What to know:

By James Van Straten (All times ET unless indicated otherwise)

In the grand theater of cryptocurrency, two philosophies dance like clowns at a circus. Do you “buy when there is blood in the streets”? Or do you heed the wise warning: “don’t catch a falling knife”? 🤔

Today, we find ourselves in a peculiar market, the day after the largest cryptocurrency, Bitcoin (BTC), took a nosedive, its steepest three-day decline since the infamous FTX collapse of 2022. Oh, the irony! BTC now languishes 25% below its January high, even with President Trump’s crypto-loving administration waving its flag. 🏴☠️

It’s no wonder that the largest hack in crypto history has sent shivers down the spines of investors. And let’s not forget the memecoin madness, which has siphoned liquidity from the market like a vacuum cleaner on steroids. 🧹💨

Historically, bull-market corrections have seen Bitcoin tumble as much as 35%. Given that BTC has been on a joyride without a meaningful pullback since last August, this current situation feels almost… normal? 🤷♂️

CoinDesk’s research reveals that Bitcoin was stuck in a tight range for far too long, and a break was as inevitable as a cat knocking over a glass. On-chain data shows Bitcoin recently bounced off its 200-day moving average, around $81,800. Meanwhile, short-term holders are selling like it’s Black Friday, perhaps signaling some capitulation in the market. 🛒

BlackRock’s IBIT saw record outflows on Wednesday. But fear not! A massive expansion deal for Core Scientific (CORZ) and strong earnings from MARA Holdings (MARA) have both stocks soaring over 10% before the opening bell. And NVIDIA (NVDA) topped fourth-quarter estimates, soothing investors’ frayed nerves. Stay alert, folks! 🚨

Token Talk

By Shaurya Malwa

- Pump.fun, a Solana-based memecoin launchpad, has seen a sharp decline in token launches and graduations amid this falling market. Talk about a party pooper! 🎉

- The platform peaked in October 2024, creating over 36,000 tokens in a day and generating a whopping $3 billion market cap. But now? Daily token launches have plummeted by more than 60%. Ouch! 😱

- Data from Dune Analytics shows Pump.fun’s token graduation rate is stuck at a dismal 1%-2%, with many tokens failing to hold their value post-launch. It’s like watching a balloon deflate. 🎈

- This decline coincides with Solana’s SOL dropping over 40% since the year’s start. Coincidence? I think not! 🧐

Derivatives Positioning

- Open interest in perceptual futures tied to APT, one of the best-performing coins of the past 24 hours, has increased, but funding rates and cumulative volume delta are negative. Traders are clearly hedging their bets! 🎲

- SOL and LTC have also seen increases in open interest, but with positive funding rates. A glimmer of hope? 🌟

- BTC and ETH options on Deribit indicate downside concerns extending until the end of March, while later expirations still show a preference for call options. The plot thickens! 📈

- Block flows on Paradigm have been mixed, with puts and OTM call spreads lifted. The SOL March 7 expiry put option at the $120 strike was purchased. Interesting times ahead! ⏳

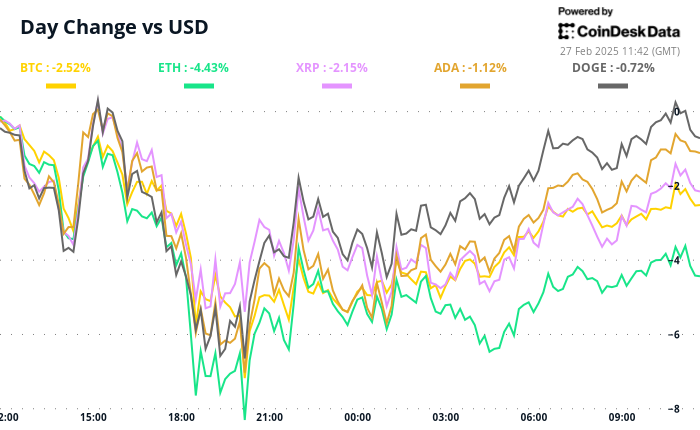

Market Movements:

- BTC is up 3% from 4 p.m. ET Wednesday at $86,735.19 (24hrs: -2.12%)

- ETH is up 1.98% at $2,378.49 (24hrs: -3.49%)

- CoinDesk 20 is up 2.98% at 2,821.02 (

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-27 15:35