What to know:

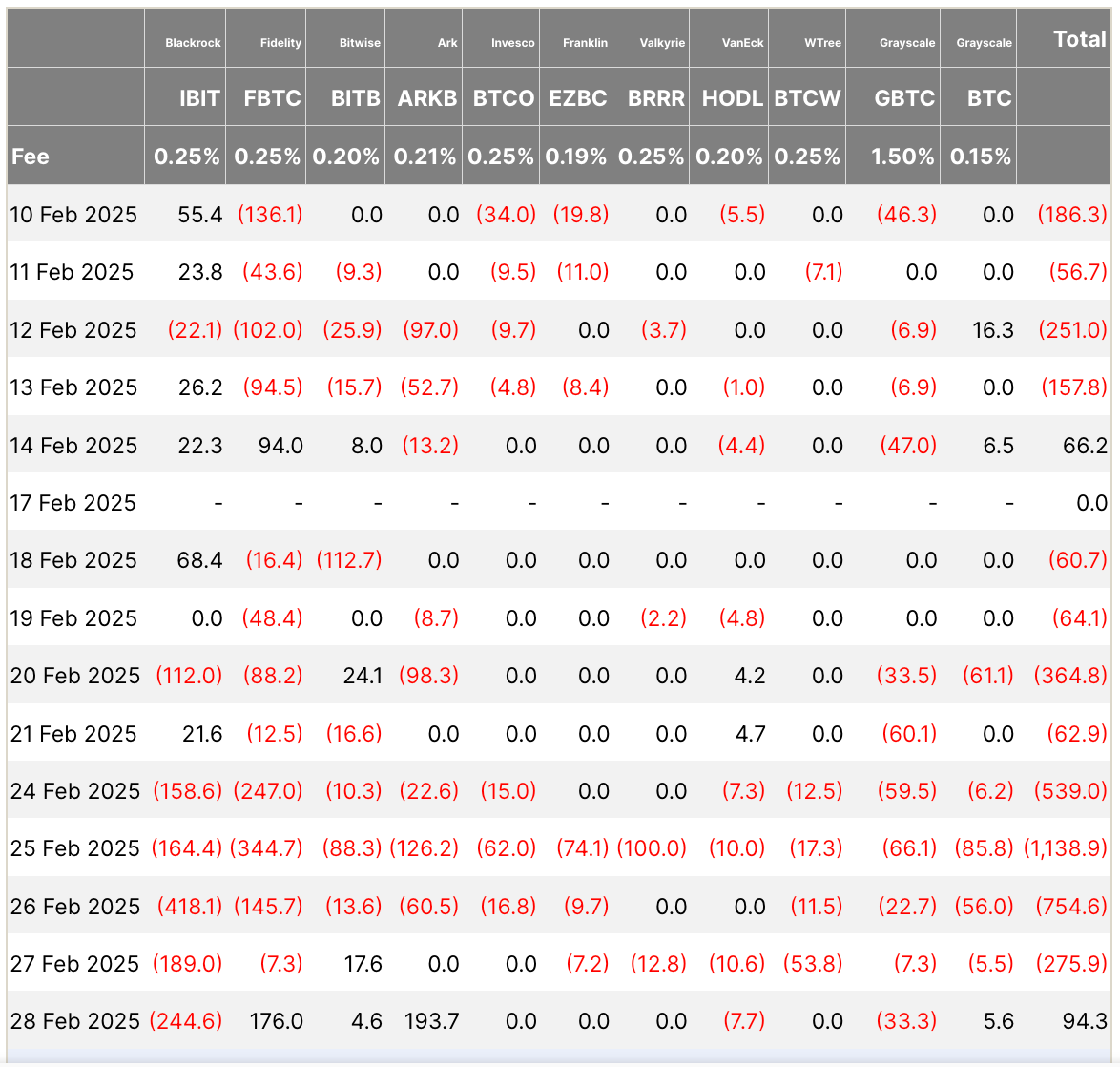

- Lo and behold! Spot Bitcoin ETFs have summoned a somewhat miraculous $94.3 million in inflows on February 28, thus concluding an eight-day rendezvous with the dreaded outflow streak.

- During this less-than-charming eight-day escapade, the 11 spot Bitcoin ETFs dancing in the U.S. market bore witness to an exodus of over $3.2 billion, as disheartened investors fled like it was a particularly dreary party.

- Bitcoin, in a dramatic twist befitting the finest pantomime, recovered to a dazzling $84,900 after plunging to a low of modesty at $78,000 on the very same day.

As February bid adieu—a month villainously dubbed the worst in three years—the spot Bitcoin exchange-traded funds (ETFs) in the U.S. clutched at $94.3 million in blessed inflows on the last day. A miracle? One might say!

Despite this cheerful capstone, investors had been rather generous with their withdrawals, pulling back a staggering $3.2 billion from these funds whilst the digital asset prices danced the tango downwards.

In a theatrical plot twist, BlackRock’s iShares Bitcoin Trust (IBIT)—the leading diva in the world of Bitcoin ETFs—experienced a melodramatic flair with $244.6 million departing like it was a bad review. Meanwhile, other hefty players like Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF saw their fortunes improve with inflows of $176 million and $193.7 million respectively; data from Farside Investors, the gossip column of the finance world, reveals.

As the curtains pulled back on the market’s theatrics, Bitcoin emerged from its $78,000 gloom, now trading at a sparkling $84,900 after a dainty 1.6% recovery in just 24 hours. Meanwhile, the broader CoinDesk 20 Index managed a modest rise of 0.3% to 2,705—a round of polite applause is in order!

However, let’s not get too carried away; BTC is still nursing a rather melancholic 12% decline over the past week, whilst the greater crypto market wallows in a rather sad 15.8% drop—as if the party had ended before it even began. The spot Bitcoin ETFs had been locked in a wretched outflow saga since February 14, a date that promised excitement but delivered only $66.2 million in inflows.

On a contrasting note, the spot ether ETFs seem to be facing their own tragic scene on February’s finale, enduring an ongoing outflow with $41.9 million embracing the exit. Since their last foray into positive territory, a staggering $357.5 million has bid adieu, as reported by Farside’s scandalous observations.

This momentary revival—or perhaps an elaborate illusion—coincides with President Trump’s upcoming crypto summit scheduled for March 7, amid whispers that BlackRock has whimsically allocated 1% to 2% of its extravagant spot Bitcoin ETF into one of its model portfolios. Quite the spectacle, wouldn’t you agree? 🤔

Read More

2025-03-01 20:27