Ethereum‘s Epic Comeback: Has Solana Finally Met Its Match? 🤯

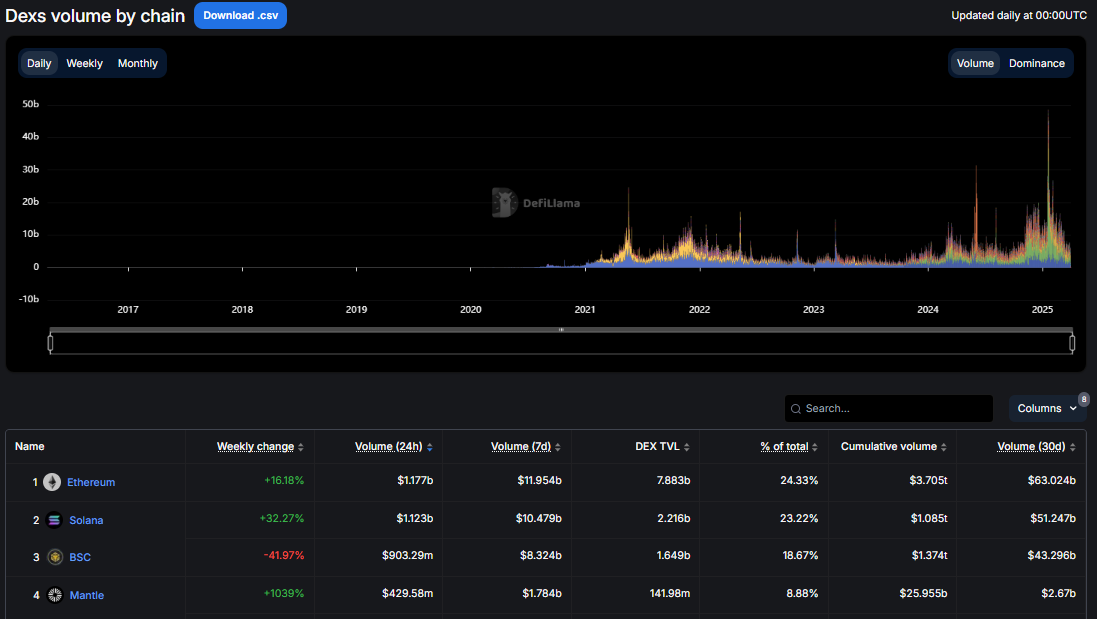

Ethereum (ETH) has regained its position as the leading blockchain for decentralized exchange (DEX) trading volume, and we’re not surprised.

After months of Solana’s (SOL) dominance, Ethereum has finally flipped the script, surpassing its competitor in DEX trading volume for the first time since September 2024. And let’s be real, it’s about time.

Ethereum’s Resurgence: A Turning Point in the DeFi Ecosystem?

According to data from DefiLlama, Ethereum-based DEXs recorded a whopping $63 billion in trading volume throughout March 2025, leaving Solana’s $51 billion in the dust.

But what’s behind Ethereum’s resurgence? We think it’s a combination of its established infrastructure, network effects, and the fact that people just can’t get enough of it.

Solana, on the other hand, had been riding high on its low fees and high transaction throughput, but it seems its DEX trading volume has taken a hit. Franklin Templeton predicted Solana’s DeFi surge could rival Ethereum’s valuation, but it looks like that’s not happening just yet.

//beincrypto.com/wp-content/uploads/2025/04/BMTUSDT_E7334A_2025-03-11_11-54-20-3.png”/>

Data on Dune shows that this downturn aligns with a slowdown in the platform’s token graduation rate, which has fallen from 0.8% to 0.65% per week. A lower graduation rate suggests fewer tokens are reaching the $100,000 market capitalization threshold required to migrate from Pump.fun to the Raydium platform.

Ethereum’s Strength in the DEX Market: A Long Way to Go?

While Solana’s DEX activity has faltered, Ethereum’s trading volume has remained resilient. And we think it’s because Ethereum’s got the infrastructure and network effects to back it up.

Uniswap (UNI) and Curve Finance (CRV) are doing their part to keep Ethereum on top, with Uniswap alone facilitating over $30 billion in trading volume in March. Ethereum’s ability to reclaim the top spot is also attributed to its established infrastructure and network effects.

Industry analysts believe that while Solana is very competitive, it still has a long way to go before it can dethrone Ethereum. And we think they’re right.

Meanwhile, others say Ethereum’s resurgence may extend into the second quarter (Q2), driven by upcoming network upgrades and broader market trends. The Pectra upgrade, once implemented on the Ethereum mainnet, is expected to improve scalability and efficiency, potentially boosting user adoption and trading activity.

“On-chain developments offer some hope for ETH…With Pectra now successfully deployed on the Holesky testnet and a mainnet upgrade expected in Q2, could we see a reversal of the downward ETH/BTC trend in the coming quarter?” analysts at QCP Capital noted.

And if that’s not enough, spot Ethereum ETFs saw net inflows on Monday, contrasting with net outflows from Bitcoin ETFs. This trend suggests growing investor confidence in Ethereum’s market position.

This shift in ETF flows could indicate a broader reallocation of capital within the crypto market, particularly as Ethereum strengthens its DeFi ecosystem and prepares for key upgrades.

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Ultimate Half Sword Beginners Guide

- Unlock Every Room in Blue Prince: Your Ultimate Guide to the Mysterious Manor!

- Russian Twitch Streamer Attacked in Tokyo as Japan Clamps Down on Influencer Behavior

- Unlock the Ultimate Barn Layout for Schedule 1: Maximize Your Empire!

- Madoka Magica Magia Exedra Tier List & Reroll Guide

2025-04-01 17:03