What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

Oh, the crypto traders! They’re like a bunch of tightrope walkers, wobbling and swaying after Wednesday’s FOMC minutes revealed that the Fed is playing it cool, holding rates steady until inflation decides to behave itself. They even talked about pausing or slowing down the balance sheet runoff—how thrilling! 🎢

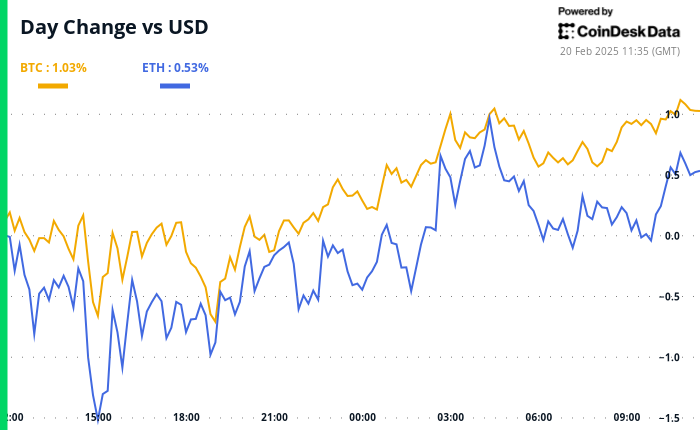

Meanwhile, the yield on the 10-year Treasury took a nosedive, and the dollar decided to take a little vacation. Cryptocurrencies are feeling a bit sprightly, with the CoinDesk 20 Index up 1.4% and bitcoin prancing around 1.2% higher over the last 24 hours. This little party followed some cheeky remarks from Czech National Bank Governor Ales Michl, who’s all for bitcoin as a reserve asset, and President Donald Trump, who claimed he’s ended “Joe Biden’s war on Bitcoin and crypto.” Oh, the drama! 🎭

Bitcoin traders are now playing the waiting game, as demand fizzles out like a flat soda, blockchain activity is as lively as a snail race, and liquidity inflows are about as exciting as watching paint dry. They’re eyeing a potential pullback to $86,000, but for now, they’re sitting pretty at over $97,000. Their cautious approach is as clear as day, with declining volatility and a significant drop in open interest. 🐌

Open interest on bitcoin futures contracts has plummeted below $60 billion from nearly $70 billion in late January, according to Coinglass data. This decline comes amidst the unraveling of the memecoin craze, which has been about as stable as a house of cards in a windstorm, especially after Argentina’s Libra debacle dampened the party mood. 🎉

“Right now, the market is in a bit of a cooldown phase,” said David Gogel, VP of strategy and operations at the dYdX Foundation, as if we didn’t already know! “Bitcoin’s been holding up, but after failing to break past $105k in January, we’ve seen capital inflows slow down and speculative assets like Solana and memecoins take a hit.” Ouch! That’s gotta sting! 😬

That hit is as clear as a bell in the aggregate open interest for futures contracts for SOL, the Solana blockchain’s native token. OI dropped from around $6 billion late last month to around $4.3 billion now, according to data from TheTie. Solana, once the belle of the ball, is now just another wallflower at the memecoin dance. 💃

“The market should stay attuned to broader macro-drivers and geopolitical developments that could trigger moves,” Wintermute OTC trader Jake O told CoinDesk. And by “broader macro-drivers,” he means the rising tensions between Trump and Ukrainian President Volodymyr Zelensky, which led to a not-so-subtle public exchange. Oh, the suspense! 🍿

Declining leverage and a shift away from riskier plays suggest the market may be entering a new phase. What that actually entails remains to be seen. Stay alert! 👀

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: Consensus Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Oliver Knight

- PI, the native token of the

Read More

- Unleash Your Heroes’ True Potential: Best Stadium Builds for Every Overwatch 2 Hero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lucky Offense Tier List & Reroll Guide

- Elder Scrolls Oblivion: Best Mage Build

- Elder Scrolls Oblivion: Best Spellsword Build

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- Best Crosshair Codes for Fragpunk

- SWORN Tier List – Best Weapons & Spells

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- WARNING: Thunderbolts Spoilers Are Loose – Proceed with Caution!

2025-02-20 15:11