Crypto Daybook Americas: USDC Takes January Crown as Bitcoin Looks to Core PCE Data

What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market is treading water and the biggest cryptocurrency, bitcoin, is taking a bull breather. Its upward momentum is getting stifled by Trump’s renewed tariff threats, which are also sending gold prices soaring to record highs and propping up demand for the U.S. dollar.

But there is action in some corners of the market. The VIRTUAL token popped after its recent listing on Upbit, and Hyperliquid’s HYPE token has seen a 3% gain. Litecoin is also making waves, with its perpetual futures open interest on centralized exchanges climbing to 5.19 million LTC, the most since Dec. 9, according to Coinglass. The surge hints at fresh capital flowing into the market, likely fueled by hopes of a spot ETF listing in the U.S.

Speaking of stablecoins, USDC is stealing the spotlight as the star performer this month, boasting a remarkable market cap growth of 21% to $53.12 billion. That’s its best month since May 2021, according to TradingView data. In contrast, USDT, the heavyweight champion of dollar-pegged stablecoins, eked out just a 1% increase. USDC even outperformed bitcoin, which grew a respectable 10%.

According to IntoTheBlock, USDC’s outperformance is likely due to its compliance with Europe’s MiCA regulations, while rivals like USDT face tough headwinds. But don’t count USDT out just yet; its market is starting to bounce back, and the simultaneous growth of USDC is offering a bullish impulse for the crypto market.

As we keep an eye on the macro landscape, the pivotal U.S. core PCE — the Fed’s go-to measure for inflation — is set to be released. Expectations are for a hot headline figure, with core reading, which excludes food and energy, showing positive improvements that might help BTC break out of its dull price action near $104,000.

However, ING is cautioning that the dollar might stay strong into the weekend.

“If we don’t receive any news on Canada and Mexico by the end of today, there’s a risk that the dollar could strengthen further as the market starts to price in a higher chance of tariffs being announced tomorrow,” it wrote. So, stay alert!

What to Watch

- Crypto:

- Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD in the EU to comply with MiCA regulations. Withdrawals will be supported through Q1.

- Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork network upgrade (v1.0.14)

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 PEPE.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based layer-2 mainnet.

- Feb. 5 (after market close): MicroStrategy (MSTR) Q4 FY 2024 earnings.

- Feb. 6, 8:00 a.m.: Shentu Chain network upgrade (v2.14.0).

- Feb. 11 (after market close): Exodus Movement (EXOD) Q4 2024 earnings.

- Feb. 12 (before market open): Hut 8 (HUT) Q4 2024 earnings.

- Feb. 13: CleanSpark (CLSK) Q1 FY 2025 earnings.

- Feb. 13 (after market close): Coinbase Global (COIN) Q4 2024 earnings.

- Feb. 15: Qtum (QTUM) hard fork network upgrade at block 4,590,000.

- Feb. 18 (after market close): Semler Scientific (SMLR) Q4 2024 earnings.

- Feb. 20 (after market close): Block (XYZ) Q4 2024 earnings.

- Feb. 26: MARA Holdings (MARA) Q4 2024 earnings.

- Feb. 27: Riot Platforms (RIOT) Q4 2024 earnings.

- March 4: Cipher Mining (CIFR) releases Q4 2024 earnings.

- Macro

- Jan. 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases December’s Personal Income and Outlays report.

- Core PCE Price Index MoM Est. 0.2% vs. Prev. 0.1%.

- Core PCE Price Index YoY Est. 2.8% vs. Prev. 2.8%.

- PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%.

- PCE Price Index YoY Est. 2.6% vs. Prev. 2.4%.

- Feb. 2, 8:45 p.m.: China’s Caixin releases January’s Manufacturing PMI report.

- Manufacturing PMI Est. 50.5 vs. Prev. 50.5.

- Jan. 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases December’s Personal Income and Outlays report.

Token Events

- Governance votes & calls

- Unlocks

- Token Listings

Derivatives Positioning

- TRX, TRUMP and OM registered the biggest increase in perpetual futures open interest. Traders, however, seem to be shorting TRUMP, as evident from the negative cumulative volume delta.

- BTC, ETH open interest and CVD are little changed. The BTC CME basis is hovering around 10%.

- Flows in Deribit’s options market have been muted, but BTC and ETH calls continue to trade pricier than puts.

Market Movements:

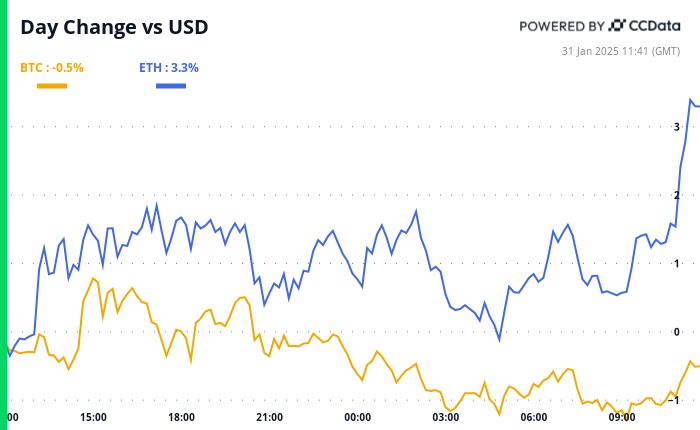

- BTC is down 0.29% from 4 p.m. ET Thursday to $104,810.50 (24hrs: -0.47%)

- ETH is up 2.39% to $3,324 (24hrs: +3.32%)

- CoinDesk 20 is down 0.3% to 3,838.81 (24hrs: +0.28%)

- CESR Composite Staking Rate is up 4 bps to 3.07%

- BTC funding rate is at 0.0012% (1.2961% annualized) on OKX

- DXY is up 0.47% at 108.30

- Gold is unchanged at $2,794.77/oz

- Silver is up 0.19% at $31.60/oz

- Nikkei 225 closed +0.15% to 39,572.49

- Hang Seng closed +0.14% to 20,225.11

- FTSE is up 0.3% at 8,673.13

- Euro Stoxx 50 is up 0.39% at 5,302.75

- DJIA closed on Thursday +0.38% to 44,882.13

- S&P 500 closed +0.53% to 6,071.17

- Nasdaq closed +0.25% to 19,681.75

- S&P/TSX Composite Index closed +1.31% to 25,808.25

- S&P 40 Latin America closed +2.21% to 2,388.03

- U.S. 10-year Treasury is up 2 bps at 4.536%

- E-mini S&P 500 futures are up 0.43% at 6,125.75

- E-mini Nasdaq-100 futures are up 0.79% at 21,795.50

- E-mini Dow Jones Industrial Average Index futures are up 0.32% at 45,200.00

Bitcoin Stats:

- BTC Dominance: 59.21 (-0.11%)

- Ethereum to bitcoin ratio: 0.03127 (0.84%)

- Hashrate (seven-day moving average): 781 EH/s

- Hashprice (spot): $61.7

- Total Fees: 4.97 BTC/ $522,698

- CME Futures Open Interest: 176,270 BTC

- BTC priced in gold: 37.3 oz

- BTC vs gold market cap: 10.60%

Technical Analysis

- The chart shows $60 has emerged as a strong resistance for BlackRock’s IBIT exchange-trade fund since December, with bulls consistently failing to establish a foothold above that level.

- Such patterns represent bullish exhaustion and often pave the way for minor price pullbacks that shake out weak hands, setting the stage for the next leg higher.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $340.09 (-0.34%), up 0.2% at $340.77 in pre-market.

- Coinbase Global (COIN): closed at $301.30 (+3.54%), down 0.17% at $300.80 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.33 (+0.83%).

- MARA Holdings (MARA): closed at $19.18 (+4.13%), up 0.36% at $19.25 in pre-market.

- Riot Platforms (RIOT): closed at $11.90 (+6.06%), up 0.76% at $11.99 in pre-market.

- Core Scientific (CORZ): closed at $12.26 (+6.98%), up 3.18%% at $12.65 in pre-market.

- CleanSpark (CLSK): closed at $10.97 (+6.92%), up 0.55% at $11.03 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.50 (+6.33%), up 3.47% at $23.28 in pre-market.

- Semler Scientific (SMLR): closed at $52.15 (+0.13%).

- Exodus Movement (EXOD): closed at $61.38 (-31.27%), down 2.23%% at $60.01 in pre-market.

ETF Flows

ETF Flows

Spot BTC ETFs:

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2025-01-31 15:09