TL;DR

- Bitcoin (BTC) had a little tantrum at the start of the week, but it’s back on its feet, ready to break records like a toddler in a toy store.

- But wait! The FOMC meeting is lurking around the corner like a cat eyeing a laser pointer. 😼

New Peak in Just a Few Days?

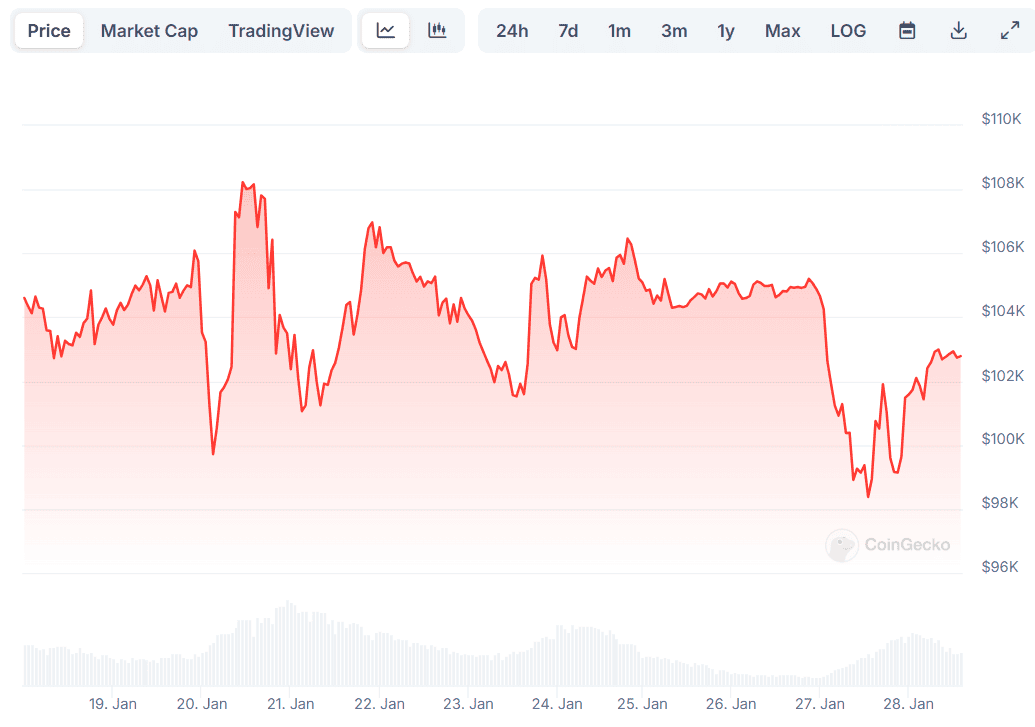

So, here we are in 2025, and Bitcoin is still the drama queen of the cryptocurrency world. It’s been bouncing around like a rubber ball in a room full of toddlers, but somehow, it’s still in a bullish mood. Just before Donald Trump’s latest reality show debut, Bitcoin hit a jaw-dropping high of nearly $110,000, only to have a mini-meltdown and drop below $98,000. But don’t worry, the bulls came back faster than a kid who just realized there’s cake at the party, pushing it back up to around $103K. 🎉

February has historically been Bitcoin’s time to shine, like a high school prom queen. The only times it flopped were in 2014 and 2020—two years we’d all like to forget. But in 8 out of the last 12 Februaries, Bitcoin has pumped up like a balloon at a kid’s birthday party. And guess what? This February is post-halving, which means it’s like a second chance at prom—previous post-halving Februaries have led to some serious gains. 💃

Next up, we have Bitcoin’s Market Value to Realized Value (MVRV), which has been hanging out below the healthy level of 2.5. This is like finding a pair of jeans that actually fit after a long shopping trip—definitely a sign that it might be time to buy. 🛍️

And let’s not forget about Bitcoin’s exchange netflow. According to CryptoQuant, outflows have been outpacing inflows like a kid running away from broccoli. This shift from centralized platforms to private wallets could be a bullish sign, reducing the immediate selling pressure. It’s like taking candy away from a toddler—less chance of a meltdown! 🍬

Bonus: the FOMC Meeting

Now, let’s talk about the FOMC meeting, which is scheduled for January 28-29. This is where the experts will decide if they want to change interest rates, currently set at 4.25% – 4.50%. Lowering the rates would make borrowing money cheaper, which could send investors flocking to riskier assets like Bitcoin, like moths to a flame. 🔥

But if they decide to raise the rates, it could be a total buzzkill for Bitcoin and the entire crypto market. According to Polymarket, there’s a 98% chance that the rates will stay the same after the meeting. Will it cause any price fluctuations for BTC? Only time will tell, but I wouldn’t hold my breath—unless you’re into that sort of thing. 😅

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2025-01-28 17:44