By Francisco Rodrigues (All times ET unless indicated otherwise)

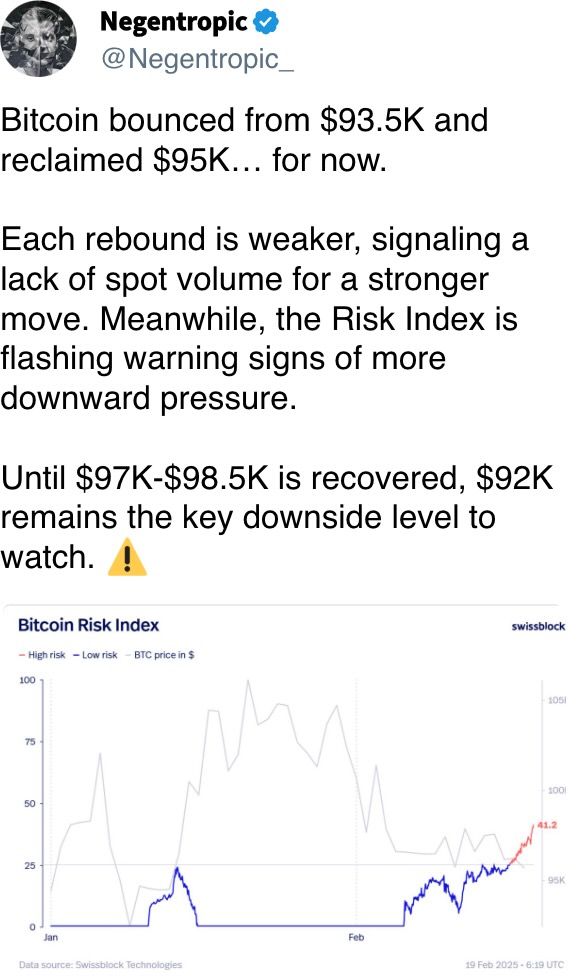

Ah, the cryptocurrency market! A stage where actors—err, investors—adopt the noble “wait-and-see” stance, as if they were auditioning for a Molière play. 🎭 The BTC Volatility Index (DVOL) on Deribit has descended from its lofty perch of 72 to a modest 50.8 since January 20. Quelle surprise! Tracy Jin, COO of MEXC, declares this a sign of bitcoin’s maturation, comparing it to the staid dynamics of commodity markets. Mon dieu, who would have thought?

Meanwhile, the FTX creditor payouts have begun, but the Libra token debacle continues to amuse. Hayden Davis, co-creator of the token, boasts of buying access to Argentine President Javier Milei’s inner circle. Sacré bleu! The memecoin sector, already a circus, sees its market cap drop 4.4% in 24 hours. 🤡

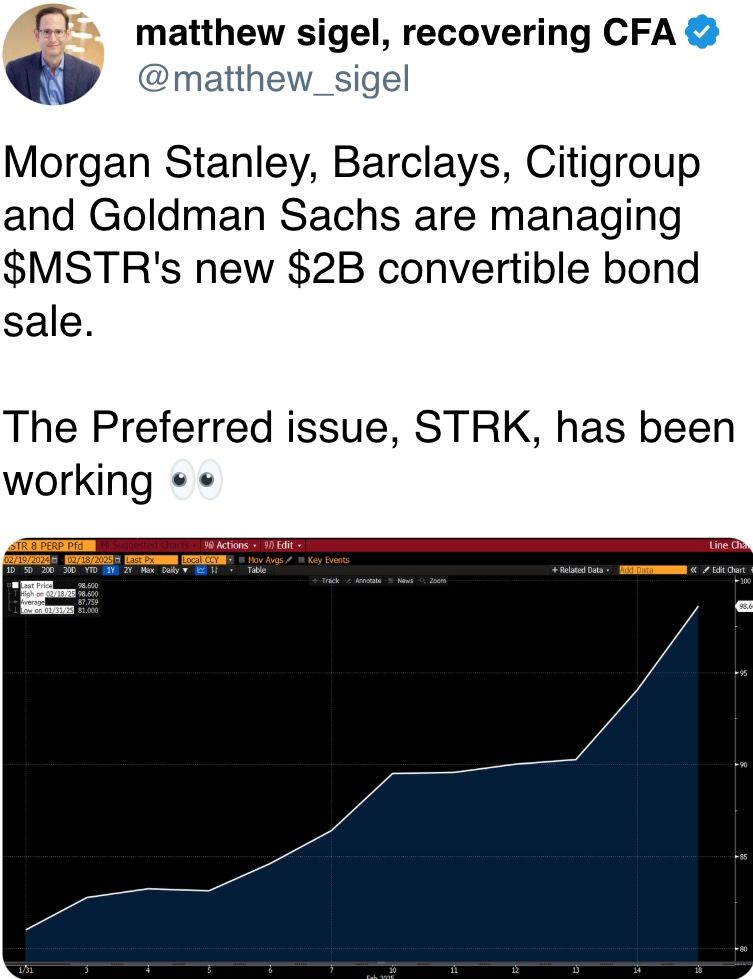

Strategy, the largest corporate holder of bitcoin, plans to raise $2 billion by selling zero-coupon convertible notes. The funds? To buy more BTC, naturellement. Meanwhile, Brevan Howard Digital’s CEO and CIO (yes, one person) reminds us that 24/7 risk management is still a necessity. Quelle horreur!

On the macro front, traders eagerly await the Federal Reserve’s January meeting minutes. President Trump’s comments on tariffs—25% for automobiles, semiconductors, and pharmaceuticals—add to the drama. Meanwhile, U.S.-Russia talks in Riyadh aim to end the war in Ukraine, but excluding Ukraine and Europe remains a sticking point. Mon Dieu, the absurdity!

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 3: Consensus Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Oliver Knight

- Sonic, the rebranded Fantom token, has surged 37% in a week. On-chain activity and rebrand euphoria are to blame. 🚀

- The memecoin sector reels from the Libra token controversy. Market cap down 4.4% in 24 hours. Pump and dump? Mais oui!

- DeFi protocols lose $35 billion in value since mid-December. Solana-based liquid staking protocols take the brunt. Ouch!

Derivatives Positioning

- BTC’s CME futures premium compresses to 6%. Bullish expectations? Tempered. 🐂

- LTC, TRX, and HYPE lead perpetual futures open interest growth. 🚀

- BTC and ETH options show bullish sentiment, but call premiums have reduced. 🤷♂️

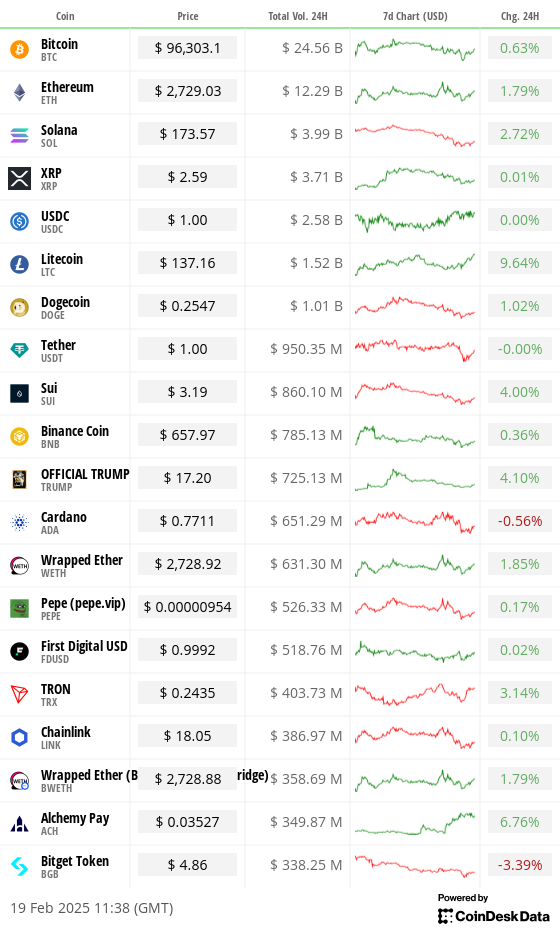

Market Movements:

- BTC: $96,356.41 (+1.34%)

- ETH: $2,735.66 (+3.25%)

- CoinDesk 20: 3,195.66 (-2.80%)

- Gold: $2,944.53/oz (+0.31%)

- Silver: $33.05/oz (+0.59%)

Bitcoin Stats:

- BTC Dominance: 61.08 (-0.32%)

- Hashrate: 784 EH/s

- Total Fees: 4.7 BTC / $452,182

Technical Analysis

- SOL-BTC ratio breaks out of consolidation. Solana underperformance likely. 😬

Crypto Equities

- MicroStrategy (MSTR): $333.97 (-1.11%)

- Coinbase Global (COIN): $264.63 (-3.53%)

- Galaxy Digital Holdings (GLXY): C$26.31 (-4.58%)

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$60.7 million

- Cumulative net flows: $40.06 billion

Spot ETH ETFs

- Daily net flow: $4.6 million

- Cumulative net flows: $3.16 billion

Overnight Flows

Chart of the Day

- Agora Dollar (AUSD) surpasses $100 million in market cap. Next stop: $1 billion? 🚀

In the Ether

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-02-19 15:28