🚨 Attention Crypto Investors! 🚨

Are you tired of hearing about the crypto market crash? Well, guess what? Not all tokens are taking a nosedive! In fact, some are soaring high like a majestic eagle! 🦅

Don’t believe us? Check out these tokens that are defying gravity:

- MakerDAO’s MKR: Up by a whopping 20% in just 24 hours! 🚀

- Story Protocol’s IP: Nearly a 40% increase! 📈

- Celestia’s TIA, XDC, QNT, and HYPE: All outperforming the broader market! 🌟

- XRP: Hanging on to a key Fibonacci level, keeping bulls’ hopes alive! 🐂

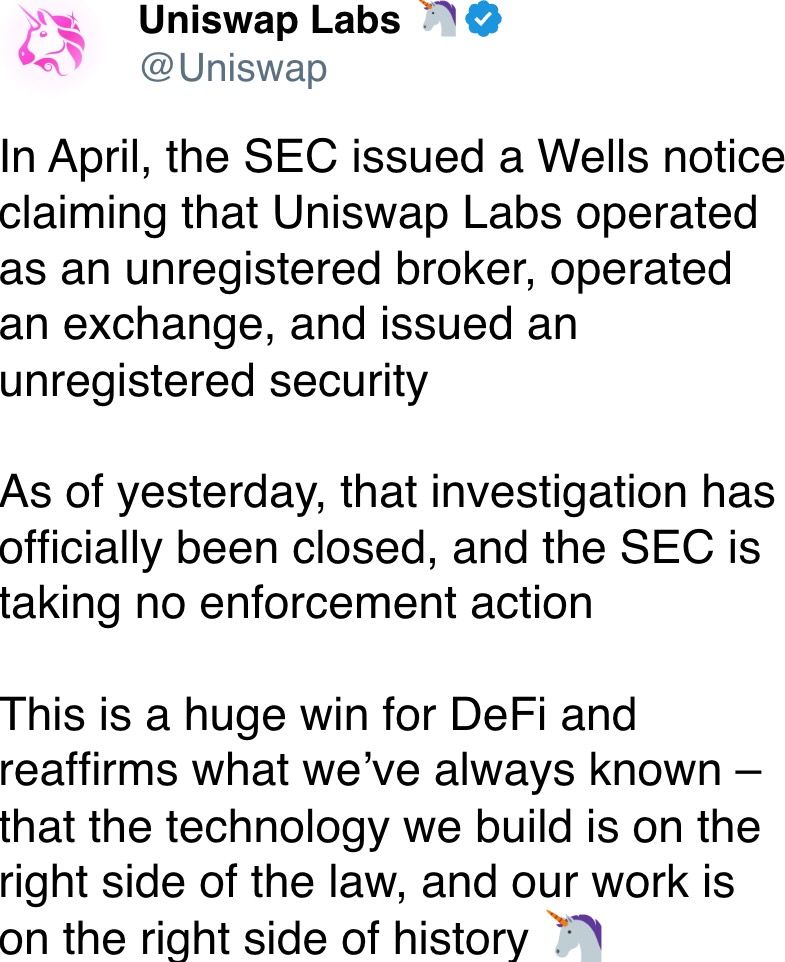

But wait, there’s more! According to Matthew Hougan, chief investment officer of Bitwise Asset Management, the crypto market is currently digesting the end of the recent memecoin frenzy. This could potentially be replaced by productive sectors such as stablecoins, real-world assets, and DeFi. 💸

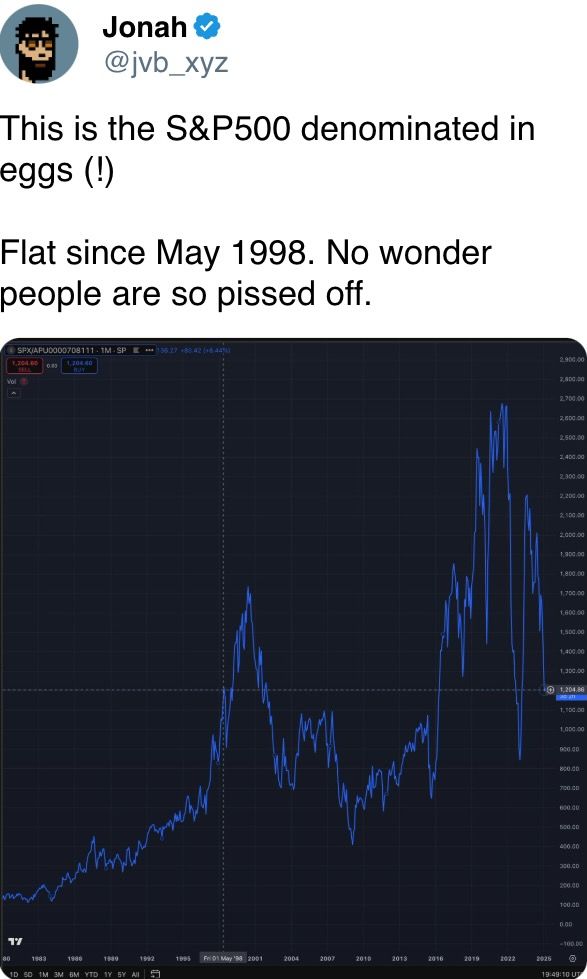

However, on the macroeconomic front, the optimism seen after the Nov. 4 election is being replaced by caution. The U.S. consumer confidence dropped to an eight-month low, and one-year inflation expectations were highest for 1.5 years. President Donald Trump’s tariffs were singled out as the primary concern in almost every household and business survey. 😟

The dour sentiment and a strengthening yen might keep the upside in risk assets restricted for some time. Earlier this week, Belgium’s central bank’s head, Pierre Wunsch, warned that the ECB risks sleep-walking into too many rate cuts. The Fed, for its part, is unlikely to do QE anytime soon. (Sure, the January meeting minutes discussed an end of quantitative tightening, but that does not mean quantitative easing.) 💸

📅 Key Events to Watch Out For:

The Senate Banking Committee, led by Senator Cynthia Lummis, is set to revisit crypto regulations during Wednesday’s scheduled hearing titled “Exploring Bipartisan Legislative Frameworks for Digital Assets.” Stay alert! 🚨

Token Talk 🗣️

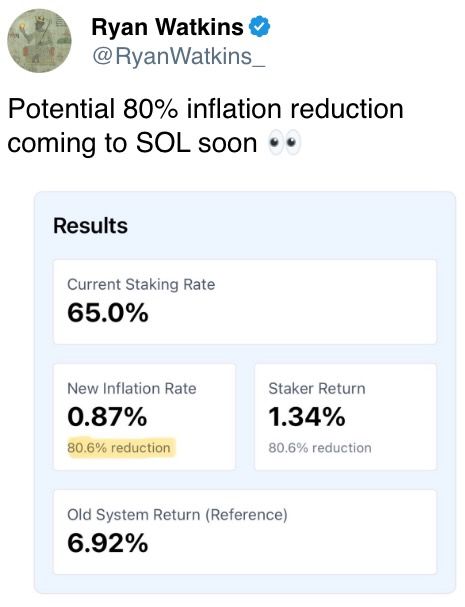

- Solana is considering implementing a governance proposal to change its inflationary monetary policy. 💸

- Story Protocol’s token, IP, has been bucking the bearish trend that gripped the cryptocurrency market over the last few days. 📈

- The industry ecosystem is also rallying behind cryptocurrency exchange Bybit after its $1.5 billion hack. The exchange has launched a “war against Lazarus” to crowdsource investigative efforts against the North Korean-linked group. 🕵️♂️

📈 Derivatives Positioning

- BTC‘s one-month CME futures basis has dropped to 4%, the lowest in nearly two years, according to Velo Data. That’s a sign of weakening bullish sentiment. Ether’s basis has dropped to just over 5%. 📉

- Perpetual funding rates for TRX, AVAX, XLM, SHIB, and OM are negative, reflecting a bias for bearish short positions. 🐻

- BTC, ETH short-term puts continue to trade at a premium to calls, reflecting fears of a continued price drop. 📉

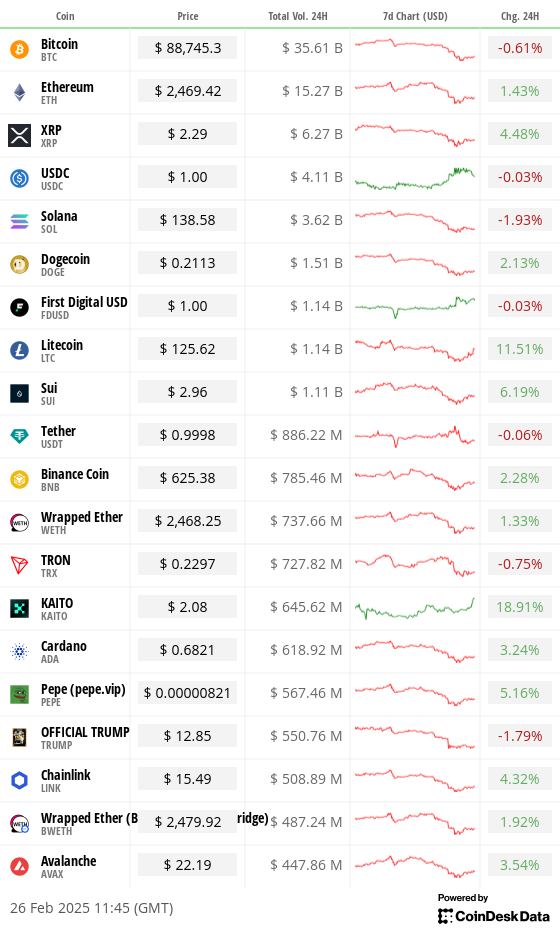

📊 Market Movements:

- BTC is up 1% from 4 p.m. ET Tuesday at $89,19377 (24hrs: -0.11%)

- ETH is down 0.36% at $2,487.88 (24hrs: +2.19%)

- CoinDesk 20 is up 0.42% at 2,882.89 (24hrs: +2.34%)

📈 Bitcoin Stats:

- BTC Dominance: 61.11 (0.13%)

- Ethereum to bitcoin ratio: 0.02793 (-0.75%)

- Hashrate (seven-day moving average): 746 EH/s

- Hashprice (spot): $52.40

- Total Fees: 11.39 BTC / $1.1 million

- CME Futures Open Interest: 164,970 BTC

- BTC priced in gold: 30.5 oz

- BTC vs gold market cap: 8.66%

📊 Technical Analysis

- Bitcoin’s hourly chart shows the MACD histogram has been biased bullish since late Tuesday. Still, there has been little progress to the upside in terms of price. 📉

- The divergence between prices and MACD, coupled with the downward sloping key averages, suggests potential for another round of selling before a meaningful bottom is reached. 📉

- A convincing move above $90,000 is needed to invalidate the bearish outlook. 📈

📈 Crypto Equities

- MicroStrategy (MSTR): closed on Tuesday at $250.51 (-11.41%), up 3.66% at $259.68 in pre-market

- Coinbase Global (COIN): closed at $212.49 (-6.42%), up 2.04% at $216.82

- Galaxy Digital Holdings (GLXY): closed at C$20.09 (-7.84%)

- MARA Holdings (MARA): closed at $12.41 (-10.62%), up 2.86% at $12.77

- Riot Platforms (RIOT): closed at $9.32 (-6.71%), up 2.79% at $9.58

- Core Scientific (CORZ): closed at $9.76 (-1.01%), up 3.28% at $10.08

- CleanSpark (CLSK): closed at $8.15 (-8.43%), up 1.96% at $8.31

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.04 (-11.25%), up 4.46% at $17.80

- Semler Scientific (SMLR): closed at $42.42 (-4.42%), up 2.5% at $43.48

- Exodus Movement (EXOD): closed at $39.86 (-3.16%), down 1% at $39.46

📈 ETF Flows

Spot BTC ETFs:

- Daily net flow: -$937.7 million

- Cumulative net flows: $38.09 billion

- Total BTC holdings ~ 1,157 million.

Spot ETH ETFs

- Daily net flow: -$50.1 million

- Cumulative net flows: $3.02 billion

- Total ETH holdings ~ 3.750 million.

📈 Overnight Flows

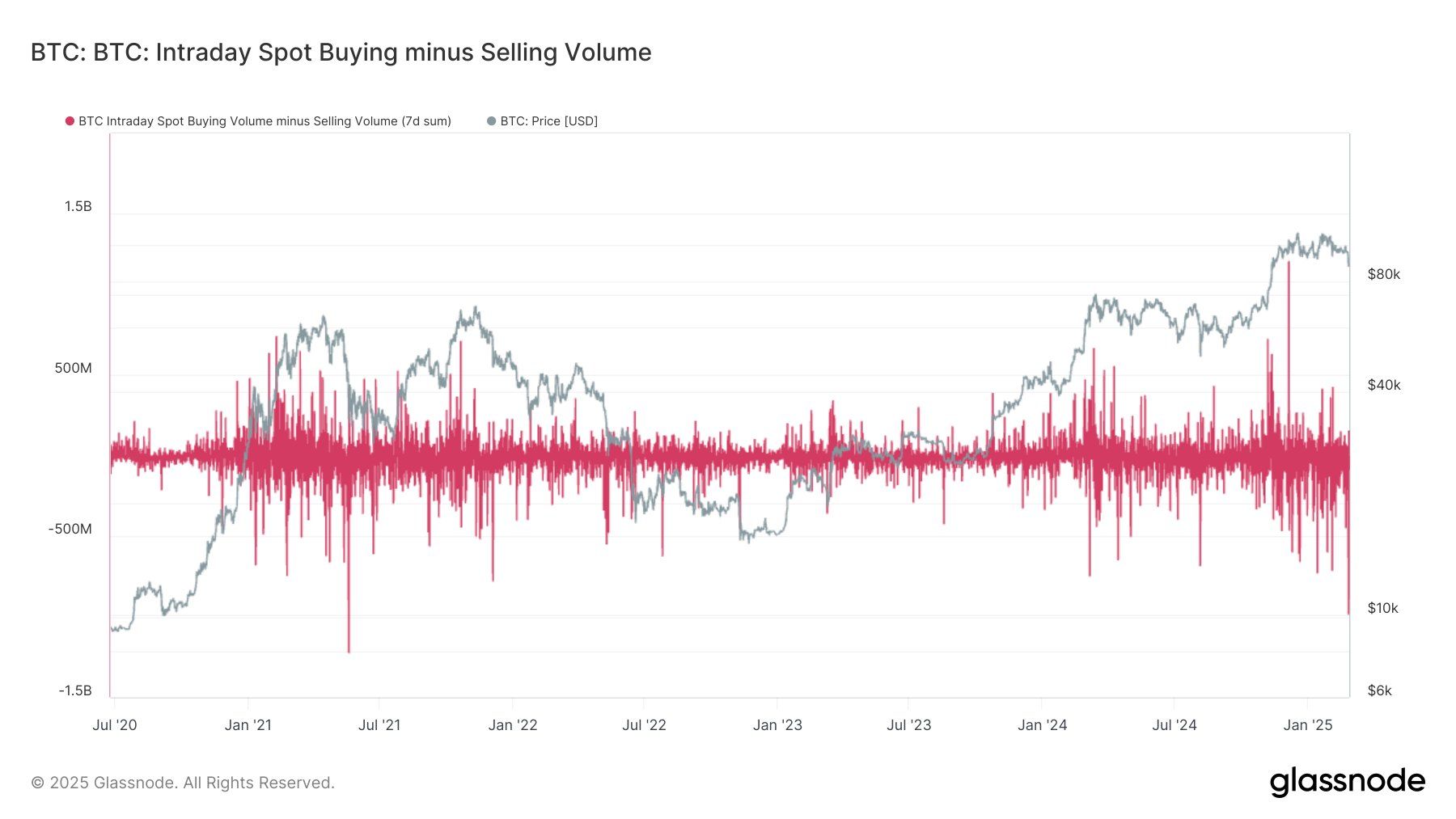

📊 Chart of the Day

The net selling volume in BTC on Tuesday was the strongest since May 2021, according to data tracked by Glassnode and Andre Dragosch, head of research for Europe at Bitwise. Perhaps weak hands have capitulated, leaving the market in a much healthier state. 💪

🌊 In the Ether

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

2025-02-26 15:33