late-stage bid to acquire TikTok. This has, predictably, sent HBAR investors into a frenzy, as if they’ve just discovered a pot of gold at the end of a very volatile rainbow.

Market participants, ever the optimists, have piled into long positions, their confidence in HBAR’s future as unshakable as a Russian winter. The altcoin’s value has surged by 17% in the past 24 hours, a rise as dramatic as a soap opera cliffhanger.

HBAR’s Futures Market: A Bullish Circus 🎪

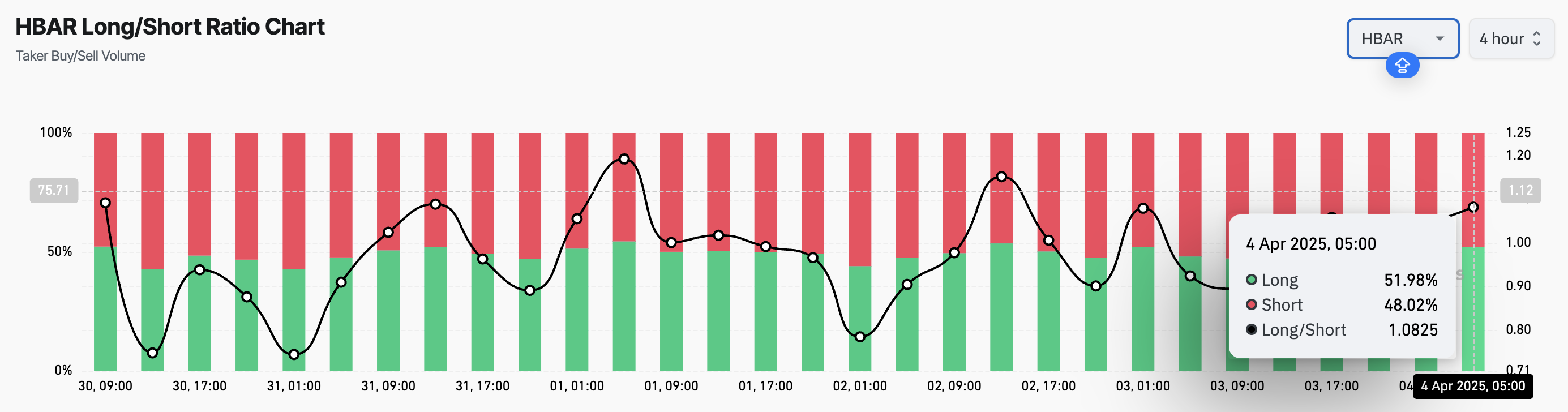

HBAR’s long/short ratio has hit a monthly high of 1.08, a number that would make even the most stoic trader crack a smile. More traders are holding long positions than short ones, a clear sign that the market is as bullish as a matador in a china shop.

The long/short ratio, for those who’ve been living under a rock, compares the number of long positions (bets on price increases) to short ones (bets on price declines). When it’s above one, as it is now, it’s a sign that traders are expecting the price to rise, a trend as reliable as a Moscow winter.

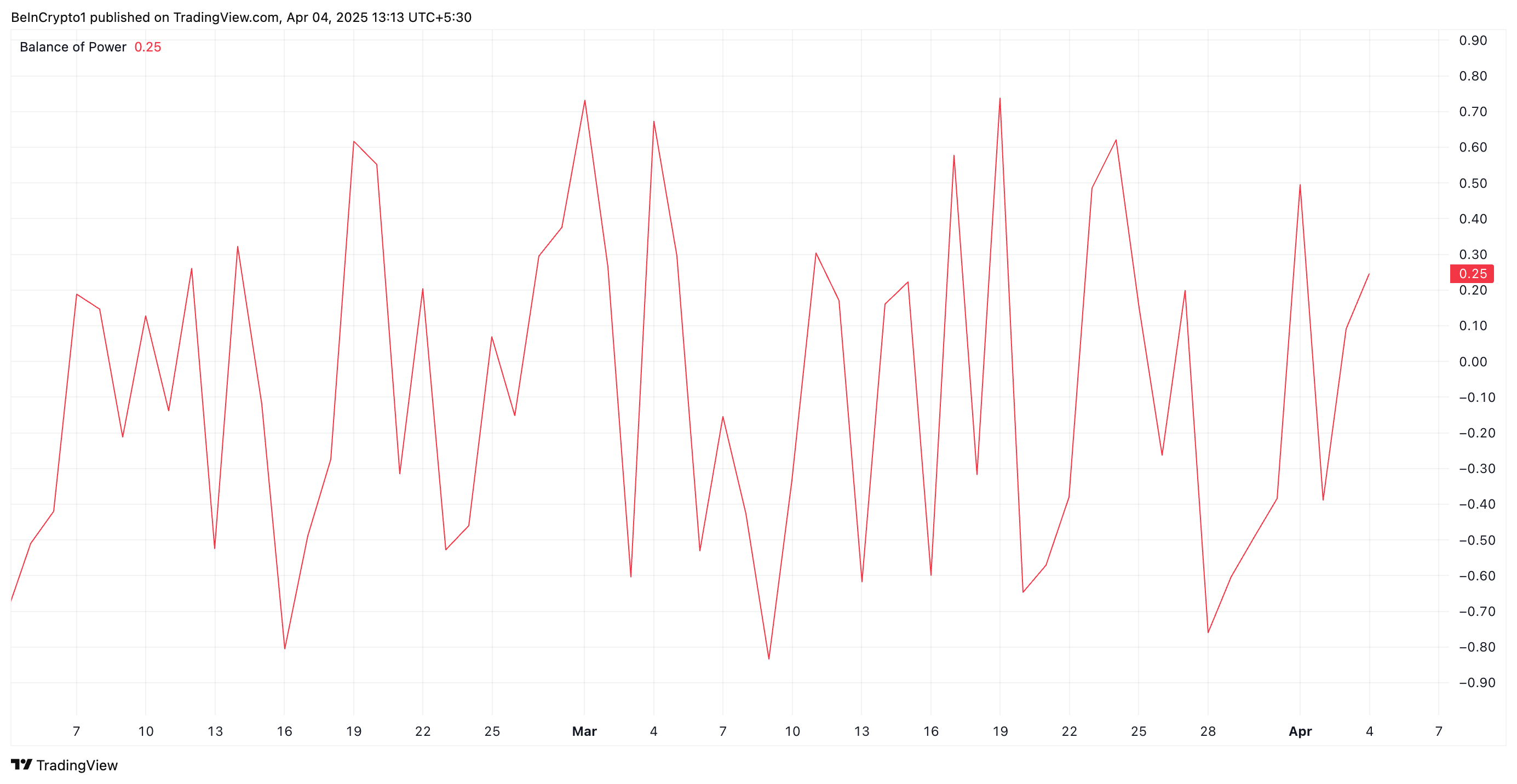

Further bolstering this bullish outlook is HBAR’s Balance of Power (BoP), which is currently above zero at 0.25. This indicator, which measures buying and selling pressure, suggests that buyers are in control, pushing the price higher with the determination of a babushka chasing a runaway chicken.

When the BoP is above zero, it’s a sign that buying pressure is stronger than selling pressure, a bullish signal as clear as a vodka toast at a Russian wedding.

HBAR Buyers: The Comeback Kids 🥊

During Thursday’s trading session, HBAR briefly hit a four-month low of $0.153, a price as depressing as a rainy day in St. Petersburg. But, like a phoenix rising from the ashes, buying pressure has strengthened, and the altcoin is now correcting its downward trend.

If HBAR buyers can maintain their grip, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247, a rise as hopeful as a spring thaw.

However, if profit-taking activity resurges, this bullish projection could be invalidated faster than a New Year’s resolution. In that case, HBAR could resume its decline and fall to $0.129, a drop as inevitable as the setting sun.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-04-04 17:06