Ah, Ethereum! Once the darling of the crypto world, now it finds itself in a rather unfortunate predicament, having plummeted from a dizzying height of over $3,600 to a state of disheveled despair. It seems our dear ETH has taken to forming a series of lower highs and lower lows, much like a tragic hero in a Waugh novel.

As it teeters on the brink of solidifying below the crucial $2,000 support, one can only imagine the capitulations that await in the short term. Will it be a dramatic exit, or merely a whimper? Only time will tell!

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the price has been falling faster than a socialite’s reputation after a scandal. The 200-day moving average, once a bastion of hope at around $3,000, was lost in February, and attempts to reclaim it have been as futile as a politician’s promises.

Yet, lo and behold! The RSI is in oversold territory, hinting at a potential short-term relief bounce. But should ETH fail to hold above the $2,000 mark, the next strong support lies at the $1,600 area, which is starting to feel like a cozy little pit of despair.

The 4-Hour Chart

In the 4-hour timeframe, ETH has been trading within a falling wedge pattern (marked in yellow), which, if confirmed with a breakout, could be a bullish reversal signal. But let’s not hold our breath, shall we?

Recently, the cryptocurrency’s price broke below the key $1,900 support and tested the $1,800 demand zone, where buyers, bless their hearts, stepped in to prevent further decline. Now, it’s attempting to reclaim the $1,900 area, signaling a potential recovery—if one can call it that.

Moreover, the RSI on the 4H timeframe shows a rebound from oversold levels, suggesting that bearish momentum could be fading. If ETH manages to break back above $1,900, it might see a short-term push toward the $2,100 resistance zone. However, if this recovery fails, another drop toward the $1,600 support level will be highly likely. Oh, the drama!

Sentiment Analysis

By Edris Derakhshi (TradingRage)

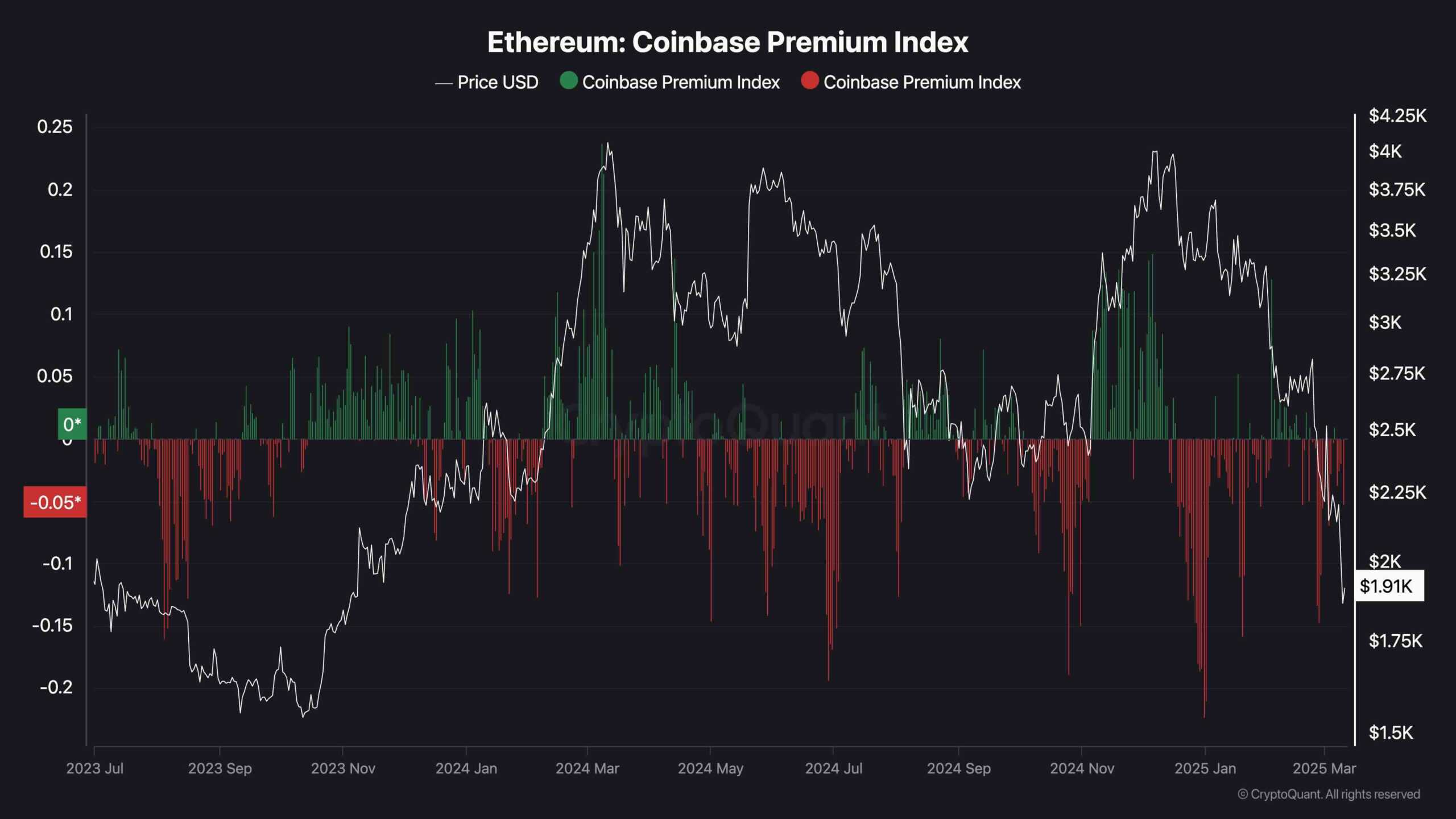

Coinbase Premium Index

The Coinbase Premium Index, that fickle friend, shows a strong correlation with Ethereum’s price movements, reflecting the buying or selling pressure from U.S. investors. Currently, the premium has been negative for an extended period, indicating that ETH is trading at a discount on Coinbase compared to Binance. How quaint!

This suggests weaker demand from U.S. institutional and retail investors, aligning perfectly with ETH’s broader bearish trend. Historically, sustained negative premium values have coincided with price declines, much like a bad review in a literary journal.

For ETH to regain its bullish momentum, the Coinbase Premium Index needs to turn positive, signaling renewed U.S. buying pressure. A shift into green territory would indicate institutional accumulation, often preceding price recoveries. However, with ETH languishing around $1,900 and the premium still negative, demand remains weak, increasing the risk of further downside unless sentiment shifts. How delightful!

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- League of Legends MSI 2025: Full schedule, qualified teams & more

- 28 Years Later Fans Go Wild Over Giant Zombie Dongs But The Director’s Comments Will Shock Them

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Nintendo Switch 2 System Update Out Now, Here Are The Patch Notes

2025-03-11 16:06