What to know:

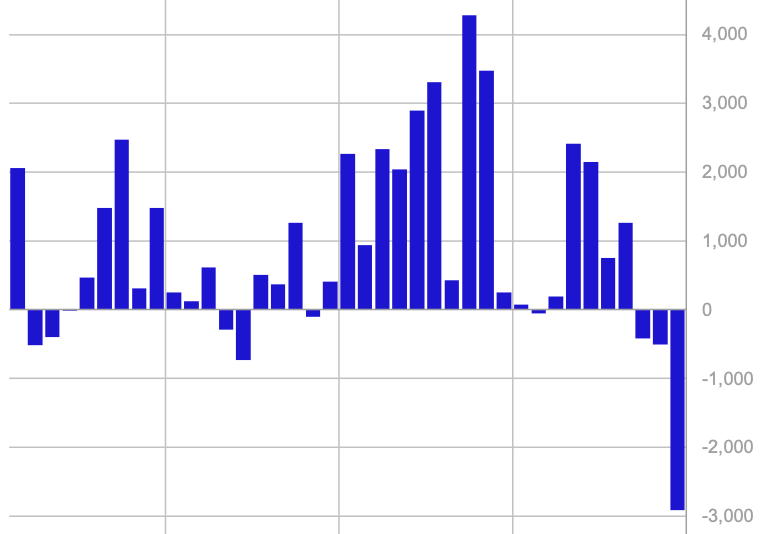

- Crypto ETPs, in a dramatic twist, witnessed a staggering $2.9 billion in outflows last week, extending a three-week streak to a jaw-dropping $3.8 billion. Talk about a financial exodus!

- Leading the charge into the abyss was BlackRock’s iShares Bitcoin Trust (IBIT), which posted a record-breaking $1.3 billion in outflows. Who knew Bitcoin could run so fast?

- While Bitcoin investment products lost a hefty $2.6 billion, Sui (SUI) and XRP (XRP) decided to throw a little party, being among the few assets to see inflows. 🎉

In a plot twist worthy of a soap opera, crypto exchange-traded products (ETPs) experienced their largest weekly sell-off on record, with investors yanking approximately $2.9 billion from these funds, as reported by CoinShares on a rather gloomy Monday.

This massive outflow signals a dramatic shift in sentiment, akin to a sudden rainstorm after a long, sunny day of steady investment into digital asset products. ☔️

The latest wave of withdrawals has extended a three-week streak of outflows, now totaling $3.8 billion. CoinShares research analyst James Butterfill pointed to several factors likely driving this sell-off, including investor jitters following the recent $1.5 billion hack on crypto exchange Bybit and the Federal Reserve’s increasingly hawkish stance on monetary policy. Because who doesn’t love a little drama?

Before this downturn, crypto investment products basked in the glow of 19 consecutive weeks of inflows, suggesting that some investors were locking in profits amid the growing market uncertainty. A classic case of “better safe than sorry!”

Bitcoin (BTC), the heavyweight champion of cryptocurrencies, bore the brunt of the outflows, losing a staggering $2.6 billion over the past week. Meanwhile, funds betting against Bitcoin, known as short Bitcoin ETPs, saw only a modest inflow of $2.3 million, indicating that bearish sentiment has yet to fully take hold. It’s like watching a slow-motion train wreck!

While most assets struggled, a few decided to defy gravity—Sui (SUI) emerged as the top performer with $15.5 million in inflows, followed closely by XRP (XRP), which also attracted fresh investment. Who knew they had such charm?

Spot Bitcoin ETFs faced one of their toughest weeks yet, with investors pulling significant capital from these funds. BlackRock’s iShares Bitcoin Trust (IBIT), the largest of its kind, recorded a staggering $1.3 billion in outflows, according to CoinShares, marking the highest weekly withdrawal since its launch. Ouch!

Similarly, CME Bitcoin futures open interest dropped sharply over the past two weeks, plummeting from 170,000 BTC to 140,000 BTC, signaling a potential shift in institutional positioning. Meanwhile, the three-month futures annualized rolling basis is yielding 7%, only slightly higher than the 4% yield offered by short-term U.S. Treasuries. Not exactly a thrilling investment choice!

“This tells me the hedge funds are starting to unwind their basis trade position, which is a net neutral position,” said James Van Straten, analyst at CoinDesk. “With a narrowing spread between futures yields and risk-free returns, traders may be reallocating capital away from bitcoin derivatives in favor of safer, more liquid assets.” Because who wouldn’t want to play it safe in this wild crypto circus?

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- Stellar Blade Update 1.011.002 Adds New Boss Fight, Outfits, Photo Mode Improvements

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- League of Legends: Anyone’s Legend Triumphs Over Bilibili Gaming in an Epic LPL 2025 Playoff Showdown!

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

- Lucky Offense Tier List & Reroll Guide

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

2025-03-03 20:35