What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

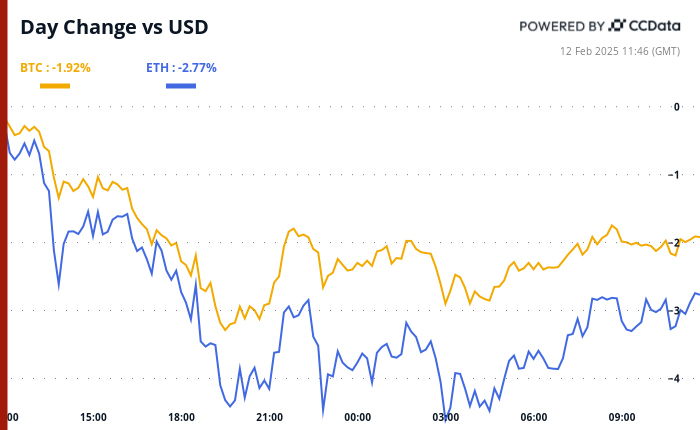

So, the U.S. inflation report is dropping today, and it might just be the magic potion to pull bitcoin (BTC) out of its sad little slump. 🥲

Historically, January has been the month where prices decide to throw a party. Last year, the data was like, “Surprise! We’re not as low as you thought!” and it looks like 2023 might be following suit. Apparently, businesses love to evaluate their costs and raise prices like it’s a New Year’s resolution. Thanks, Wall Street Journal, for the reminder! 🎉

Now, if the inflation report comes in hotter than a jalapeño in July, Dallas Fed President Lorie Logan says we might need to tighten our monetary belts. The Fed isn’t exactly in a hurry to adjust interest rates after last year’s 100 basis points of reductions. Slow and steady wins the race, right? 🐢

And let’s not forget the Trump administration’s tariffs, which could add a spicy 0.8% to core PCE. But hey, remember 2018 and 2019? Tariffs were like that friend who says they’ll come to the party but never shows up. 🙄

On the flip side, if inflation is as soft as a marshmallow, it could be a win for risk assets like bitcoin. A lower-than-expected figure might just make the U.S. dollar index feel a little weak in the knees. CoinDesk’s Omkar Godbole has the scoop on that! 🥳

Meanwhile, demand for the biggest cryptocurrency is still flexing its muscles. This week, Japanese mobile-game studio Gumi is planning to scoop up around $6.6 million worth of BTC. Talk about a shopping spree! 🛒💸

Goldman Sachs is also getting in on the action, increasing its exposure to spot bitcoin and ether ETFs. And let’s not forget Strategy’s near-weekly bitcoin shopping habit. They must have a crypto coupon book or something! 🤑

However, bitcoin’s Coinbase premium recently turned negative, which is like a warning sign that U.S. traders are feeling a bit skittish about the upcoming inflation report. Caution: crypto ahead! 🚧

And just when you thought it couldn’t get any crazier, research firm BCA Research is waving red flags, suggesting that record ETF inflows and the memecoin craze are like those warning lights on your dashboard. 🚨

JPMorgan also chimed in, noting that crypto ecosystem growth slowed last month, with total trading volumes dropping 24%. But hey, at least we’re still ahead of where we were before the U.S. elections. So, there’s that! Stay alert, folks! 👀

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Feb. 12-13: Frankfurt Digital Finance (FDF) 2025

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

- Feb. 24: RWA London Summit 2025

- Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

- The Central African Republic’s CAR token is down 95% from Monday’s peak prices. Ouch! That’s like dropping your ice cream on a hot day. 🍦💔

- CAR was issued late Sunday and promoted by the republic

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-02-12 15:14