What to know:

- Key sources of USD liquidity begin to tighten.

- Trump to evaluate feasibility of strategic BTC reserve.

- A pattern that marked the previous bull market peak reappears.

Ah, since the dawn of 2023, Bitcoin (BTC) has embarked on a classic journey akin to a well-rehearsed ballet, with price pirouettes followed by moments of stillness, all leading to the grand finale of a potential breakout. 🎭

Currently, our dear cryptocurrency is caught in a waltz between $90,000 and $100,000, the third act of a broader performance that began at a humble $20,000. The audience, or rather the market, is convinced that this will culminate in a triumphant bull breakout, just as it did in the melodramatic acts of mid-2024 and 2023. But alas, three developments suggest that the curtain may fall prematurely.

Tightening USD liquidity

One must understand that any asset class, not just our beloved crypto, has a particular aversion to the tightening of fiat liquidity. The U.S. Dollar (USD), the global reserve currency, is tightening its belt, much to the chagrin of BTC enthusiasts. Arthur Hayes, the chief investment officer at Maelstrom, has noted this unfortunate trend on X, as if he were a harbinger of doom. 😱

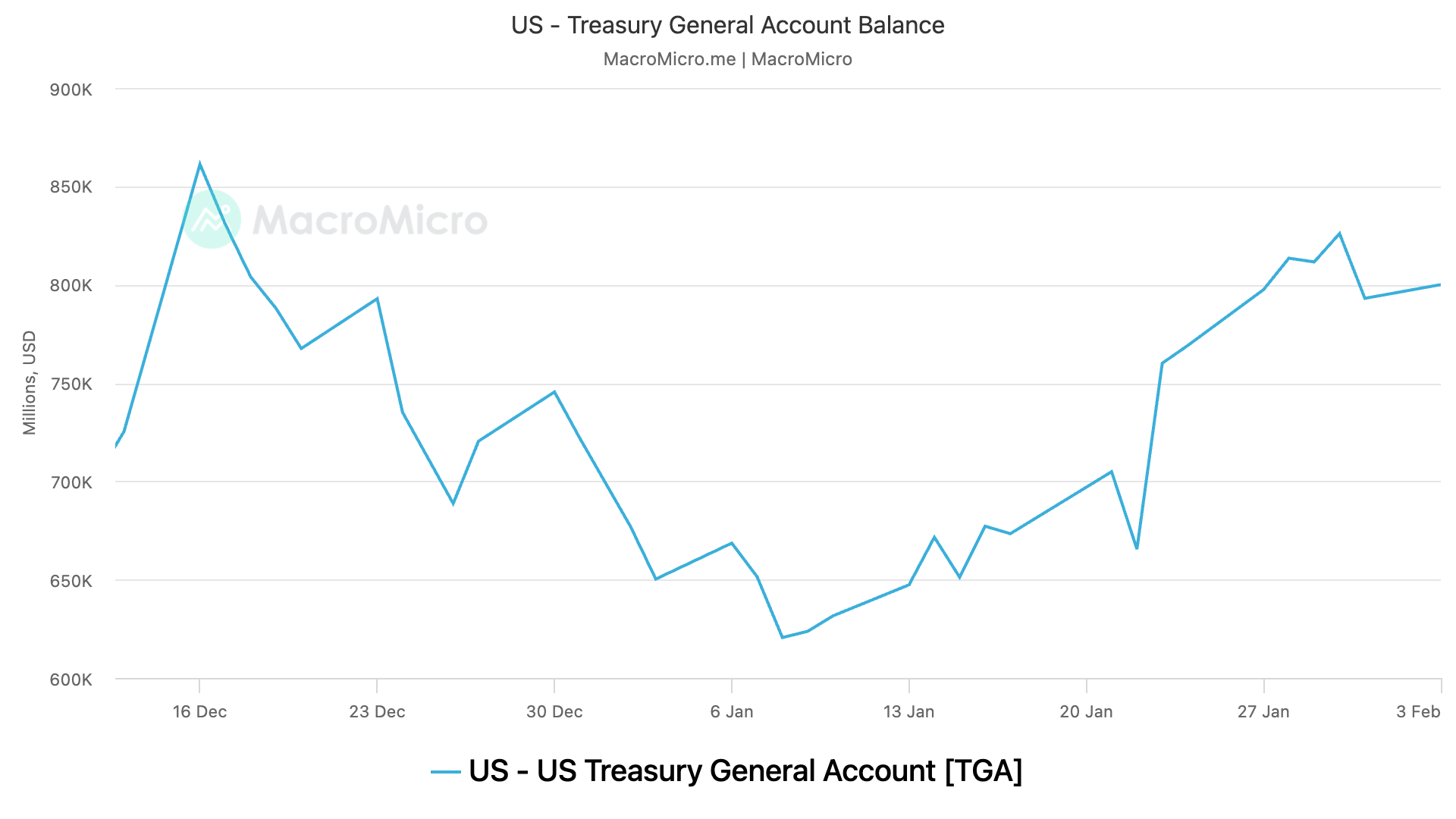

In a rather shocking twist, the USD cash balance in the Treasury General Account (TGA)—the U.S. government’s checking account—has ballooned from $623 billion to a staggering $800 billion in just four weeks. One might think they were preparing for a lavish party! 🎉

After the U.S. hit its self-imposed debt limit of $36 trillion last month, the markets held their breath, hoping the Treasury would dip into the TGA balance to keep the government afloat, thus enhancing liquidity. But alas, it seems they prefer to hoard their treasures like a dragon guarding its gold. 🐉

Anddy Lian, a thought leader and blockchain expert, lamented on X, “We’re looking at a scenario where key liquidity sources are drying up or being more tightly controlled. This could lead to a slowdown in economic activity, higher borrowing costs, and potentially a more challenging environment for risk assets, including crypto.” Sounds like a party pooper, doesn’t he? 🎈

Trump administration to ‘evaluate’ strategic BTC reserve

Since the grand entrance of President Donald Trump on January 20, he has been busy fulfilling various campaign promises—tariffs, illegal migrants, and international affairs, oh my! But wait, what about the strategic BTC reserve? This was supposed to be the cherry on top of the crypto cake! 🍰

Instead, the Trump administration has decided to take a leisurely stroll, opting to “evaluate” the feasibility of such a reserve. A rather disappointing turn of events for crypto investors who were hoping for swift action, akin to Trump’s rapid-fire responses on other matters. 🏃♂️💨

Jim Bianco, president and macro strategist at Bianco Research, LLC, quipped, “Wait, Trump said he would do a $BTC Reserve, not promise to ‘evaluate it.’ Evaluate/Study is what Washington does when they don’t want to do something.” Touché! 🎤

In a dramatic twist, BTC plummeted from over $100,000 to $96,000 overnight after Trump’s crypto Czar revealed that evaluating the feasibility of a bitcoin reserve was now a top agenda item. Talk about a plot twist! 📉

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2025-02-05 09:41