So, here’s the scoop: 89% of DEX pools are basically a playground for their creators to pull off the ol’ pump-and-dump. 🎢 The other 11%? Oh, they’re just rugged by the creator’s buddies or the token deployer. And get this—sometimes the same shady money source funds both the creator AND the exploiter. It’s like a bad heist movie, but with blockchain. 🕶️

Once a DEX pool is launched, the token is usually ghosted faster than a bad Tinder date. 🚶♂️ Most last about six to seven days, but 1% of these schemes stick around for four to five months. Why? Who knows! Maybe they’re just really committed to the bit. 🤷♂️

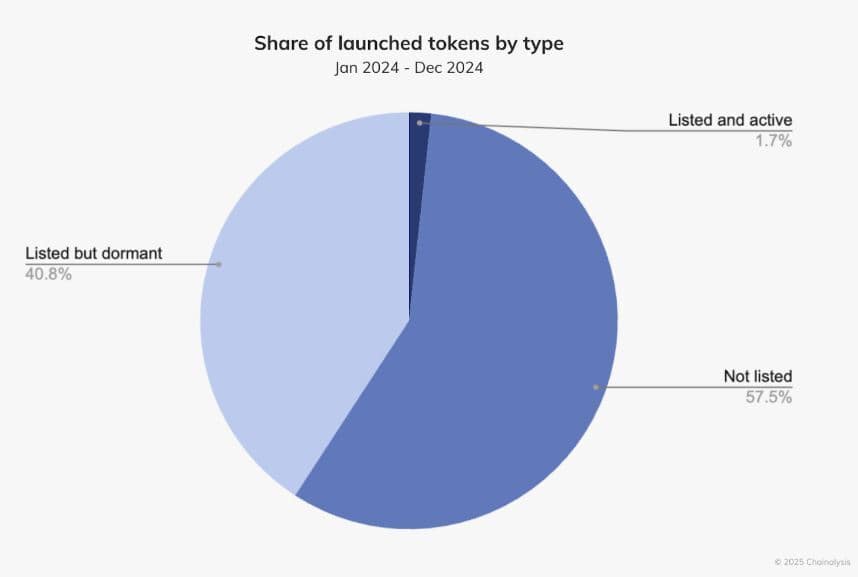

In 2024, over 3 million tokens were created, and 42.54% of them made it to a DEX. That’s like throwing spaghetti at the wall and hoping something sticks. 🍝

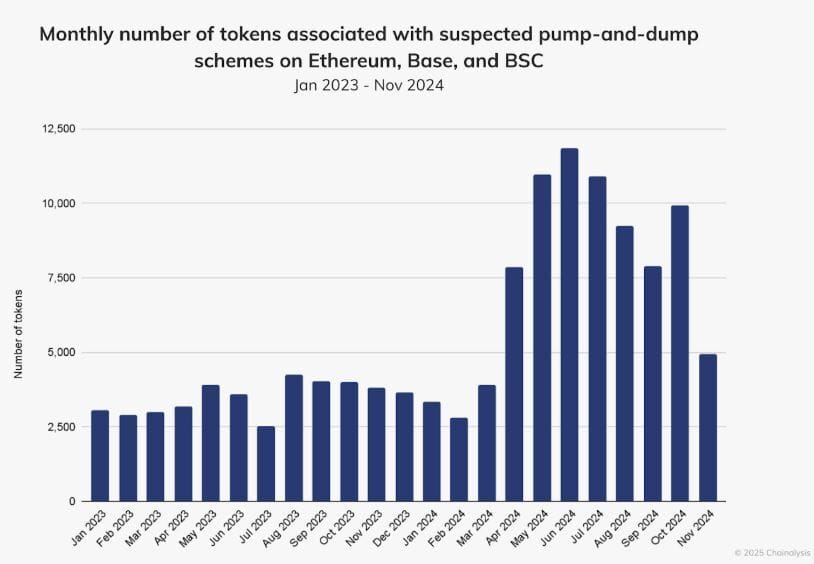

Ethereum was the king of token creation last year, thanks to the ERC-20 standard. But BNB and Base were also busy cranking out tokens like a factory. 🏭 In July alone, they launched over 400,000 tokens. That’s more tokens than there are excuses for why your crypto portfolio is down. 📉

But here’s the kicker: only 1.7% of these tokens were actually traded last month. The rest? Probably abandoned faster than a New Year’s resolution. 🗑️ Some were just short-term schemes, capitalizing on hype before vanishing into the ether. Poof! ✨

And let’s not forget wash trading—the other favorite pastime of crypto scammers. Chainalysis found $2.57 billion in possible wash trading activity. That’s a lot of fake trades! 🎭 On CEXs, it’s all about boosting volumes to look cool. On DEXs, it’s costlier because of gas fees, but hey, scammers gotta scam. 💸

Regulators are finally catching on. The SEC charged four market makers last year for inflating token volumes, and the IRS uncovered an international scheme involving 18 participants. It’s like Ocean’s Eleven, but with less charm and more jail time. 🚔

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2025-01-29 16:08