What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

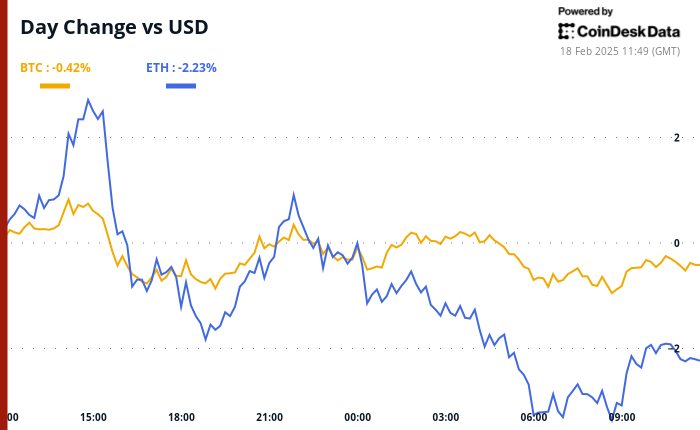

In the grand theater of cryptocurrency, where fortunes are made and lost faster than one can say “blockchain,” we find ourselves in a rather peculiar moment. Bitcoin (BTC), that elusive digital gold, has barely shifted in the past 24 hours, down a mere 0.7%. Yet, the broader market is enveloped in a gloomy fog, a bearish mood that has descended upon us like a dark cloud following the infamous Libra token debacle. Accusations of fraud fly through the air, and whispers of impeachment for Argentina’s President Javier Milei echo in the halls of power. Ah, the drama!

The CoinDesk 20 Index, that barometer of crypto sentiment, has taken a dip of approximately 2.3% over the past day. The fate of the market seems to hinge precariously on the outcome of U.S.-Russia negotiations in Riyadh, where discussions are not merely about ending the conflict in Ukraine but also about “normalizing” relations. One can only hope they bring snacks to the table!

Adding to the uncertainty is the Bahamas-based FTX Digital Markets, which has decided to start repaying creditors today. Yes, you heard it right! A staggering $16 billion is at stake, and the liquidity will flow in the form of stablecoins. First in line are those poor souls with claims under $50,000, who will receive a generous 119% of their adjudicated claim value, plus 9% annual interest accrued since November 2022. It’s like a surprise party, but instead of cake, you get a check!

What will these repayments mean for the market? Some analysts scoff, declaring the amount “too small to move the needle,” while others speculate that FTX’s historical affection for the Solana ecosystem might mean some of these funds will find their way there. It’s like watching a soap opera unfold, with twists and turns at every corner!

Meanwhile, investors have shifted their gaze to ether, the second-largest cryptocurrency by market capitalization. U.S.-listed spot ETFs are seeing a net inflow of $393 million this month, a stark contrast to the $376 million outflow for spot bitcoin ETFs. It seems ether is the belle of the ball this time around!

As Ethereum prepares for its Pectra upgrade, which promises to enhance scalability and security, individual investors are feeling a bit bearish. Trade-war threats loom large, interest-rate cut expectations have been dashed, and inflationary surprises keep popping up like unwelcome guests. A survey from the American Association of Individual Investors reveals that bearishness is at a two-year high. But fear not, for this pessimism often serves as a contrarian indicator. Institutional investors are also feeling the pinch, their risk appetite waning amid the specter of a trade war. Stay alert, dear reader!

Conferences:

CoinDesk’s Consensus will take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 1 of 3: Consensus Hong Kong

- Feb. 23-March 2: ETHDenver 2025 (Denver)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

- March 2-3: Crypto Expo Europe (Bucharest, Romania)

- March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Francisco Rodrigues

- Donald Trump supporters are set to receive around $50 worth of the official TRUMP tokens if they bought merchandise from the websites associated with the U.S. president. Talk about a political souvenir!

- The token was unveiled just days before Trump took office and has since lost more than 70% of its value. A true collector’s item, indeed!

- Solana-based decentralized exchange Jupiter has begun accumulating USDC

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- ‘Severance’ Renewed for Season 3 at Apple TV+

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Ultimate Half Sword Beginners Guide

- Unlocking Expedition Anchor Locks: Tips for Pacific Drive Players

2025-02-18 15:38