What to know:

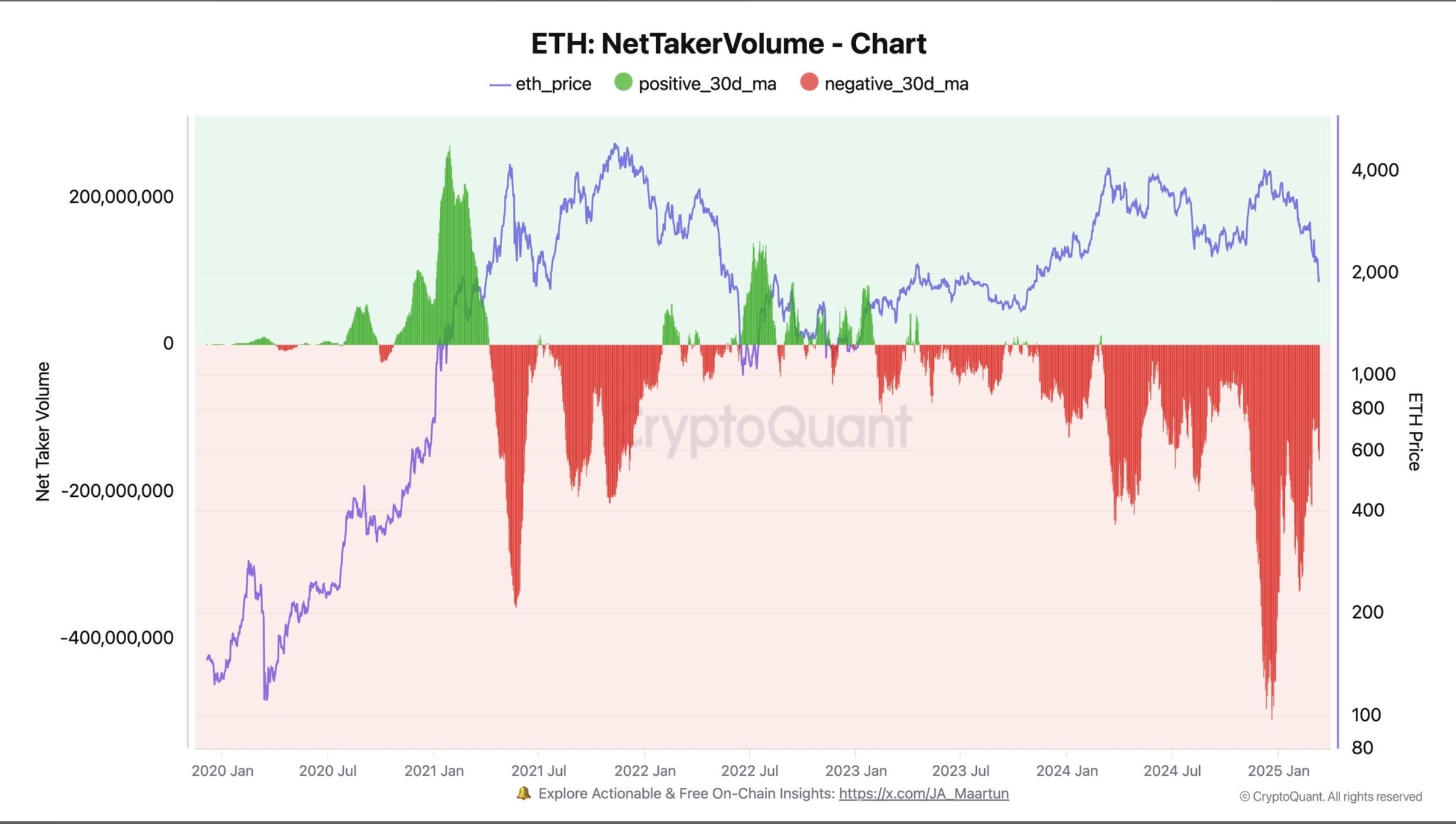

Ether (ETH) has taken a nosedive, plummeting 43% this year. It peaked at a lofty $3,744 before crashing down to a more modest $1,899. According to CryptoQuant CEO Ki Young Ju, the past three months have seen record levels of active selling—the highest in half a decade. That’s right, folks, ETH is being sold faster than a wizard’s last spellbook at a fire sale. 📉

CoinDesk research adds that the ETH/BTC ratio has hit a five-year low, and the four-year compound annual growth rate (CAGR) has gone negative against Bitcoin. In other words, ETH is to Bitcoin what a soggy biscuit is to a gourmet croissant. 🥐

ETH has only dipped below $1,900 a handful of times since 2020. If you bought ether between June 2022 and October 2023, or throughout 2020, you’d still be in the green. But let’s be honest, that’s about as likely as finding a unicorn in your backyard. 🦄

Glassnode data shows that short-term holders (STHs)—those who’ve held ETH for less than 155 days—are taking the brunt of the losses. But even long-term holders (LTHs) are starting to throw in the towel. It’s like watching a slow-motion train wreck, but with more graphs and fewer explosions. 🚂

Meanwhile, the real MVPs of this sell-off are the whales—those holding 100,000 ETH or more. They’ve been offloading their stash since February, driving realized losses like a herd of panicked elephants. 🐘

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- League of Legends MSI 2025: Full schedule, qualified teams & more

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 28 Years Later Fans Go Wild Over Giant Zombie Dongs But The Director’s Comments Will Shock Them

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-03-13 16:13