Ethereum‘s price has been taking a nosedive faster than a lead balloon over the past few weeks, and while it seems to have caught its breath, there’s still a chance it might take a tumble down the rabbit hole.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, it’s as clear as muddy waters that ETH has been going through a colossal crash since it broke below the 200-day moving average, which is currently hovering around the $3,000 mark.

Although the price has even tested the $2,100 support zone during the crash, it has bounced back and is currently testing the $2,700 level from below. If the market can reclaim this level and the 200-day moving average soon, a new bullish trend could kick off. On the other hand, if it fails, the $2,400 support level will be the first target for a subsequent bearish move. 📉

The 4-Hour Chart

Looking at the 4-hour chart, things are starting to look more interesting than a bag of popcorn, as the asset has been moving inside a descending channel pattern lately.

However, the market is about to test the higher boundary of the pattern, and in case of a breakout, it would likely rally at least toward the recent major high of $2,900. On the other hand, a breakdown of the pattern could lead to a rather quick drop toward the $2,400 region. 📈

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Open Interest

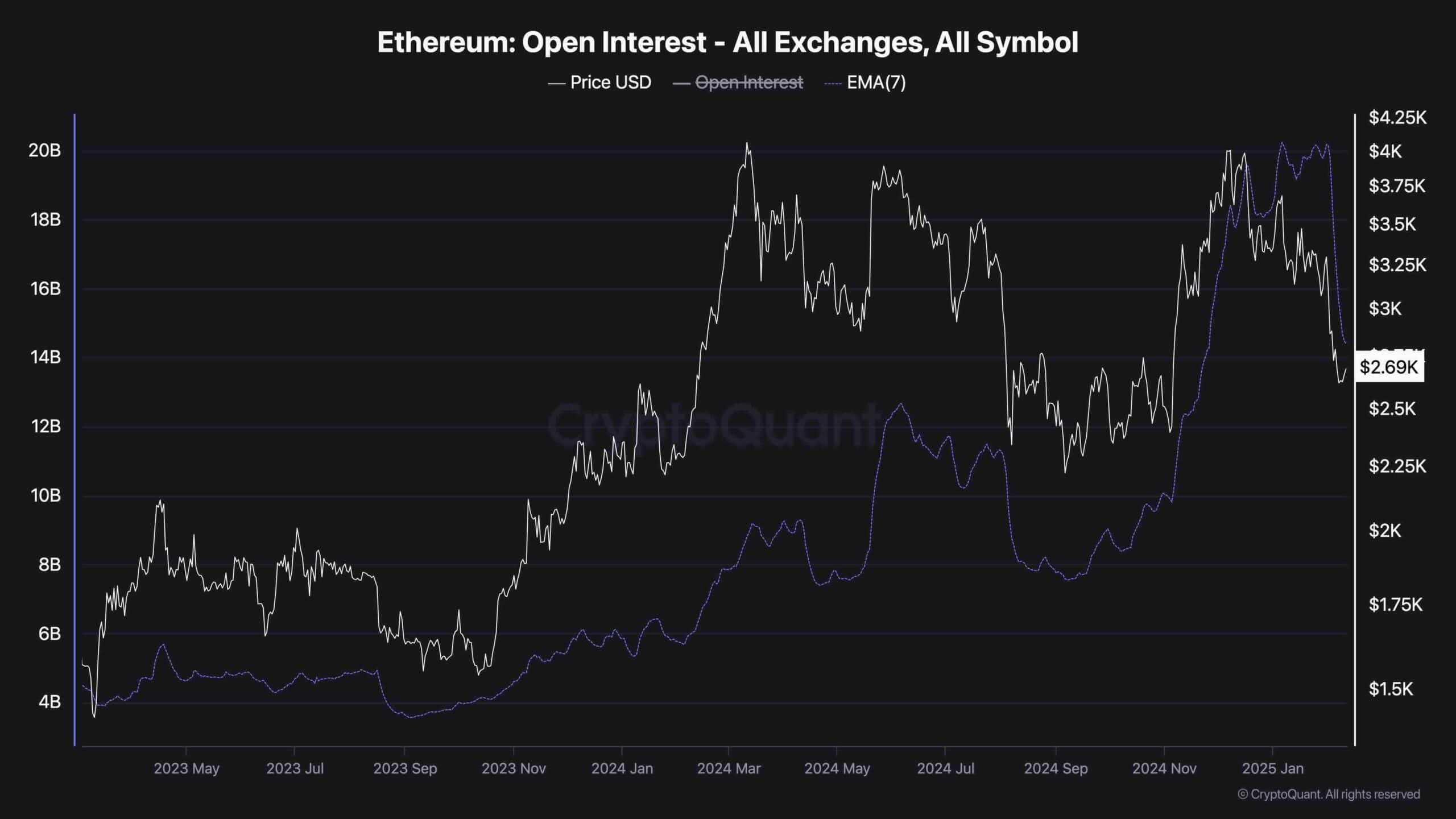

During the recent Ethereum crash, a large number of futures traders have been liquidated and kicked out of the market, and not many are willing to return and open leveraged positions at the moment.

This is clearly evident in the chart above, which demonstrates the Ethereum open interest metric. It displays the total number of open futures contracts in all perpetual futures exchanges.

As the chart depicts, the recent price crash has been simultaneously aggravated by and led to large liquidation cascades, which is shown by the massive plunge in open interest. Yet, this can be a good sign, as the futures market is cooling down, and a dominant buying pressure from the spot market can result in a recovery soon. But, of course, this is heavily reliant on whether the demand is able to overpower supply in the spot market. 🤑

Read More

- Best Crosshair Codes for Fragpunk

- Monster Hunter Wilds Character Design Codes – Ultimate Collection

- Enigma Of Sepia Tier List & Reroll Guide

- Hollow Era Private Server Codes [RELEASE]

- Wuthering Waves: How to Unlock the Reyes Ruins

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Ultimate Tales of Wind Radiant Rebirth Tier List

- Best Crossbow Build in Kingdom Come Deliverance 2

- Best Jotunnslayer Hordes of Hel Character Builds

- Skull and Bones Timed Out: Players Frustrated by PSN Issues

2025-02-12 16:22