- Oh dear! Bitcoin is having a bit of a sulk with its bearish 1-day structure, but wait! There’s a glimmer of hope for a bounce towards $88k. Fingers crossed! 🤞

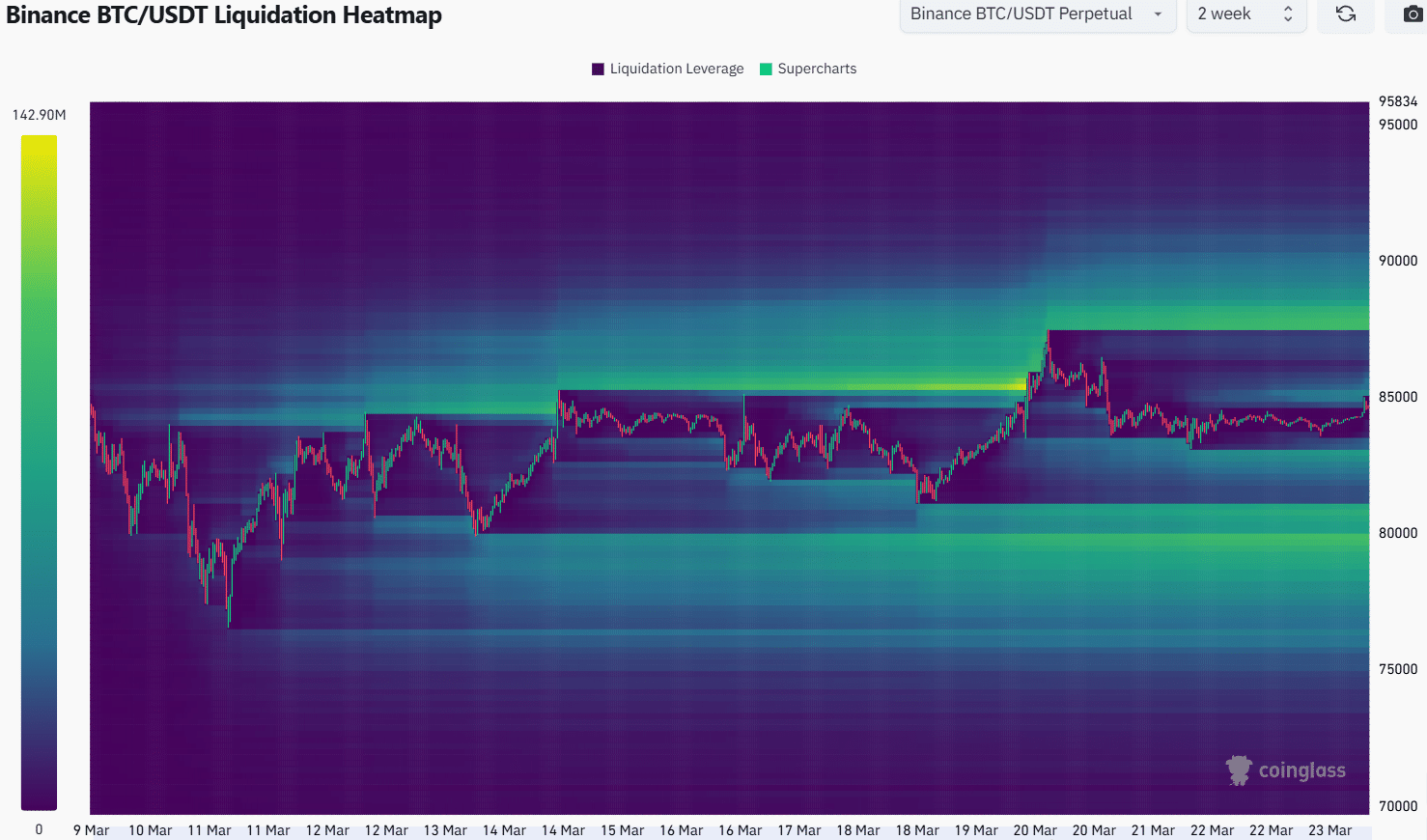

- Warning! The liquidation heatmap suggests that bulls might want to think twice before diving headfirst into long positions on BTC. 🐂💔

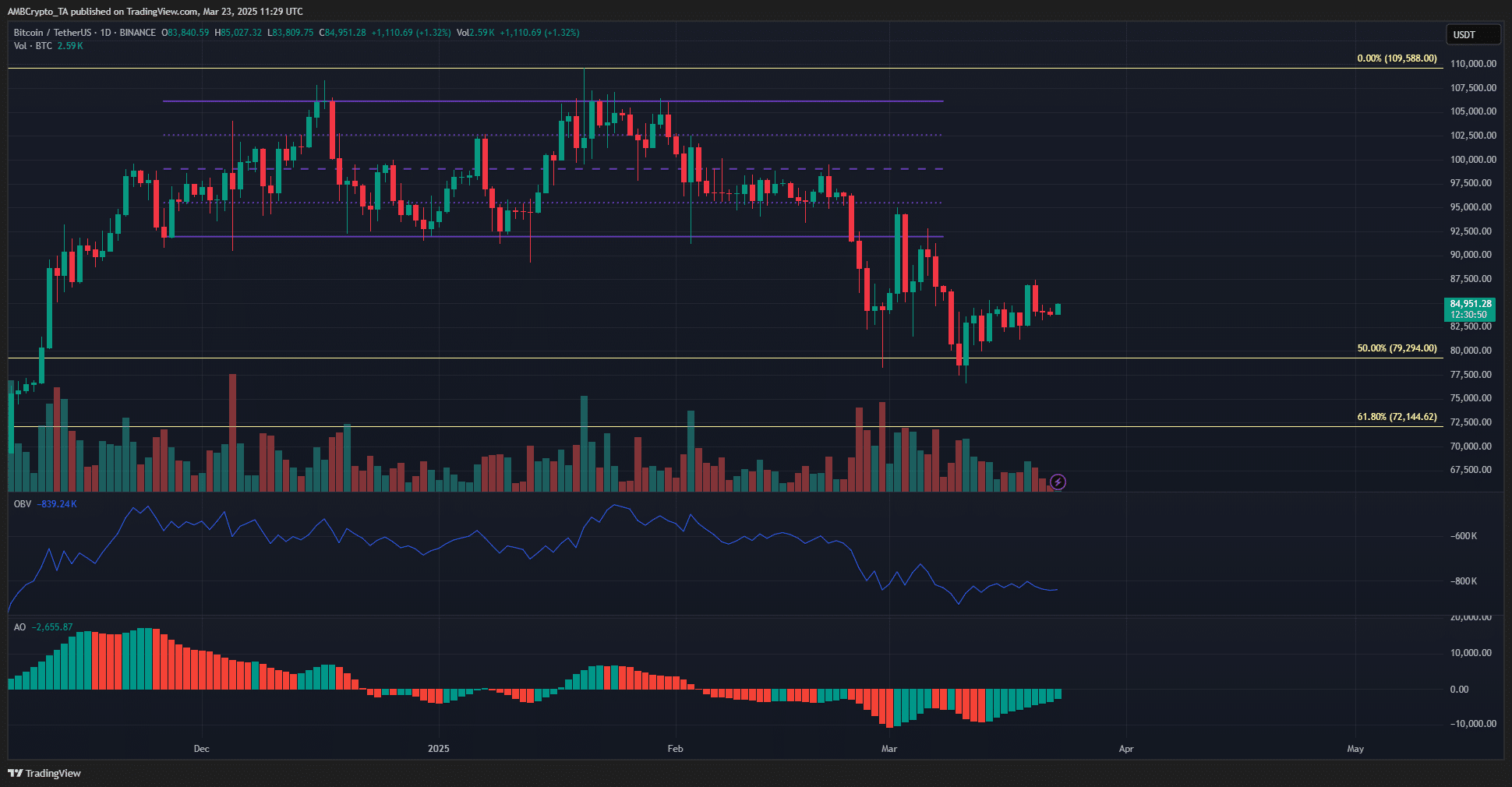

So, Bitcoin [BTC] has been lounging above the $82k support level for the past week, but let’s be honest, it’s not exactly throwing a party with its bullish outlook on the 1-day timeframe. 🎉🙄

Lower timeframes are whispering sweet nothings about a potential bounce, but only if that pesky $86.8k resistance decides to play nice and get breached. 😏

According to the Fibonacci retracement levels from the August-December rally (because who doesn’t love a good Fibonacci?), the $72k support level could be the next target. But don’t panic just yet! On-chain metrics are not exactly supporting this doom-and-gloom scenario. 😅

Long-term holders are clutching their Bitcoin like it’s a beloved teddy bear, preferring to HODL rather than sell. So, there’s still a flicker of hope for recovery! 🧸✨

Is Bitcoin about to take another nosedive? 🤔

The BTC daily chart is still holding onto its bearish structure like a toddler with a security blanket. The OBV has been on a downtrend since February, indicating that selling pressure is still the reigning champion. 🏆

While the bearish momentum has eased according to the Awesome Oscillator, it hasn’t exactly flipped to bullish. Talk about a slow-motion drama! 🎭

After a dramatic fall below a 3-month-old range in early March, Bitcoin seems to have formed a new range (cue the suspenseful music). The mid-range level at $86.9k has been tested as both support and resistance over the past three weeks. 🎶

As it stands, a move below $83k could kick off a bearish trend, while a breakout past $86.8k might just start an uptrend. It’s like a game of musical chairs, but with more money at stake! 💸

The OBV has been making higher lows over the past ten days, but let’s not kid ourselves; it’s not exactly a sign of strong buying. It’s more like a gentle nudge rather than a full-on shove. 😅

The 2-week liquidation heatmap reveals that the closest liquidity cluster is at $88k. The magnetic zone at $83k is looking a bit weak compared to the one at $88k. Talk about a popularity contest! 🏅

Further down, the $80k level is sizeable, but it’s like that friend who lives too far away to visit regularly. 😒

So, traders, brace yourselves! The Bitcoin price might just be drawn towards $88k before facing a bearish rejection. It’s like a rollercoaster ride, but without the safety harness! 🎢

Technical analysis suggests that if $86.8k flips to support, it might be safe to go long. But the liquidation heatmap says, “Not so fast!” Caution is the name of the game, especially for our bullish friends. 🐂⚠️

Traders should keep a close eye on the reaction at both resistances. A rejection could present a golden opportunity to short-sell the asset. It’s all very thrilling, isn’t it? 🎉

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Ultimate Half Sword Beginners Guide

2025-03-24 04:37