In a world where security breaches have become the new norm, the crypto realm finds itself in a precarious dance with danger. It seems that the only thing more volatile than the market is the security of its providers. Who knew that digital assets could be so… *exposed*? 😅

Today, Marcin Kaźmierczak from Redstone Oracles unveils the ominous prophecy that 2025 will be a pivotal year for DeFi and on-chain finance. Spoiler alert: it’s not all sunshine and rainbows! 🌧️

Meanwhile, Kevin Tam takes a magnifying glass to the institutional adoption of bitcoin, as revealed by the recent 13-F filings. It’s like watching a slow-motion train wreck—fascinating yet terrifying.

–Sarah Morton

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday, if you dare.

DeFi Renaissance – Why 2025 Will Be The Year of Decentralized And On-Chain Finance?

Ah, the infamous hack of ByBit, where nearly 401,000 ETH vanished into the ether, valued at a staggering $1.5 billion. It’s a stark reminder that security is not just a buzzword; it’s the lifeblood of crypto adoption. Can institutions really expand on-chain after such a debacle? Of course! It’s all about baby steps and shiny security procedures. 🍼🔒

Growing Adoption of Yield-Bearing Assets: Staking, Liquid Staking, Restaking and Liquid Restaking

In the grand theater of traditional finance, yield-generating assets are the stars of the show, outshining their non-productive counterparts. Investors are flocking to ether, the “productive” darling of the crypto world, as it fuels a network of decentralized applications. Who wouldn’t want a piece of that action? And let’s not forget the rise of liquid staking—because who doesn’t love a little liquidity with their yield? 💧💰

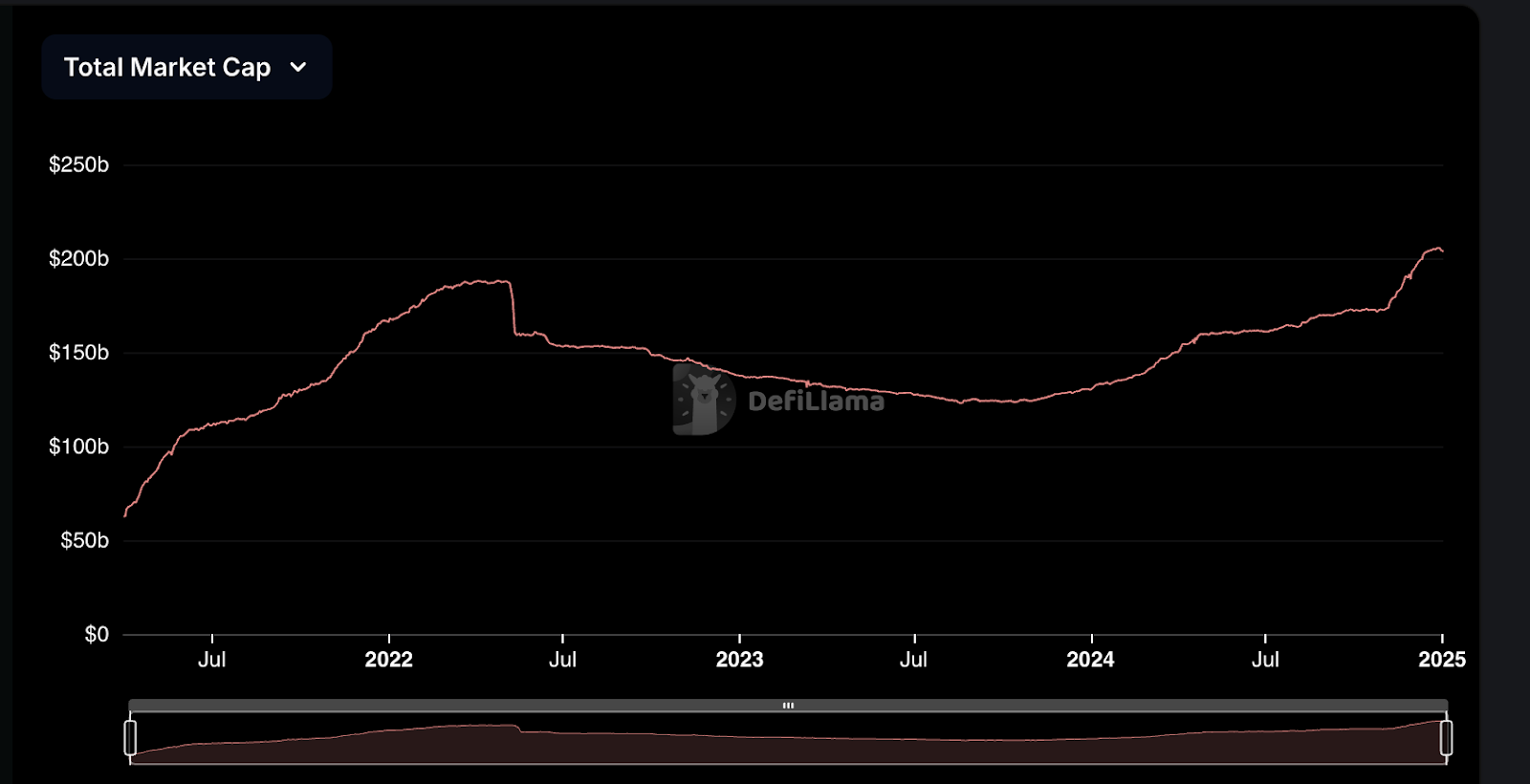

With around one-third of all ETH—approximately $90 billion—staked, the DeFi landscape is set for a seismic shift. As traditional financial institutions dip their toes into staking, we might just see a migration from custodial to non-custodial solutions. Welcome to the future, folks! 🚀

Stablecoin Growth

The global thirst for U.S. dollar exposure is insatiable, and stablecoins are here to quench that thirst. USDC is leading the charge, making dollar-denominated wealth preservation as easy as pie. 🍰 With venture capital pouring into stablecoin projects, it’s a gold rush of sorts. And let’s not forget the regulatory frameworks that are giving stablecoins a shiny new badge of legitimacy. Who knew compliance could be so sexy? 😏

Enhanced Interoperability and User-Friendly Non-Custodial Solutions

As we march toward 2025, the challenge of moving funds across networks looms large. But fear not! A “one-click solution” is on the horizon, promising to simplify the DeFi experience for newcomers. It’s like a magic trick, but with money! 🎩💸

Wallet providers are also stepping up their game, aiming to make crypto more accessible and user-friendly. Because let’s face it, the current setup is about as inviting as a cold shower. 🥶

Bitcoin Reaching $100K

While merely holding bitcoin isn’t directly tied to

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

2025-02-27 19:23