XO Kitty Season 3 Trailer Spoils One Big Kiss Happened Off-Screen

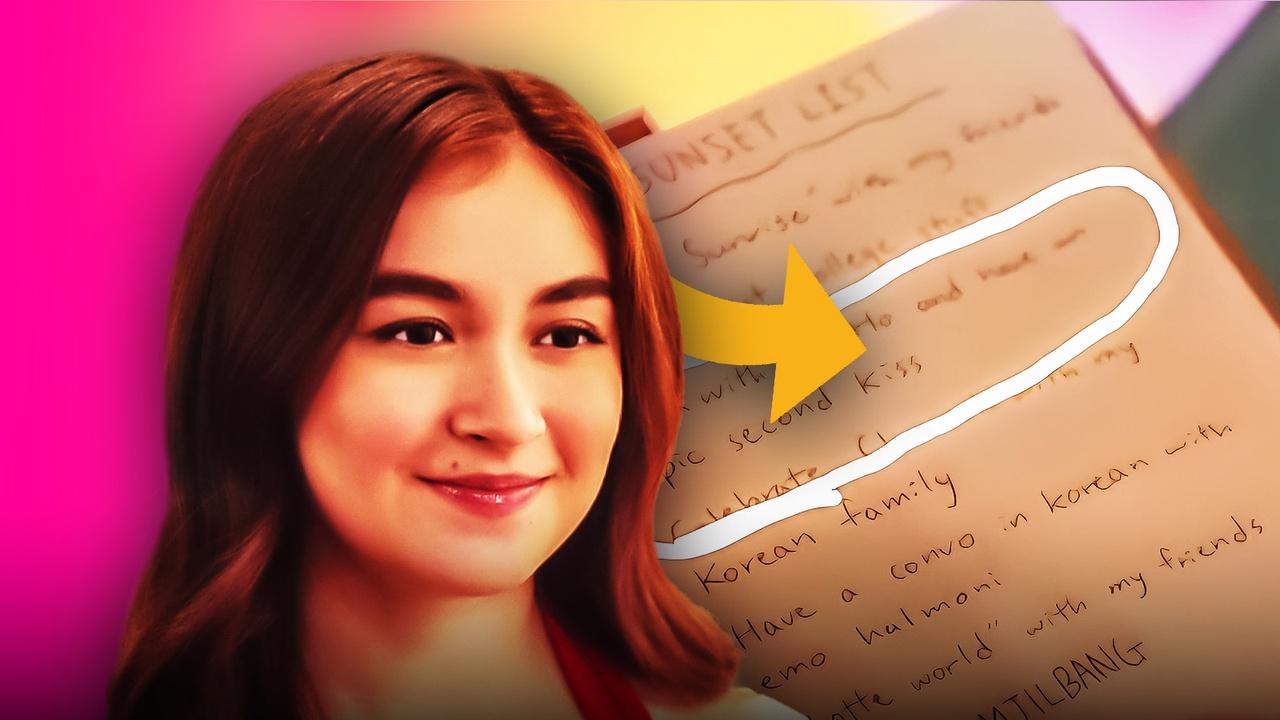

Netflix has dropped the official trailer for Season 3 of XO Kitty, giving fans a look at what’s coming up – including some surprising plot twists and a guest appearance by Lana Condor, reprising her role as Lara Jean Covey from To All The Boys I’ve Loved Before. Sharp-eyed viewers also noticed a detail in the trailer that might hint at a new development in Kitty and Min-Ho’s relationship.