Bitcoin‘s Weekend Odyssey: Will It Break $88,500? 🤔

Standard Chartered, that bastion of fiscal sanity, has predicted that Bitcoin (BTC) will likely break above $88,500 this weekend, following a strong performance in the tech sector. Because, of course, it’s not like Bitcoin has ever defied expectations before 🙃.

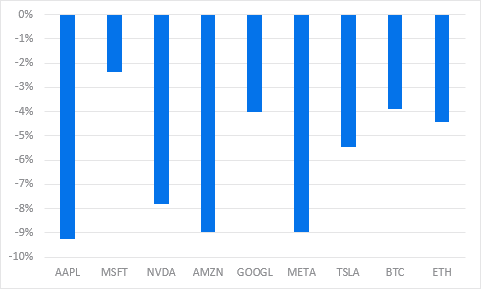

The bank’s Global Head of Digital Assets Research, Geoff Kendrick, shared these expectations in an exclusive with BeInCrypto. Kendrick, being the seer that he is, pointed to recent price action among major technology stocks, including Microsoft, as an indicator of Bitcoin’s short-term trajectory. Ah, the old “if MSFT goes up, BTC will too” trick 🤦♂️.

What Standard Chartered Says About Bitcoin This Weekend

In an email to BeInCrypto, Kendrick explained that a decisive break above the critical $85,000 level appears likely post-US non-farm payrolls. Because, you know, nothing says “predictable” like a bank’s analysis 🤣.

“Strongest performers were MSFT and BTC. Same again so for today in Bitcoin spot and tech futures,” Kendrick said.

However, China’s retaliatory tariffs could increase market uncertainty, driving prices down in the short term. But hey, who needs stability when you’ve got Bitcoin, right? 🤪

Standard Chartered Calls to HODL Bitcoin

Amid Bitcoin’s growing role in traditional finance (TradFi), Kendrick advised investors to maintain their holdings. Because, you know, it’s not like Bitcoin’s value is going to plummet to zero anytime soon 🤑.

“Over the last 36 hours, I think we can also add ‘US isolation’ hedge to the list of Bitcoin uses,” he added.

This suggests that Bitcoin could serve as a protective asset in geopolitical and macroeconomic uncertainty. Because, you know, nothing says “protective asset” like a volatile cryptocurrency 🤷♂️.

The BTC/USDT daily chart shows a critical technical setup, with Bitcoin’s price currently trading around $82,643. A former support level of $85,000 now stands as resistance, limiting the pioneer crypto’s upside potential. But hey, who needs technical analysis when you’ve got Kendrick’s predictions, right? 🤪

On the downside, a key demand zone between $77,500 and $80,708 provides support. Despite price consolidation, the Relative Strength Index (RSI) is forming higher lows, indicating sustained growing momentum and a potential reversal. But hey, who needs momentum when you’ve got Kendrick’s predictions, right? 🤪

If BTC successfully reclaims $85,000, it could trigger a move toward $87,480. However, to confirm the continuation of the uptrend, BTC must record a daily candlestick close above the midline of the supply zone at $86,508. Because, you know, nothing says “confirmation” like a technical analysis 🤦♂️.

The bullish volume profile (blue) supports this thesis, showing that bulls are waiting to interact with the Bitcoin price above the midline of the supply zone. But hey, who needs volume when you’ve got Kendrick’s predictions, right? 🤪

Failure to breach the immediate resistance at $85,000 might lead to a retest of the demand zone, potentially breaking lower. In such a directional bias, a break and close below the midline of this zone at $79,186 could exacerbate the downtrend. But hey, who needs a downtrend when you’ve got Kendrick’s predictions, right? 🤪

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-04-04 15:06