What to know:

- Ah, the U.S. spot-listed bitcoin ETFs, those fickle creatures, have decided to part with a staggering $494 million over three days. How generous! 💔

- Meanwhile, our dear Bitcoin languishes at a mere $96,000, caught in a trading range tighter than a corset at a Victorian ball since mid-November. 🎩

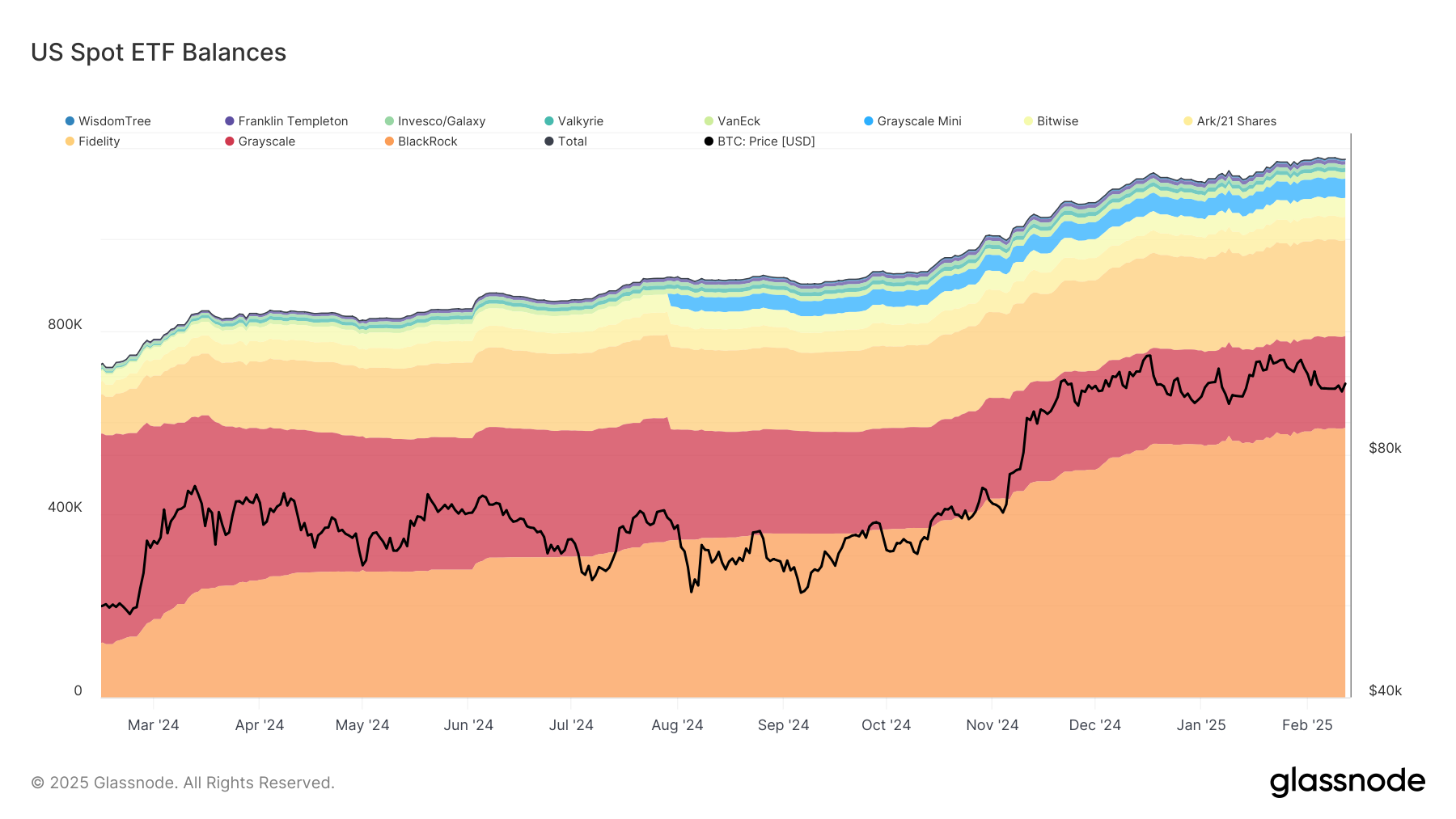

In a most theatrical display, the U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) have experienced a trifecta of outflows, totaling a rather dramatic $494 million. Wednesday, the grandest of the three, saw a staggering $251 million flee, with BlackRock’s iShares Trust (IBIT) shedding a modest $22.1 million, while the Fidelity Wise Origin Bitcoin Fund (FBTC) took the crown for the largest outflow, a princely sum of $102 million, as per the ever-reliable Farside data. 🎭

These outflows, it seems, have coincided with a volume so low it could be mistaken for a whisper in a crowded room. On Wednesday, a mere $2.58 billion graced the ETFs, with IBIT barely scraping together less than $2 billion, landing it at the tenth most traded U.S. ETF. A true underdog story, if ever there was one! 🐶

Alas, the recent Goldman Sachs filing reveals a lack of enthusiasm for new net long positions in these ETFs, which, let’s be honest, are primarily used as trading vehicles. One might say they are the wallflowers of the financial ball, waiting for a dance that never comes. 💃

As for Bitcoin, it finds itself in a rather pedestrian position at $96,000, trapped in a trading range between $90,000 and its all-time high of $109,000, a saga that began in mid-November. Will it ever break free? Only time will tell! ⏳

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-02-13 14:57