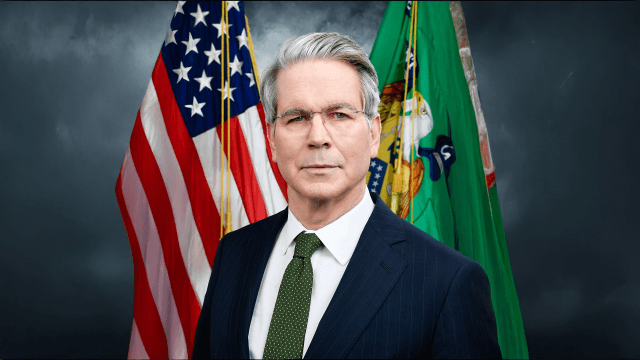

U.S. Treasury Secretary Scott Bessent, in an unsurprising move, claims this bold tactic is absolutely necessary to fend off “non-market” economies, namely China, in their not-so-friendly global tug-of-war.

Trump’s Anti-China Price Controls Send Bitcoin Crashing to $111K

The ongoing trade brawl between China and the U.S. has taken another dramatic turn, and guess who’s caught in the middle? Bitcoin, of course. It seems the digital coin has absorbed more collateral damage than any stock on the market. In a seemingly desperate bid to outwit China’s protectionism, U.S. Treasury Secretary Scott Bessent unveiled price floors for American rare earth companies. While stocks rose like the morning sun, Bitcoin was not so lucky, dropping 1.74% as the news broke.

The master manipulators in China, ever so sly, decided to up the ante by expanding export controls on rare earths. Not one to be outdone, U.S. President Donald Trump issued threats of “massive” tariffs, setting off the largest liquidation in crypto history. Over $19 billion vaporized in a blink, and the crypto market lost more than $410 billion in mere days. Because who needs stable markets anyway? 🙄

The Chinese retaliated on Tuesday by sanctioning five U.S. subsidiaries of South Korea’s Hanwha Ocean-because why not? The U.S. responded with tariffs on Chinese maritime products reaching a cool 150%. Truly, who’s keeping track of these escalating numbers anymore? Meanwhile, Bessent, after his colorful remarks about China, has now embarked on his new hobby: implementing price controls. Starting with rare earths, of course, because why settle for a small target when you can go for the big one?

“When we get news like this from China, especially on rare earths, you realize we must either be self-sufficient or rely on our allies,” Bessent told CNBC, sounding like a man at the helm of a political game of chess. “We’re setting price floors and forward buying across multiple industries to prevent the Chinese from getting any further ahead.” Well, that’s one way to deal with it, I suppose. Let’s just pray they don’t buy everything up and tank the whole market!

And for those of us not living under a rock, let’s be clear: price controls are when the government forces a minimum price for goods or services, kind of like a guarantee that even if you mess up, you’re still getting paid. Bessent’s talking about all of it-price floors, forward buying, equity stakes-whatever it takes to “save” the economy.

The prospect of the government stepping in to rescue rare earth companies gave a nice little boost to stocks. But Bitcoin, as always, got left behind in the dust.

BTC’s nosedive? Probably because some economists are not exactly thrilled with the idea of price controls. They tend to shrink demand and throw production into chaos, unless, of course, the government steps in to buy up all the excess. But, as Bessent himself admitted, “We have to be careful not to overreach.” Oh, really? Could’ve fooled me with all the recent moves. 🤷♂️

Overview of Market Metrics

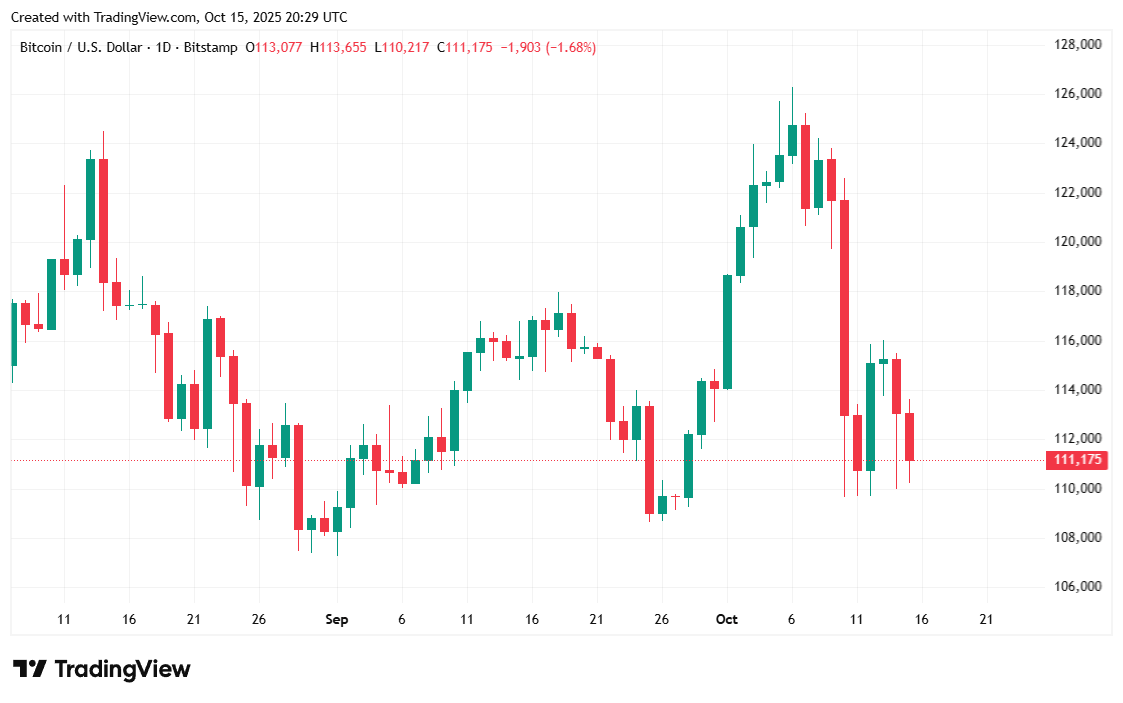

Bitcoin is now trading at $111,013.79-down 1.74% over the last 24 hours. Over the past week, the digital currency has seen a 10.27% drop, oscillating between $110,235.84 and $113,622.38 since Tuesday. If you’re holding Bitcoin, how’s that for a fun rollercoaster ride? 🏢💸

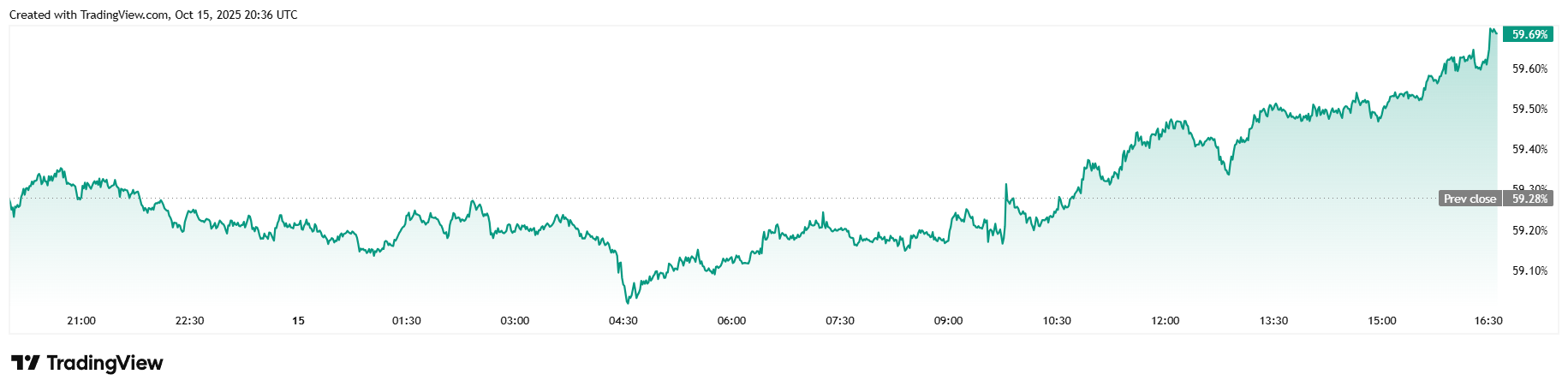

In case you’re wondering, the 24-hour trading volume dropped by a whopping 22.97% to $70.76 billion. Market cap slid down by 1.7% to $2.2 trillion. Meanwhile, Bitcoin’s dominance climbed by 0.78% to a nice 59.70%. Can’t say the same for those pesky altcoins, though. The poor things.

And for those who thrive on chaos, open futures interest is down 1.73%, totaling $72.15 billion. Liquidations were relatively tame at $85.05 million, with a healthy portion of that from the $56.30 million in long liquidations. And let’s not forget the $28.76 million in shorts wiped out, because why not balance the scales a little?

FAQ ⚡

- Why did Bitcoin drop to $111K?

Bitcoin dropped as the Trump administration imposed price floors for U.S. rare-earth firms in an attempt to curb China’s market power. - What are price floors?

A price floor is a government-mandated minimum price, often used to protect domestic industries from global competition. - How did markets react?

Stocks rose, rare-earth companies saw gains, but Bitcoin and the broader crypto market took a nosedive, spooked by fears of economic manipulation. - Who made this decision?

Treasury Secretary Scott Bessent claimed that the controls are vital for ensuring U.S. self-sufficiency in critical industries. But hey, who’s counting?

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Gold Rate Forecast

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Zombieland 3’s Intended Release Window Revealed By OG Director

- Hell Let Loose: Vietnam Gameplay Trailer Released

- 2026 Upcoming Games Release Schedule

2025-10-16 00:38