Ah, Ethereum! The capricious creature of the crypto realm, now caught in a dance of consolidation after a dramatic plunge that would make even the most stoic of souls weep. Yet, lo and behold! Key supports stand valiantly before it, like brave knights ready to defend the realm from further calamity. Could a bullish retracement be on the horizon? Only time will tell, dear reader! ⏳

Technical Analysis

By Shayan, the Oracle of Crypto

The Daily Chart

In the grand theater of finance, Ethereum has taken a bow after a deep correction, landing squarely in the $2K support range. This level, dear friends, is not just any level; it is the sacred ground that has held firm since December 2023, a veritable fortress of support! 🏰

Should ETH dare to breach this hallowed ground, a downward spiral may ensue, akin to a tragic play where the hero meets his doom. Yet, history whispers sweet nothings of demand at this level, suggesting that consolidation may be the order of the day, with a flicker of hope for short-term bullish escapades. 🌈

The 4-Hour Chart

On the lower timeframes, the bearish structure of Ethereum remains as stubborn as a mule. Lower lows and lower highs abound, signaling the sellers’ dominance like a dark cloud over a sunny picnic. Recently, the $2K region has been a hotbed of volatility, leading to the dramatic liquidation of leveraged positions—oh, the humanity! 😱

But wait! A bullish divergence is emerging, like a phoenix rising from the ashes, between Ethereum’s price and the RSI indicator, hinting at a potential increase in buying pressure. Could it be? Is hope alive? 🦄

With these factors in play, further consolidations within the $2K-$2.5K range seem likely, accompanied by the potential for wild price rebounds. Buckle up, folks! 🎢

Onchain Analysis

By Shayan, the Seer of Onchain Mysteries

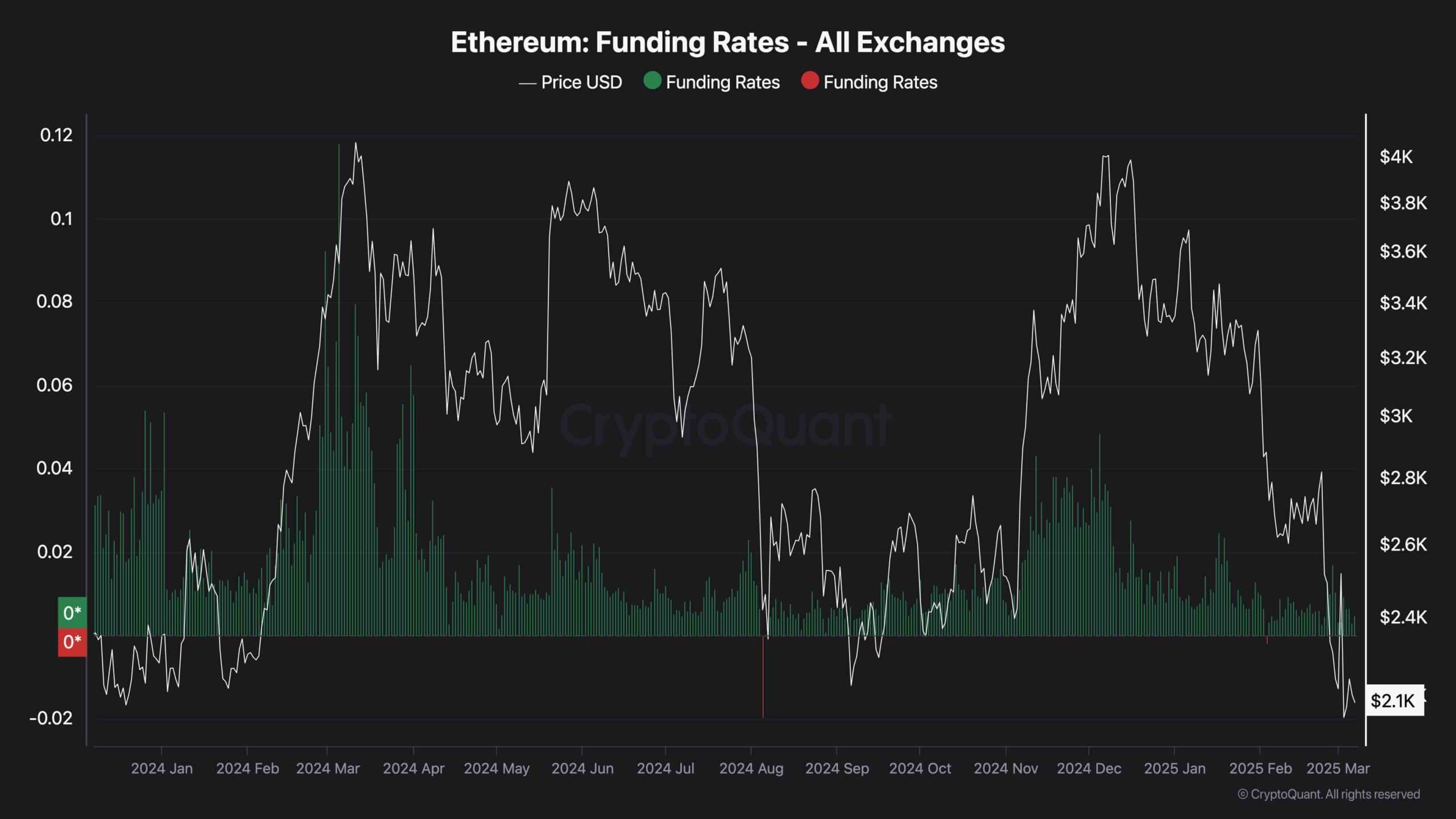

The funding rates metric, a crucial barometer of buyer versus seller dominance in the Ethereum futures market, has been on a downward trajectory since ETH’s recent peak at $4K. This decline signals a rise in short positions and an overall bearish sentiment, increasing the likelihood of a continued market correction. 📉

While negative funding rates typically indicate seller dominance, they also raise the specter of a short-squeeze event. If Ethereum manages even a modest bullish rebound, a wave of liquidations could send prices soaring, like a rocket launched into the stratosphere! 🚀

Ethereum’s ability to cling to the $2K support zone will be pivotal in determining its next grand performance. Should ETH stabilize, it may pave the way for a bullish reversal, with $2.5K and $3K as the next formidable foes. However, if the selling pressure persists, the price may plunge below $2K, signaling a deeper descent into the abyss. The coming days will be crucial in shaping Ethereum’s fate—stay tuned! 🎭

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

2025-03-07 16:46