What you must grasp, dear reader:

Now, here’s a stroke of extraordinary coincidence, if you will. It seems the recent nosedive of the esteemed Nasdaq and our charming Bitcoin has decided to waltz in step with Japan’s government bonds yielding more than a cherry tree in bloom and the Yen doing its best impression of a hardened safe-haven. One might say it all feels terribly nostalgic, reminiscent of market theatrics back in early August.

But don’t let your curiosity run away with you! There’s a chance this isn’t mere happenstance; a good many decades have shown that the mild-mannered, low-yielding Yen has quite the fondness for propping up global asset prices like Aunt Agatha at the family reunion. Is it possible that this robust Yen’s gallop has indeed cast a sour note on our beloved Wall Street and the crypto playground?

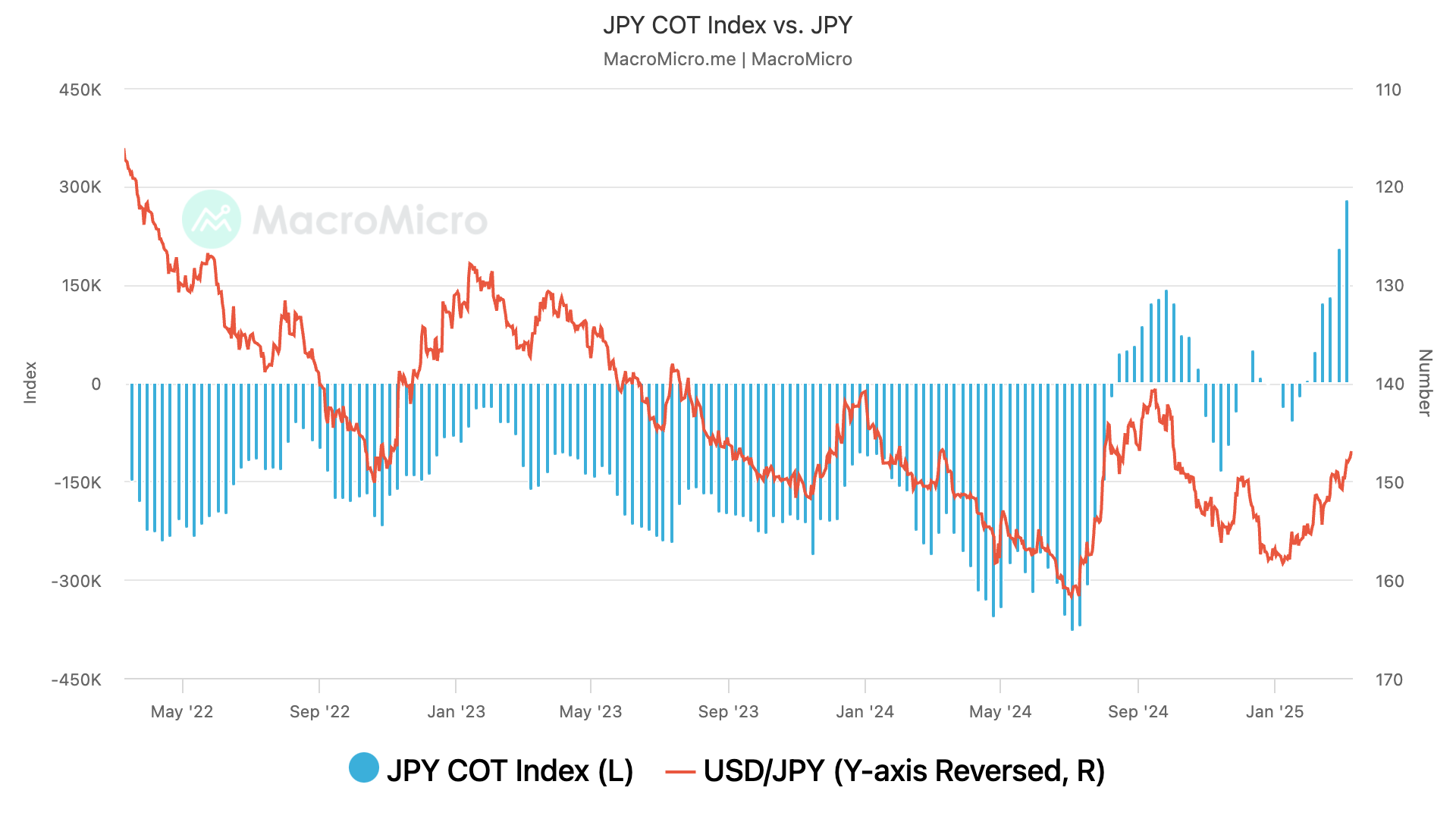

On a rather delightful note, it appears our bullish chums in the Yen camp are looking more and more like overzealous optimists at a garden party, given last week’s record longs per the CFTC data that MacroMicro has been diligently dredging up. Such blind collective enthusiasm tends to play peekaboo with disappointment, mind you, leading to some rather alarming unwinding of longs—much like an overcooked soufflé.

So, it stands to reason, the Yen’s joyful ascent might just hit the brakes for the time being, providing a veritable oasis of relief for risk assets including our dear Nasdaq and Bitcoin.

“We are now taking the extraordinary step of being cautious about chasing JPY strength,” piped up Morgan Stanley’s G10 FX Strategy team in a rather urgent note circulated among clients late Friday, presumably over tea.

Venerable strategists elaborated that many Japanese investors, blessedly unaware of the trouble brewing, are seizing the moment with their Nippon Individual Savings Accounts (NISA) to acquire foreign assets during these so-called “risk-off” episodes. This, rather conveniently, causes the pace of JPY appreciation to slow more than a tortoise with a fancy hat.

“Indeed, this panned out last August after the Yen had an enthusiastic sprint, leading to a most pronounced sell-off in equities,” strategists chimed in, as if reading the last chapter of a gripping novel.

Will history don its verbena apron and serve up another round of risk-on delight for our stalwart Nasdaq and Bitcoin? The USD/JPY pair took a leisurely jaunt upward following the July and early August slide down to a delicate 140, gallivanting up to 158.50 come January. And wouldn’t you know it, BTC similarly perked up from its early August tumble to a hearty $50,000, ultimately hitting frothy peaks above $108,000 by January.

As of this very moment, Bitcoin hovers near the $80,300 mark, having wilted a little with a nearly 5% decline this month, following a rather tragic 17.6% descent in February. At one delightful point on Tuesday, prices found themselves at a modest $76,800, as CoinDesk dutifully informs us.

Meanwhile, USD/JPY frolicked at 147.23, having previously set off alarms with a five-month low of 145.53 earlier on Tuesday. Ah, the drama of the markets!

A brief hiatus, perhaps?

While the bullish positioning looks rather stretched out, much like a waistcoat at a family gathering, these factors might not do much to change the broader sunny disposition on the JPY, buoyed as it is by the more favorable U.S. and Japanese bond yield differential.

Consequently, our intrepid risk asset bulls would do well to remain ever watchful for signs of volatility lurking in the Yen and the wider financial fields.

The accompanying chart vividly illustrates the narrow alley between yields on the 10-year U.S. and Japanese government bonds.

This spread has shrunk to a quaint 2.68% in a most JPY-pleasing manner, reaching its lowest since August 2022. Moreover, it has gallantly emerged from a macro uptrend, giving rise to whispers of a momentous bullish shift in the JPY outlook.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- League of Legends: Anyone’s Legend Triumphs Over Bilibili Gaming in an Epic LPL 2025 Playoff Showdown!

- Lucky Offense Tier List & Reroll Guide

- Jump Stars Assemble Meta Unit Tier List & Reroll Guide

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends: T1’s Lackluster Performance in LCK 2025 Against Hanwha Life Esports

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

2025-03-11 10:55