What to know:

- Ah, the crypto bulls, those optimistic creatures, have found themselves nursing a staggering $1.2 billion in losses over the past 24 hours, as the market slump from Monday decided to throw a tantrum during the Asian hours of Tuesday.

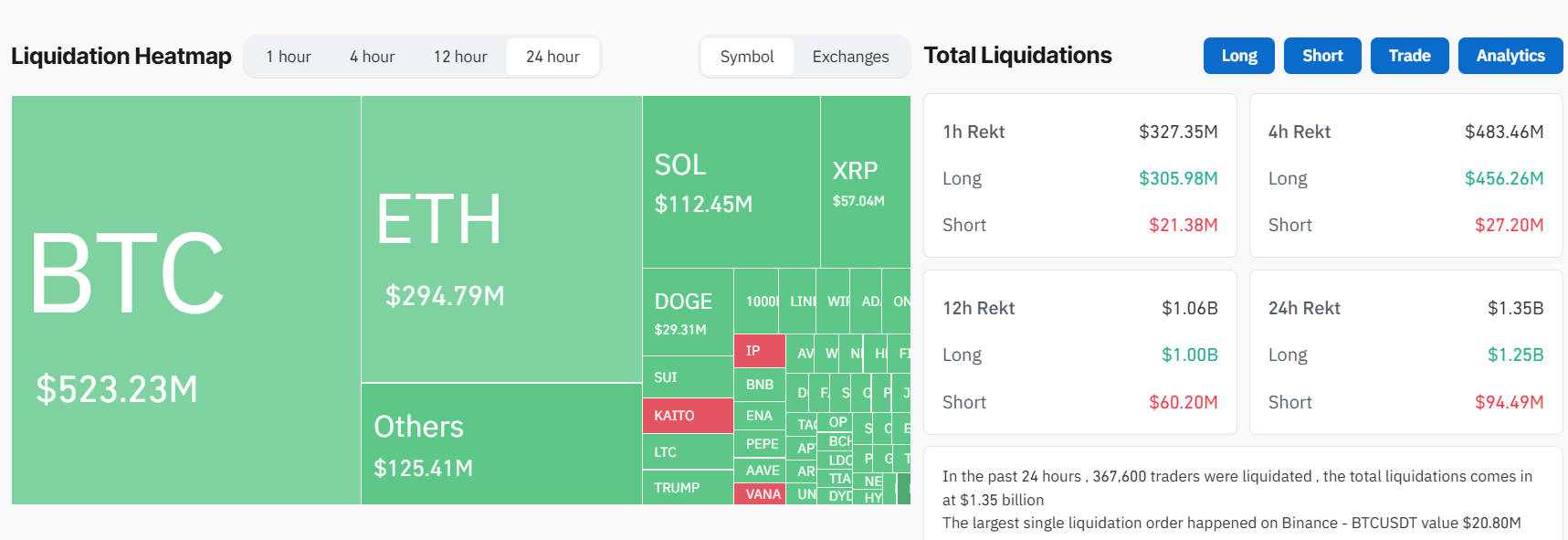

- Futures tracking our dear Bitcoin (BTC) have registered a rather dramatic over $530 million in liquidations, while the ethereal ether (ETH) has seen over $294 million evaporate into thin air. Poof! 💨

Indeed, our crypto bulls are left to lament their fate, cradling at least $1.2 billion in losses as the market’s descent from Monday deepened during the Asian hours on Tuesday, sending Bitcoin (BTC) tumbling to a disheartening under $89,000, its lowest since the mid-November festivities.

Aside from the ever-dramatic Bybit, crypto exchanges are reporting a liquidation every second, which suggests that the overall losses are far more catastrophic than the recorded $1.35 billion across long and short trades. One can only imagine the tears! 😢

Futures tracking Bitcoin have indeed registered over $530 million in liquidations, while ether (ETH) bets have seen over $294 million vanish. Solana (SOL) futures, not to be outdone, lost a staggering $112 million as the token plummeted more than 15%. Meanwhile, a 14% dive in XRP and the ever-quirky doge (DOGE) led to a cumulative loss of over $80 million. What a spectacle! 🎭

Liquidations, dear reader, occur when an exchange, in a fit of rage, forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It is a tragic affair when a trader cannot meet the margin requirements for a leveraged position, essentially lacking the funds to keep the trade alive. A most unfortunate fate! 😱

Our beloved crypto exchange Bybit, which has heroically recovered its assets after a $1.4 billion hack last week, has led the liquidation figures with over $600 million lost on its watch, followed closely by Binance at $300 million and OKX at $147 million. A veritable feast of losses! 🍽️

As for Nasdaq futures, they point ominously to continued losses in technology stocks, while the strength of the Japanese yen has sparked fears reminiscent of an August-like risk aversion. Investors, in their wisdom, tend to flock to the yen during economic uncertainty or market stress, viewing it as a safe haven, much like the U.S. dollar or gold. This risk-off sentiment usually pressures riskier assets—like Bitcoin or equities—as investors withdraw their funds from speculative investments and park them in safer bets. A wise move, indeed! 🏦

Read More

2025-02-25 12:04