In the grand theater of financial markets, where gold and bitcoin play their eternal roles, 2025 has brought a twist worthy of Tolstoyan drama. Gold, the stoic aristocrat, has surged past $3,025 per ounce, a 15% rise since January, while bitcoin, the rebellious upstart, sulks in the corner, down 10% year-to-date. 🎭

Gold’s ascent is no mere coincidence. It is the product of geopolitical chaos, ETF inflows, and the ever-entertaining U.S. tariff discussions under President Trump. Meanwhile, bitcoin, once the darling of the digital age, finds itself overshadowed, its gains a mere 16% compared to gold’s 40% year-over-year triumph. 💰

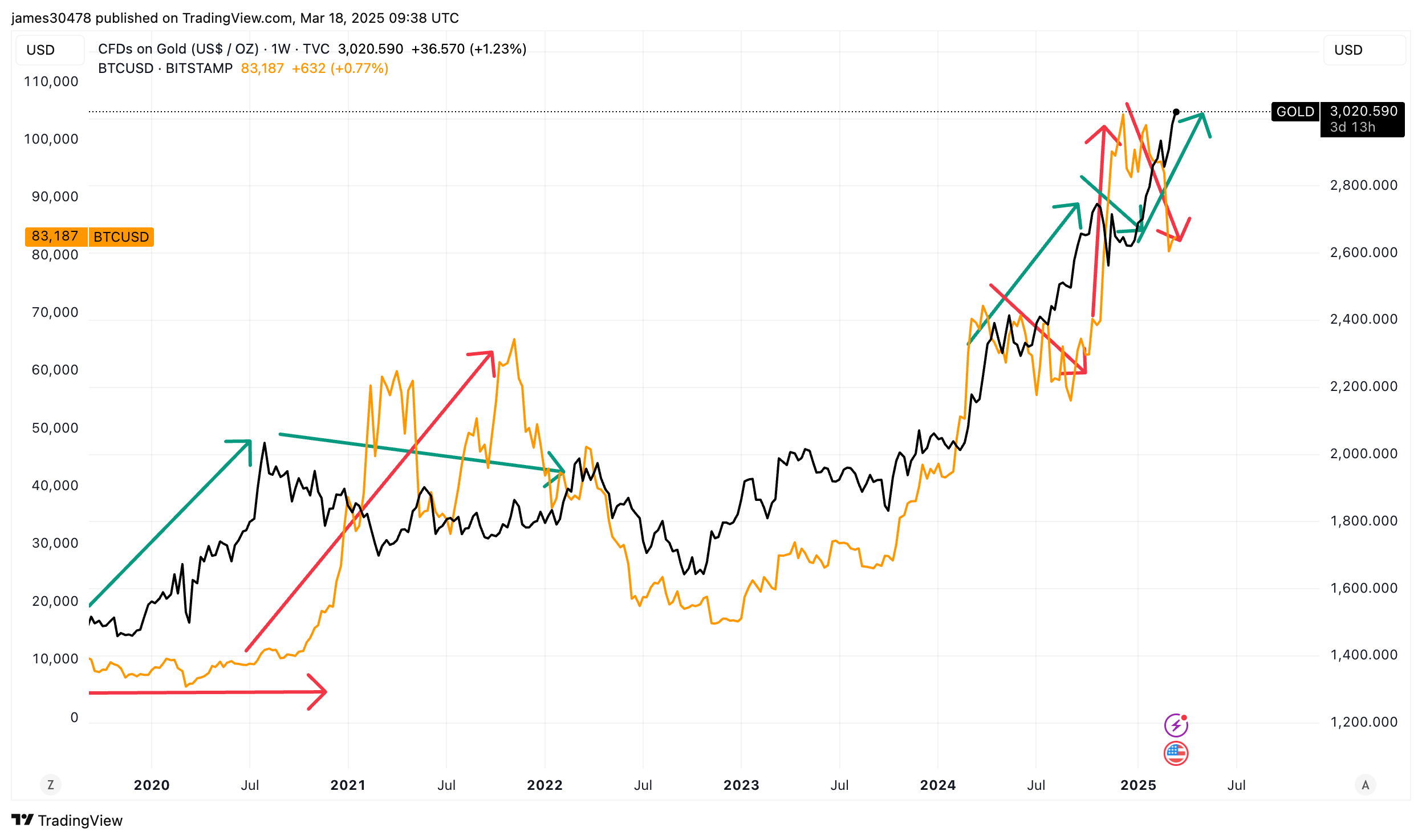

History, that wise old narrator, reminds us that gold and bitcoin rarely dance together. From 2019 to 2020, gold soared while bitcoin yawned. In 2021, bitcoin had its moment in the sun while gold took a nap. By 2022, both were humbled by rising interest rates, only to rise again in 2023 and 2024. Now, in 2025, gold has reclaimed the spotlight, leaving bitcoin to wonder if it’s just a passing fad. 📜

Charlie Morris, founder of ByteTree, has dubbed this gold rally a “proper gold rush,” a phenomenon the crypto crowd has never truly witnessed. “Gold above $3,000, silver above $24, and gold stocks gaining momentum—it struck me that the crypto crowd has never witnessed a true gold rush. The last time this happened was in 2011, when Bitcoin was just emerging at $20. They will now.” 🏃♂️

As the curtain falls on this act, one can’t help but chuckle at the irony. Gold, the ancient relic, continues to outshine its digital rival, proving that sometimes, the old ways are the best ways. Or perhaps, as Tolstoy might say, “All happy markets are alike; each unhappy market is unhappy in its own way.” 😏

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-03-18 13:21