Behold, the tale of woe:

- In a saga of cryptic proportions, the market doth tremble, as Bitcoin‘s worth plummets near the $80k abyss. Dogecoin and Cardano‘s ADA, once noble, now face losses dire.

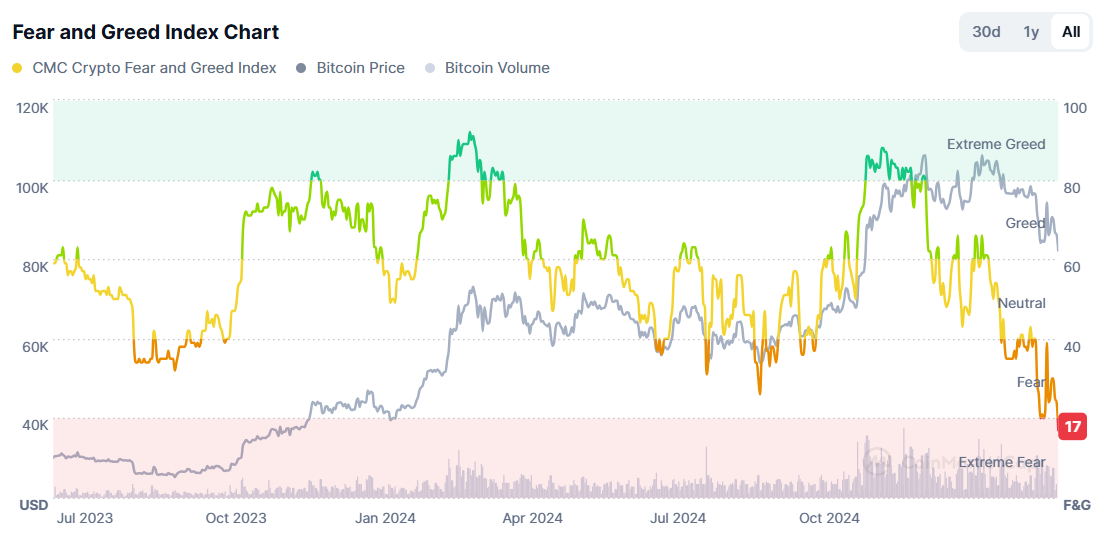

- The crypto fear and greed index, a barometer of investors’ souls, hath reached a nadir unseen since yesteryear, foretelling ‘extreme fear’ amongst the brave and the fearful.

- Traders, ever watchful, eye macroeconomic omens and Federal Reserve whispers, hedging their bets with short-dated treasuries, anticipating a rate cut as early as May.

A chill wind blows through the crypto realm, extending its icy grasp into the second week. Bitcoin, the grand sovereign, stoops to $80,000, a shadow of its former self, dragging the kingdom of altcoins into darkness.

Cardano’s ADA and Dogecoin, once heralded as the harbingers of change, lead the descent, plummeting 10% in a day’s sorrow. XRP follows suit, shedding over 7%. BNB Chain’s BNB, Ether, and Tron’s TRX, fall like leaves in autumn, losing 5%, while Bitcoin, the king, loses 4%.

The crypto fear and greed index, a beacon of investor sentiment, flickers at a mere 17, a whisper of its might, marking ‘extreme fear’ as its lowest point since the dawn of 2023.

This index, a sage of volatility, momentum, social media’s pulse, Google’s gaze, and Bitcoin’s dominion, serves as a guidepost, warning of despair or the dawn of opportunity.

Alas, the gains of yore, spurred by President Trump’s strategic crypto reserve, have vanished like morning mist. XRP, Solana’s SOL, and ADA, once soaring on the wings of hope, have fallen back to earth.

Trump’s promise of a crypto bounty, a reserve of seized Bitcoin, proved hollow, leaving traders bereft. The White House Crypto Summit, a gathering of great import, ended in anticlimax, lacking the thunderous proclamations anticipated.

Global markets, too, reel from the tariff wars ignited by Trump and his peers, as the dollar’s strength wanes, dipping below 105, a harbinger of ill fortune for risk assets.

Now, traders wait, their eyes fixed on the horizon, seeking signs in macroeconomic portents and the Federal Reserve’s decrees. Kevin Guo, the sage of HashKey Research, foresees a path of caution, guided by the winds of equities and the Federal Reserve’s patient stance.

Yet, amidst the gloom, a glimmer of hope emerges. Traders bet on short-dated treasuries, anticipating a resumption of rate cuts by the Federal Reserve, a boon for crypto’s valiant few.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Mirren Star Legends Tier List [Global Release] (May 2025)

- MrBeast removes controversial AI thumbnail tool after wave of backlash

2025-03-10 11:16