At present, our dear Bitcoin finds itself languishing a rather miserable 22.94% beneath its glittering all-time high, and a touch 1.84% shy of where it closed the curtain on March 1. Meanwhile, the hapless US stock market has followed suit, tumbling down a kilter 6%. Experts, with their usual air of solemnity, are quick to point fingers at a dastardly decline in global liquidity as the villain behind this stage drama. Yet whispers abound that global liquidity may have finally hit rock bottom—could it be time for a Bitcoin reversal? Oh, dear reader, read on and prepare to be enlightened! 🧐

Why Experts Are Dusting Off Their Crystal Balls

Reports are trickling in claiming that global liquidity has reached its nadir. This would suggest that liquidity could soon recover like an overindulged sofa after a particularly robust meal. 🍗

According to the ever-astute experts, the correlation between Bitcoin and global liquidity stands at a rather impressive 80%. Yes, you heard it right—a whopping 80%! This suggests there’s an 80% chance that Bitcoin’s price will rise if liquidity finds its feet again. 📈

Global liquidity has bottomed.

The correlation between Bitcoin and global liquidity is 80%.

It’s highly likely Bitcoin is going to reverse!

— Crypto Rover (@rovercrc) April 1, 2025

Key Indicators That Will Have You Sweating in Anticipation

Keep those peepers peeled for these must-watch indicators:

Resistance Level – Or, the Great Bitcoin Wall

Currently, Bitcoin hovers around $84,185.01, with analysts pointing out a veritable buffet of resistance levels at $87K, $90K, $92,500, $94K, $95K, and even a cheeky $100K. Should BTC manage to break through these barriers with aplomb, one might suggest the buyers have bested the sellers in this delightful game of financial tennis. 🎾

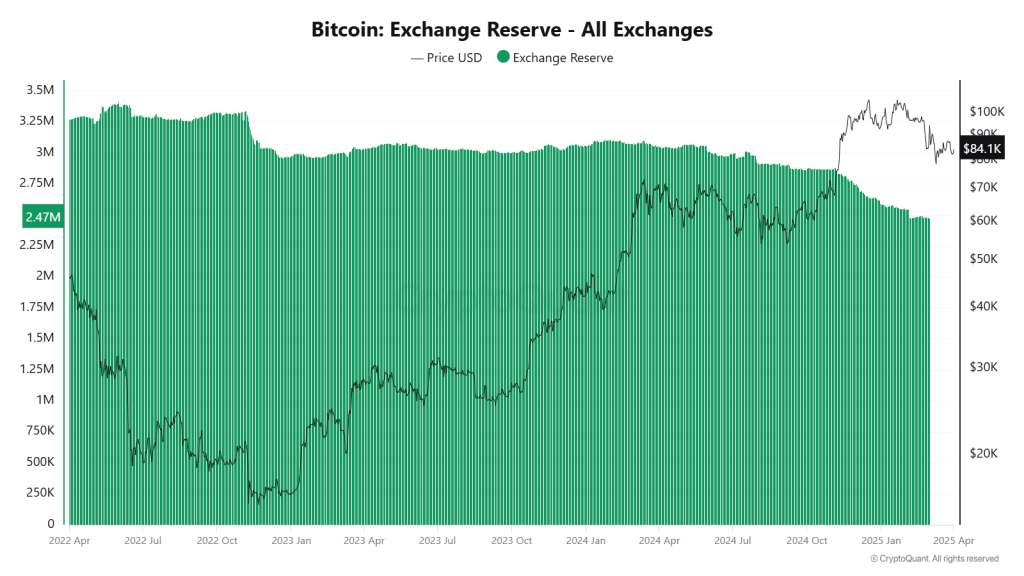

Bitcoin Exchanges’ Net Flow: The Great Escape

When our dear investors decide to whisk their Bitcoins away from exchanges, it often signifies a bullish confidence befitting the most audacious of poker faces. Thus, monitoring the ebb and flow of Bitcoin on and off the exchanges becomes a matter of paramount importance. 🕵️♂️

According to the ever-reliable Coinglass, the total exchange balance of BTC stands at 2,197,123.37. It saw a 24-hour change of +16629.17 (not bad for a day’s work) and a 7-day change of -7184.75. Yesterday, the Bitcoin Wallet net flow was a delightful +3.81K BTC. 🌊

- Also Read:

- Will BlackRock’s New Bitcoin ETP Drive Crypto Adoption in Europe?

Technical Indicators: The Magic Numbers

A golden cross—a phenomenon where a shorter-term moving average waltzes above a longer-term one—is often regarded as a bullish signal. The SMA-50 of BTC presently strikes a pose at $88,254.66 while the SMA-200 stands with a slightly prouder stance at $86,180.45. 💫

BTC’s RSI currently sits at 46.57. Should it venture consistently above the neutral 50 like a spry young lad who has just discovered a carefree life, and if it should dare to flirt with the overbought territory (above 70), we might just witness an eruption of buying enthusiasm. 🎉

To sum up, with global liquidity on the verge of a rejuvenation, Bitcoin might just be ready to execute a grand pirouette upwards. 🥳

Stay Illumined in the Twists and Turns of Crypto! ⚡

Keep yourself ahead of the game with the latest revelations, sagacious analyses, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and all those financial curiosities.

FAQs: Because What Would Life Be Without a Few Questions?

How does global liquidity affect Bitcoin’s price?

As global liquidity recovers, one can expect Bitcoin prices to rise due to the rather robust connection between liquidity and Bitcoin’s value—assuming, of course, the universe plays along. 🌌

How much will 1 Bitcoin cost in 2025?

As per the esteemed sages over at Coinpedia, 1 BTC could potentially soar to $169,046 this year if the bullish winds sustain their momentum. 🤑

Read More

- Lucky Offense Tier List & Reroll Guide

- Best Crosshair Codes for Fragpunk

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- ‘Severance’ Renewed for Season 3 at Apple TV+

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Russian Twitch Streamer Attacked in Tokyo as Japan Clamps Down on Influencer Behavior

- Skull and Bones Year 2 Showcase: Get Ready for Big Ships and Land Combat!

- Ultimate Half Sword Beginners Guide

2025-04-01 15:09