Ah, Bitcoin! The darling of the digital age, which has recently taken a nosedive that would make even the most seasoned acrobat blush. Large red candles are popping up like unsightly mushrooms after a rain, indicating a bearish momentum that could make a bull weep.

If the market doesn’t pull itself together soon, we might be looking at a crypto catastrophe of epic proportions. One can only hope that the digital currency finds its footing before it tumbles into the abyss!

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, our dear asset has been on a downward spiral, breaking through the once-mighty $90K support zone like a hot knife through butter. This dramatic descent follows a prolonged period of consolidation around the $100K mark, which it has now decided to abandon like a ship in a storm.

At present, our cryptocurrency is testing the 200-day moving average, which is hovering around the $82K mark, along with the $80K support level. Should these levels crumble like a poorly baked soufflé, we could be in for a deeper plunge, with the $63K support zone looming ominously on the horizon.

The 4-Hour Chart

The 4-hour chart presents a rather ghastly tableau of recent price action, as the drop appears to be worsening with each tick of the clock. It’s enough to make one clutch their pearls!

However, the RSI is showing a rather cheeky bullish divergence with the price, as if to say, “Not all is lost!” With the price clinging to the strong support level of $80K, there’s a glimmer of hope for a short-term rebound. Yet, for a full recovery and a return to bull market glory, the market must once again breach the $100K barrier. Fingers crossed!

On-Chain Analysis

By Edris Derakhshi (TradingRage)

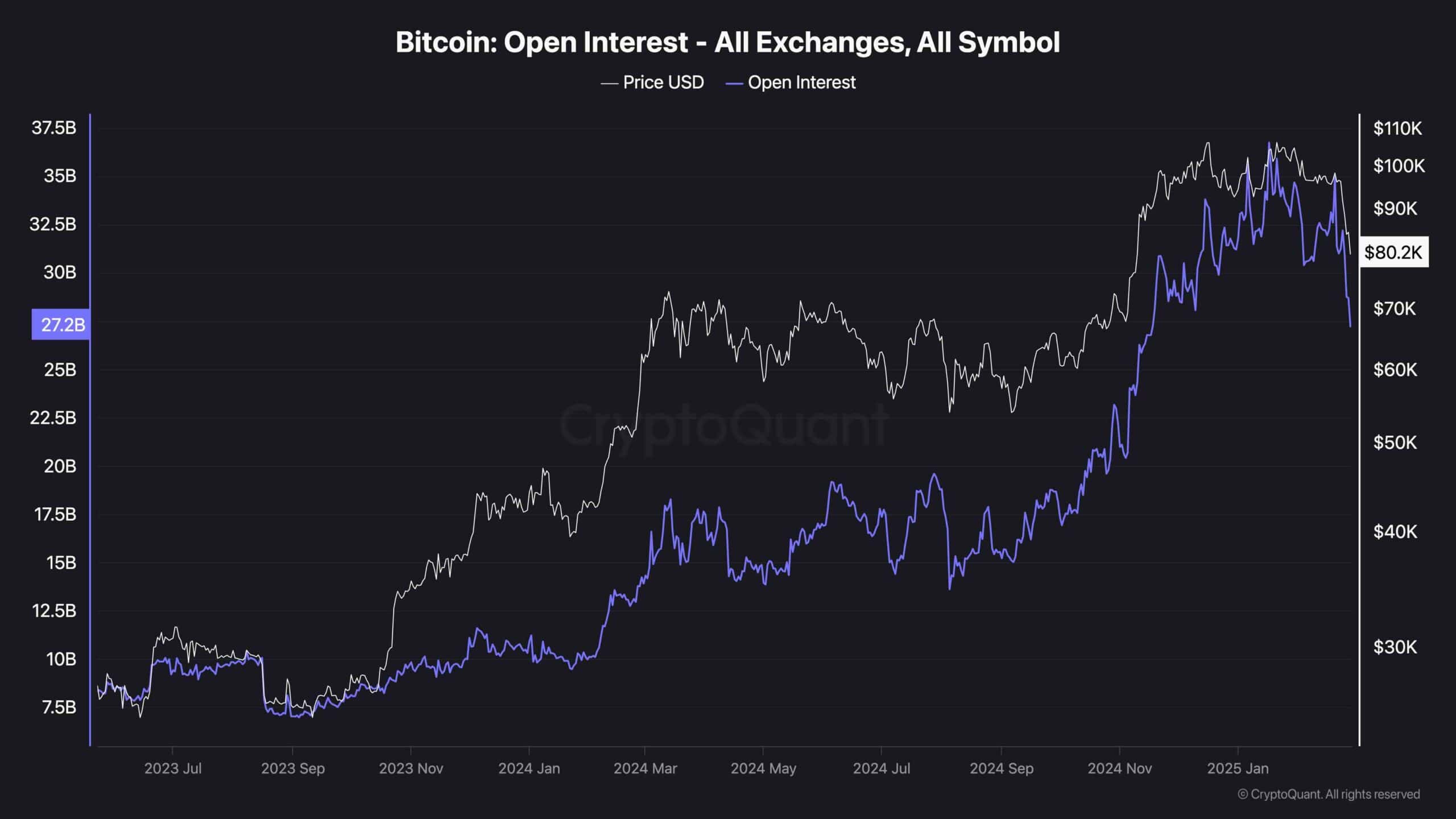

Open Interest

The futures market has been the mischievous rascal behind most of Bitcoin’s price volatility and sudden crashes over the past few years. Once again, the liquidation of high-leverage positions has sent the market into a tailspin, causing a cascade of sell-offs that would make a waterfall envious.

This chart illustrates the open interest metric, which measures the total number of open futures contracts across all centralized exchanges. The OI has been plummeting alongside the price, indicating a massive long liquidation cascade is underway. These liquidations tend to exacerbate bearish movements, adding to the overall selling pressure like a cherry on a rather unappetizing cake.

While cooldowns in the futures market are essential for a sustainable uptrend, a deeper drop could complicate matters further, as more liquidations would likely follow. It’s a precarious dance, indeed!

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-28 17:37