What to know:

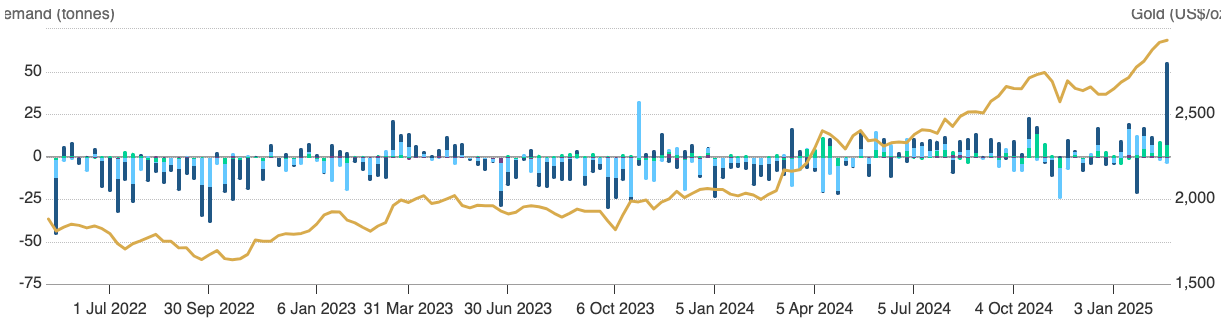

- ETFs backed by gold just experienced their largest weekly inflow since March 2022, reaching 52.4 tons, valued at approximately $4.9 billion.

- Gold’s price has risen nearly 11% year-to-date and by more than 43% over the past year, driven by geopolitical tensions and uncertainty surrounding tariffs.

- Among crypto tokens benefitting are PAXG and XAUT.

Ah, the sweet, shiny glory of gold. While Bitcoin ETFs bled out nearly a billion dollars—poor thing, it’s like watching a rich uncle go bankrupt—gold ETFs are lounging in luxury, basking in their largest weekly inflow since March 2022. A cool 52.4 tons. No biggie, just a casual $4.9 billion, most of which arrived from North America, because why not? Those guys know a thing or two about shiny objects.

The allure of gold is irresistible. It’s up almost 11% this year and an astonishing 43% from last year. What’s driving it? Geopolitical chaos, threatened tariffs—basically everything except for a relaxing day at the beach. Analysts can’t stop gushing about it. The metal’s trading at $2,910 per ounce—golden goose indeed!

Meanwhile, gold-backed cryptocurrencies like Paxos Gold (PAXG) and Tether Gold (XAUT) are living their best life. These precious tokens are keeping pace with the gold rush, outperforming the broader crypto market (which, let’s face it, is still just recovering from its digital identity crisis). As of now, PAXG and XAUT are totally outpacing the market’s average growth of 26% year-over-year. Clearly, they’re the class president in this wild school of crypto coins.

And guess what? The demand for these shiny tokens has been off the charts. Over $25 million in commodity-backed tokens were minted this month alone—the most since December 2022—while about $12 million worth were burned. A little drama, a little flair, like your favorite reality TV show, but with way more gold.

Supply, though, seems to be stubbornly unimpressed with all the excitement. According to the World Gold Council, mining production in the last quarter dropped by a couple of tons—yawn—while hedging and recycling grew. All in all, tracked gold supply rose only about 1% from last year. Gold’s just too precious to keep up with the feverish demand. Maybe it’s time we all start hoarding our own stockpile of glittery gold bars in our living rooms. Who needs the stock market when you’ve got *real* wealth?

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lucky Offense Tier List & Reroll Guide

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- How to use a Modifier in Wuthering Waves

2025-02-26 18:03